NAB tells its mortgage brokers to ‘crank it up’ for Christmas

The bank is embroiled in a new pressure-selling scandal, urging its brokers to sell five mortgages each before the end of this week.

National Australia Bank became embroiled in a new pressure-selling scandal yesterday after it was caught using its “values” reward scheme to force its staff to “fill” its “funnel” with new loans before the Christmas break.

The revelations of senior managers coercing frontline staff to sell more mortgages with the promise of internal reward points that can be redeemed for prizes came after NAB chairman Ken Henry and chief executive Andrew Thorburn received a drubbing at the banking royal commission over their failure to punish executives for bungling the bank’s relationship with regulators and dragging their heels over refunding customers’ fees where no service was provided.

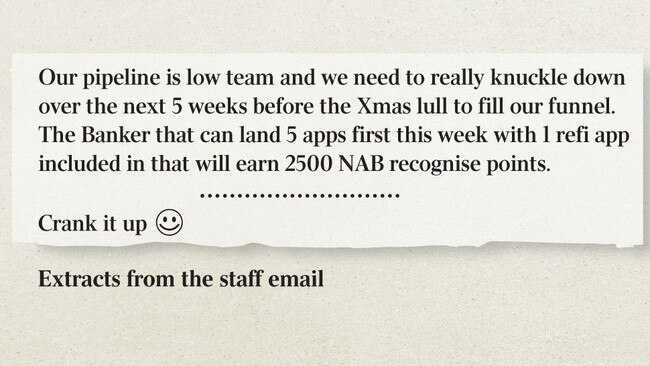

In an email sent just this week by a regional customer executive for large swathes of eastern NSW and the ACT, staff members were told they had to sell five mortgages and seal the deal on one loan refinancing by the end of the week to win points under the bank’s “Recognise” reward scheme.

“Crank it up,” the manager wrote in the internal email obtained by The Australian.

“Our pipeline is low team and we need to really knuckle down over the next 5 weeks before the Xmas lull to fill our funnel. You are our biggest introducers, we need your help right now.”

The banker revealed that under normal circumstances staff were expected to secure two home loan customers a week.

Under examination at the royal commission’s final public round of hearings in Melbourne this week, Mr Thorburn admitted the incentives NAB offered its home-loan introducers could corrupt relationships between borrowers and the bank.

The introducer referral scheme, in which businesses such as hairdressers and gyms can earn commissions for recommending NAB loans, generates one out of every 20 mortgages sold by the bank, with a cut of the “outsider’s” commission going to the member of the frontline staff who alerted the business to the scheme.

Mr Thorburn conceded the bank’s lending practices were plagued by “the wrong incentive schemes in many cases”.

NAB was recently stung by an alleged fraud ring within its introducer program in western Sydney, where cash-filled envelopes were passed between bank managers and introducers filling out dodgy mortgage applications.

“We put the bait right there for people. Right there. They stepped over the line,” Mr Thorburn told the royal commission.

However, the “crank it up” email — from a senior manager — reveals the admissions made on the stand by NAB’s executives have not been reflected in changing behaviour throughout the company’s broader staff.

Although frontline staff have been moved away from financial targets and bonuses under recommendations made by the Sedgwick review of banker remuneration, the high-pressure sales tactics show how NAB’s non-financial reward scheme has been used to push staff members to flog loans.

The “Recognise” program is designed to reward bankers who have “demonstrated NAB’s values”. Prizes include movie tickets and vacuum cleaners.

Finance Sector Union national secretary Julia Angrisano said she had been telling NAB for years that “the toxic sales culture in the bank leads to bullying behaviour, a high-pressure workplace and poor customer outcomes”.

“Andrew Thorburn says one thing in the royal commission while senior staff continue to pressure people to sell product,” Ms Angrisano said. “On the best interpretation, Mr Thorburn is being continually misled by his senior executives. On the worst interpretation, he has lost all authority within his bank.”

NAB retail executive general manager Krissie Jones said she was “disappointed with some of the language used in the email and how it might be interpreted”.

“These comments are not aligned with NAB’s values,” Ms Jones said, adding that the bank had “made significant changes to shift our culture from one that is sales-driven to one that is focused on meeting the needs of our customers”.

“We know we have more to do, and I will use this example to remind our bankers that our focus must always be on customer outcomes,” she said.

In a tense exchange on Tuesday between Dr Henry and counsel assisting the royal commission, Rowena Orr QC, the NAB chairman said the board could not be held responsible for “ensuring” the eradication of misconduct at the bank.

The former Treasury secretary was also dismissive of Ms Orr’s questions as to whether the bank could have sacked staff who did not act in customers’ interests. “Well, we could have fired everybody, I suppose,” he said.

Regulators are pushing for better standards in the banking sector after years of loose lending, and borrowers are finding their income and expenses subjected to increasingly tough examinations, leaving them unable to secure loans as large as they had hoped.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout