Investment bankers charged over ANZ cartel case

Some of Australia’s most powerful bankers have been named in a criminal case alleging cartel conduct in Australia’s markets.

Australia’s highest powered investment bankers have been named in an explosive criminal case alleging cartel conduct in Australia’s financial markets.

Criminal charges have been laid against several senior executives, including Citigroup managing director John McLean, Citi global head of foreign exchange Itay Tuchman and its chairman Stephen Roberts.

The competition watchdog has also named Deutsche Bank’s former head of Australia, Michael Ormaechea, and the bank’s former head of equity capital markets for Australia Michael Richardson, who is now at Bank of America Merril Lynch. ANZ chief risk officer for the Australia division Rick Moscati is also named.

ANZ and each of the individuals are alleged to have been knowingly concerned in some or all of the alleged conduct, the Australian Competition & Consumer Commission said. The ACCC has investigated the case before passing it to the Commonwealth Director of Public Prosecutions.

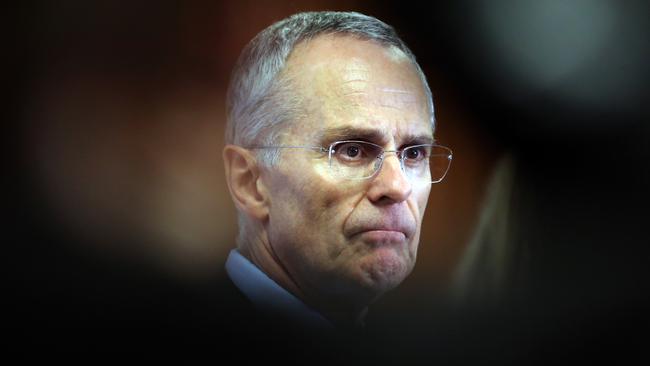

“These serious charges are the result of an ACCC investigation that has been running for more than two years,” ACCC Chairman Rod Sims said.

“Charges have now been laid by the Commonwealth Director of Public Prosecutions and the matter will be determined by the Court.”

In a statement, Deutsche Bank reiterated that “it believes it and its staff, including two former staff members Michael Ormaechea and Michael Richardson, acted responsibly, in the interests of clients and in a manner consistent with the Corporations Act and ASIC market integrity rules in relation to ANZ’s institutional share placement in August 2015”.

“Both Michael Ormaechea and Michael Richardson are highly regarded and have our full support. We will vigorously defend charges brought by the CDPP and the ACCC,” it added.

Citi also noted that it would “vigorously defend these allegations on behalf of itself and its employees”.

The matter is listed before the Downing Centre Local Court in Sydney on July 3.

The Competition and Consumer Act requires any trial of such offences to proceed by way of indictment in the Federal Court of Australia or a State or Territory Supreme Court.

Tens of millions of dollars in fines could flow from ANZ, Citigroup and Deutsche Bank in criminal cartel proceedings that have the investment banking and finance sectors on tenterhooks as the competition watchdog pursues further cases.

A potential separate civil case against the groups being pursued by the Australian Securities & Investments Commission is also well advanced.

ASIC has been working with the ACCC for about a year on the pair of legal investigations, which concern alleged cartel conduct relating to ANZ’s $2.5 billion capital raising in late 2015.

ASIC first raised concerns about the raising at the time of the institutional placement in August 2015.

The ACCC alleges that the banks acted as a cartel while handling excess stock not taken up during the capital raising, following an institutional shortfall where 30 per cent of the shares for sale were not sold.

Citigroup, Deutsche and JPMorgan were acting as joint-lead managers on the raising, although JPMorgan is believed to have been granted immunity from the legal action for its co-operation in the investigation.

Last week’s announcement of imminent legal action sent shockwaves through the investment banking community, where the sort of behaviour involved in the ANZ shortfall is said to be commonplace.