Insurers ranked for delays and refusing claims

The worst life insurance companies for handling claims have been ranked for the first time by the royal commission.

The worst life insurance companies for handling claims have been ranked for the first time, after the royal commission laid out the record of the 10 worst offenders for knocking back claims and making customers wait for a decision — up to half a year in Westpac’s case.

Tabling the most recent figures for the 10 largest life insurers in Australia, for the year through to June 2018, counsel assisting the royal commission, Rowena Orr QC, rattled off the best and worst performers for customer treatment.

Suncorp Life had the worst rate for rejecting total life insurance claims, with more than 4 per cent of all claimants denied.

This was followed by Westpac and Zurich with 3 per cent.

CommInsure was next, declining 2.7 per cent.

AMP had the lowest life denials at 0.3 per cent.

However, AMP took the longest to make a decision for life claims, taking on average 78 days. This was more than double the next most tardy insurers, Suncorp and MLC, which took 37 and 36 days to make a decision.

Australia’s largest life insurer, TAL, was the quickest, taking only 10 days to resolve a claim. Along with rejecting the most life insurance claims, Suncorp also took the crown for the worst decline rate for total and permanent disability claims, knocking back almost one in 10 claimants.

Zurich followed with a denial rate of 9.6 per cent, then National Australia Bank’s MLC life insurance with 8.3 per cent. Westpac and AMP performed the best, with less than 3 per cent of all TPD claims rejected.

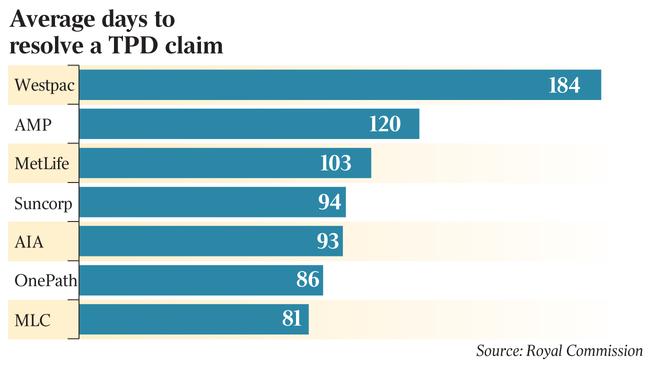

Across the industry, TPD claims took the longest to resolve, at an average of 92 days. Trauma claims took an average of 38 days, and income protection claims 33 days.

Westpac was the worst for sitting on TPD claims, taking an average of 184 days to approve or deny a claim.

AMP took the second longest, at an average of 120 days. Zurich and TAL were the quickest to make a decision for claims, at 39 and 61 days respectively.

Although the Australian Securities & Investments Commission has previously conducted sector-wide reviews of claims data in partnership with the prudential regulator, it has never published data that identified individual companies.

The regulators have found 98 per cent of death claims are paid where customers hold advised policies or “group” policies through their super fund, where 70 per cent of Australians hold insurance. This fell to 88 per cent for customers who bought direct policies, which are sold through outbound call centres, online and television advertisements.

Introducing the commission’s probe of life insurance, Ms Orr detailed how customers making claims could suffer “claims fatigue” or “claims shock” when dealing with seemingly endless bureaucracy to make a claim or when their policy falls short of expectations with a denial.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout