Hayne takes aim at life insurance commissions

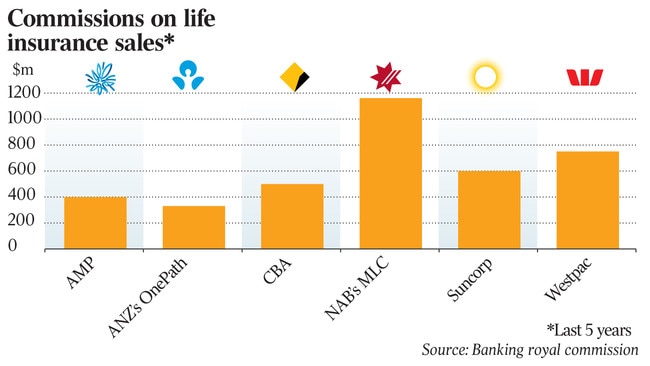

The financial services royal commission has more than $6 billion worth of commissions in its sights.

The financial services royal commission has put more than $6 billion worth of commissions in the crosshairs as Kenneth Hayne’s inquiry uncovers pushy sales tactics in the scandal-ridden life insurance industry.

Bad conduct by the 10 largest life insurers in Australia was fuelled by billions of dollars of lucrative commissions for financial advisers over the past five years.

The royal commission has detailed legal loopholes that left the corporate watchdog unable to tackle poor behaviour and a history of failed attempts by the industry to self-regulate.

Independent life insurer ClearView Wealth yesterday confessed to breaking anti-hawking laws more than 300,000 times in breaches that carry potential criminal charges, as it was put under the griller for cold-calling sales pitches that targeted sick and poor Australians with inferior policies they could not afford and on which they rarely claimed.

Opening the sixth round of hearings for the royal commission yesterday, senior counsel assisting, Rowena Orr QC, delivered a lengthy list of transgressions confessed to by the country’s largest insurers, including the use of out-of-date medical definitions, a pushy sales culture hawking questionable policies, unsolicited and misleading sales calls and secret surveillance that further damaged claimants’ mental health.

The renewed focus on commissions paid to financial advisers, who in the case of AMP were found to be cancelling and then signing up customers to the same products to win the largest possible bonuses, comes after previous bombshell evidence centred on the skyrocketing $850 million compensation bill for fees charged by financial institutions where no service was provided, including fees charged to dead people.

“Exploitative practices” such as “misleading advertising” and “cold calling” were identified by the Consumer Action Legal Centre as problems affecting the direct, or outbound, life insurance model, Ms Orr said.

Customers making claims could also suffer “claims fatigue” or “claims shock” when dealing with seemingly endless bureaucracy to make a claim, or when their policy fell short of expectations, she added.

The hearing came as the powerful House of Representatives economics committee blasted the Australian Securities & Investments Commission for failing to punish financial companies and for too quickly opting for enforceable undertakings rather than legal action.

“Australians expect the big banks and others to fear their regulator,” said Sarah Henderson MP, who chairs the committee.

While new laws have clamped down on the amounts life insurers can pay in upfront and trail commissions — now 80 per cent for upfront commissions, falling to 60 per cent in the next two years — Ms Orr rung out more than $6bn in commissions paid by some of the country’s largest institutions.

This included $1.16bn paid by National Australia Bank’s MLC division, and $830m by ANZ’s for-sale OnePath superannuation business.

AMP had shelled out $380m of bonuses to advisers while Commonwealth Bank paid $460m.

Westpac, which allowed its financial advisers to only sell its own BT Financial-branded products, paid out $640m on commissions and a separate $112m in payments that were grandfathered after the 2013 Future of Financial Advice reforms.

Suncorp, which like Westpac only gave advisers its own policies to sell on its so-called “approved products list”, paid out $590m in commissions.

AIA Group and TAL, the country’s two largest group insurers, which now sell a large volume of policies through superannuation, doled out $690m and $840m in commissions.

“As the cap on upfront commissions continues to reduce over the next few years, it remains to be seen whether this will be reflected in the premiums paid by customers,” Ms Orr said.

The most explosive revelations came after ClearView chief actuary and risk officer Gregory Martin admitted to more than 300,000 potentially criminal breaches of anti-hawking laws after customers were cold-called without opting in or were not provided with a product disclosure statement.

The royal commission heard that after it took over the life insurance business from health insurer Bupa, ClearView used remuneration incentives of bonuses up to $8000 a fortnight to drive sales staff to sell as many policies as possible, including a plan to target poorer Australians.

The strategy backfired, with large swathes of customers cancelling the Your Insure-branded policies that were sold to them or letting the insurance lapse when they could not afford the cover.

“The intention of ClearView is not to offer rubbish products to the market,” Mr Martin said.

“If we had our time again we wouldn’t do that business.”

Mr Martin will return to the witness stand this morning, followed by Grant Stewart, expected to be a consumer witness, and Freedom Insurance chief operating officer Craig Orton.

Shares in the listed Freedom Insurance have fallen more than 50 per cent since it was named as a royal commission case study and ASIC banned the business model responsible for 90 per cent of its revenue: high-pressure outbound sales centres.

Ahead of the public hearings, life insurers confessed to a litany of misconduct or conduct falling below community expectations.

Freedom Insurance admitted its representatives may have breached anti-hawking laws, some of its customers had tried to cancel policies and yet were still charged premiums, and some customers complained that they had not agreed to direct debits.

AMP admitted to “possible” misconduct — a qualifier that was heavily stressed by Ms Orr — in churning life insurance customers by cancelling policies and setting up new ones.

CBA admitted to rejecting claims with out-of-date medical definitions, which led to $4m in payouts to more than 30 customers.

Suncorp admitted to surveillance that made a claimant’s mental health worse, and said it would remediate customers $17.2m for add-on insurance through car dealers, while Westpac didn’t properly refund customers or charge them the right fees.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout