Kenneth Hayne lashes NAB’s Andrew Thorburn, Ken Henry in royal commission’s final report

Hayne takes aim at NAB, saying he fears a ‘wide gap’ between the public face of the bank and what it does in practice.

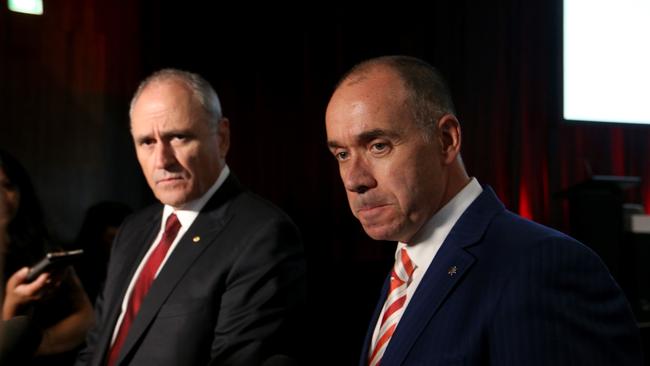

National Australia Bank has copped a Hayne royal commission battering with chairman Ken Henry and chief executive Andrew Thorburn lambasted for not accepting “necessary responsibility”.

Commissioner Kenneth Hayne singled NAB out for special attention in his final report, saying he feared there may be a “wide gap” between the public face of the bank and what it does in practice.

“NAB also stands apart from the other three major banks,” the report said. “Having heard from both the CEO Mr Thorburn, and the chair Dr Henry, I am not as confident as I would wish to be that the lessons of the past have been learned.

“I was not persuaded that NAB is willing to accept the necessary responsibility for deciding, for itself, what is the right thing to do, and then having its staff act accordingly.”

Hayne’s revelations will add to existing pressure on the tenure of NAB’s chairman and CEO after a number of scandals at the bank including charging fees for no service and rampant misconduct in its mortgage introducer program.

After a bruising appearance at the seventh and final round of the royal commission last year Dr Henry has now also drawn further criticism, from Hayne himself. That came alongside a swipe at Mr Thorburn, who is returning from extended leave to formulate the bank’s response to the report.

“I thought it telling that Dr Henry seemed unwilling to accept any criticism of how the board had dealt with some issues. I thought it telling that Mr Thorburn treated all issues of fees for no service as nothing more than carelessness combined with system deficiencies when the total amount to be repaid by NAB and NULIS on this account is likely to be more than $100 million,” Hayne said.

He also cited a story revealed in The Australian about NAB urging bankers to sell at least five mortgages before Christmas, in the same week Dr Henry and Mr Thorburn gave evidence at the commission.

“Overall, my fear — that there may be a wide gap between the public face NAB seeks to show and what it does in practice — remains.”

The other three major bank CEOs, weren’t spared Hayne’s attention even though NAB bore the brunt of the punches.

Hayne noted that the banking regulator had taken Commonwealth Bank to task over its conduct and compliance issues, including an enforceable undertaking.

“I was persuaded that Mr Comyn, CEO of CBA, is well aware of the size and nature of the tasks that lie ahead of CBA,” he said. “None of the other banks have been confronted so directly.”

Westpac — which is seeking to retain the bulk of its wealth operations, unlike its peers — was called out for the commitment made by CEO Brian Hartzer to repair the bank’s relationship with the Australian Securities and Investments Commission.

“While I do not doubt Mr Hartzer, CEO of Westpac, when he says that Westpac has sought to ‘reset’ its relationship wit ASIC, only time will tell whether that proves to be right.”

Westpac and ASIC faced off in court several times last year including on bank bill rigging and in 2019 will resume a responsible lending action after refusing to agree on key principles of a settlement.

On ANZ Bank, Hayne said: “I have little doubt that Mr Elliott CEO of ANZ is also well aware of the size and nature of the tasks that lie ahead.”

Hayne’s final report also called for the Australian Prudential Regulation Authority to complete its work on updating standards and guidance for banker pay “as soon as reasonably possible”. That would ensure financial services companies designed pay systems with a view to reducing misconduct and encouraging “sound management” of non-financial risks.