Banks brace for Hayne fallout

On the eve of the release of Kenneth Hayne’s final report, we examine what it will mean for banks, markets and regulators. Brace for the industry to be permanently reshaped.

The three volumes of his final report that banking royal commissioner Kenneth Hayne handed over to Governor-General Peter Cosgrove on Friday and to be publicly released on Monday will be trawled over by the industry and regulators as they get a sense of what his plans to create a fairer and more robust system mean for their futures.

“There could be far-reaching structural effects inside the institutions,” says Mark Johnson, a stalwart in the banking industry and the author of the 2009 report on Australia as a financial centre.

“Quick major changes may come out of it and we’ve already seen evidence of that.”

Even before Treasurer Josh Frydenberg accepted the 1000-plus page document — and endured an awkward moment when Hayne declined press invitations to shake his hand during a photo call on Friday — seven rounds of hearings packed with tales of fees charged to the dead, physical and financial collapses and emotional devastation wrought on banking’s victims have already reshaped the industry.

“The diagnosis has already been absorbed by the banks,” Johnson says. “All the evidence has shown that cross-selling of products through bank branches, particularly when they have commission structures attached to them, is very difficult.”

Johnson also notes that following the APRA-led review into Commonwealth Bank that uncovered “very badly flawed” risk and governance systems, the banks would “have to distil” change.

Former competition tsar Graeme Samuel says that with tens of thousands of potential instances of illegality raised at the royal commission, he was all but certain there would be recommendations by Hayne for further investigations and regulatory and criminal legal action.

“We can’t overstate its importance if commissioner Hayne adopts the same commonsense approach,” the former Australian Competition and Consumer Commission chairman says, adding the commission and APRA CBA report, which he was involved in authoring, were a “significant wake up call” to corporate Australia.

“Corporate Australia tends to go to sleep again quite quickly,” Samuel says, calling for lasting change. He also says he is in “slight disagreement” with Hayne on the use of the courts for enforcement, given cases could span several years and were highly complex.

Instead, he suggested enforcement tools such as enforceable undertakings should be used on a “take it or leave it basis” by the corporate regulator.

Banks, markets, regulators and ordinary Australians who have watched on in horror are waiting for Monday’s revelations. But the hearings themselves have already permanently reshaped Australia’s finance industry.

Markets

Betting on a fall on the share price of the big banks has long been regarded as Australia’s widow-maker trade, causing large losses to overseas hedge funds who saw our financial institutions as fat, bloated, overexposed to the housing market and ready to tumble.

But 2018 was the year that the strategy came good, thanks to Hayne’s inquiry and a crackdown on residential lending by the prudential regulator.

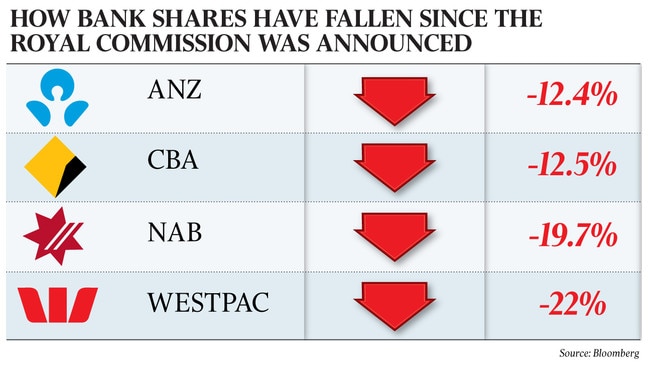

Over the past 12 months more than $80bn has been carved from the market value of finance sector players mentioned at the royal commission, with the big four banks first on the tumbrel to the sharemarket guillotine.

Since the start of February last year, as the commission geared up for its first public outing, traders have stripped almost $68bn from the combined market valuations of Commonwealth Bank, ANZ, Westpac and NAB.

AMP, which was exposed for misleading the corporate regulator over a fees-for-no-service scandal, and IOOF, whose chief executive and chairman the prudential regulator now wants banned from the superannuation industry, have both lost more than half their market cap.

The casualties

Celebrity financial adviser Sam Henderson, his legal team and his expensive suit barged into the royal commission’s Melbourne hearing room one afternoon in April, bristling with energy.

Within a few hours his business, Henderson Maxwell, and a media career that included appearances on Sky Business and in the pages of the Financial Review, had been sucked of life.

In one of the royal commission’s most spectacular case studies, Fair Work Commissioner Donna McKenna gave evidence that the advice Henderson gave her was so bad she would have immediately lost $500,000 if she’d taken it up.

The airing of recordings of one of Henderson’s staff apparently impersonating McKenna in a call to her existing super fund sealed the deal, and Henderson Maxwell was soon done.

Also collapsing during the hearings was Terry McMaster, who hyperventilated in the witness stand and had to be taken away in an ambulance, together with his business, Dover.

The financial advice network, which was among the 10 biggest in the country but had developed a reputation as a licensee of last resort for planners, closed its doors in June.

Meanwhile, listed insurance sales business Freedom admitted in December that it had no viable business model after committing to getting out of high-pressure call centre sales of junk insurance, including accidental death and injury cover. This followed hearings in September that exposed a sleazy sales culture that extended to mocking as a “bloody whinger” a Baptist minister who rang the company attempting to cancel insurance sold to his intellectually disabled son.

Regulators

Hayne’s public horsewhipping of the regulators sent them galloping to the courts as if they were Melbourne Cup runners hit with a jigger.

The Australian Securities & Investments Commission was first to salute, filing Federal Court action against NAB in September over tens of millions in fees it charged to superannuation customers who got nothing in return — the culmination of a lengthy investigation that was exposed during the hearings, along with the anger of investigators towards NAB’s attitude.

The Australian Prudential Regulation Authority followed with legal action in December, accusing IOOF chief executive Chris Kelaher, chairman George Venardos and other senior executives of not being fit and proper people to run a super fund and asking the Federal Court to ban them from the industry.

Behind the scenes, ASIC has also been attempting to take the whip hand by reshaping itself as an aggressive, prosecution-focused regulator, hiring QC Daniel Crennan as a commissioner and moving to focus on investigations, not cutting deals.

Stung by the commission’s criticism, and public exposure of its almost complete failure to take wrongdoers on in court, APRA has also launched a review of its enforcement practices.

As The Australian reported on Friday, the government is also likely to order an external review of its capabilities.

Either way, the so-called “mature” regulator is many lengths behind its sister agency.

The job losses

The human cost of Hayne’s seven rounds has also been notable.

Embattled wealth group AMP has endured the largest personnel casualties. First, then chief executive Craig Meller was forced to bring forward his flagged retirement, and he was followed in quick succession by AMP chair Catherine Brenner. Both were entangled in allegations AMP misled the regulator and tinkered with an independent report compiled by Clayton Utz.

AMP’s head of advice Jack Regan took a long period of time off after a gruelling time in the box at the commission, before parting ways with the company late in 2018.

A broader refresh of the board ensued through 2018, leading to the appointment of banking veteran David Murray as chair and former treasury secretary John Fraser and Credit Suisse executive John O’Sullivan as directors. This week, AMP appointed SMSF Association co-founder Andrea Slattery to its board as a non-executive director.

National Australia Bank’s wealth and consumer bank boss Andrew Hagger fell on his sword in September. That followed his second appearance at the royal commission and followed allegations that he didn’t provide accurate information to the corporate regulator and showed a “disregard for the gravity” of misbehaviour within the advice division.

At IOOF the royal commission’s scrutiny of its governance and renewed interest by the banking regulator saw the latter start legal action in December. APRA started disqualification proceedings against Venardos, Kelaher and three other executives. Venardos and Kelaher are on leave while IOOF defends the action.

Those high-profile departures are coupled with scores of much quieter exits at the banks and wealth managers as they confessed wrongdoing to the royal commission and revisited trouble-prone divisions to assess if customers were being mischarged.\

Divestments

Call it the sell-off frenzy or the biggest shake-up in ownership in the financial services sector in almost two decades. Already, three banks have moved to divest their wealth operations.

The exits are not just linked to regulatory costs and change but capital intensity and profitability and a largely failed experiment by the sector in wealth management.

ANZ has agreed to sell its life insurance operations to Swiss giant Zurich, while its financial planner dealer group has transferred to IOOF. But the bank faces complications in offloading its pensions and investments division to IOOF.

CBA is selling its life insurance operations and global asset management unit, while plans are afoot to separate its financial planning businesses and mortgage broking interests into a separate listed entity.

NAB sold an 80 per cent stake in its life insurance arm in 2015 and is planning to either separate or sell its MLC business this year.

Lending

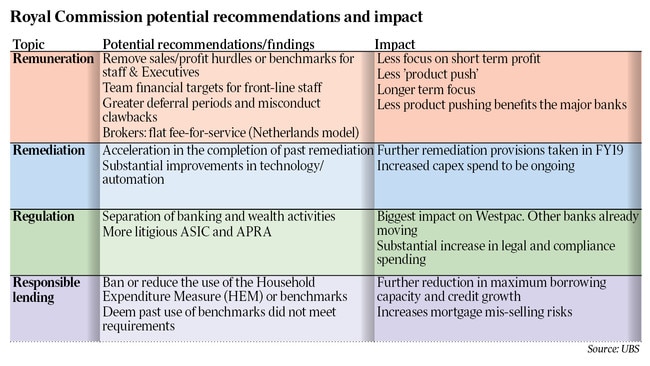

The banking regulator’s attempts to slow the housing market put lending criteria and pricing firmly in the spotlight.

That was exacerbated by the royal commission’s sharp focus on responsible lending obligations and loan serviceability.

The royal commission also emphasised the pitfalls of the Household Expenditure Measure which has been relied on by banks to calculate lending capacity.

That focus prompted banks to move to add more detailed questions to loan applications.

The extra scrutiny plus out-of-cycle rate rises by many banks to offset funding costs spurred talk of a credit squeeze last year and warnings of the impact of slower loan growth on the economy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout