Fels calls for compo scheme for bank victims

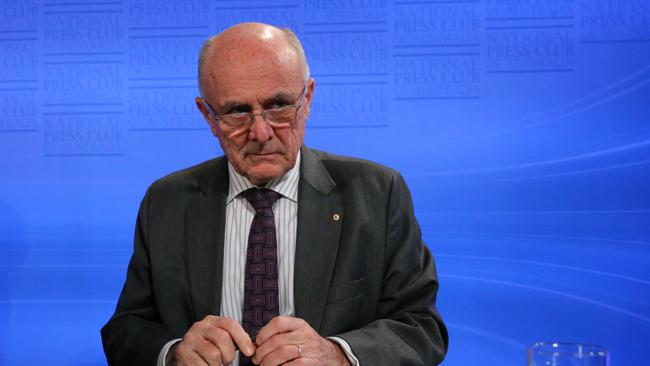

A new body should be set up to compensate victims of bad bank behaviour, former competition tsar Allan Fels says.

A new body should be set up to compensate victims of bad bank behaviour as part of a major overhaul of the finance industry following the royal commission, former competition tsar Allan Fels says.

Professor Fels and former Productivity Commission chairman Peter Harris told The Australian that the release of the banking royal commission’s interim report on Friday showed much work was needed to shake up financial regulation and get the system working for consumers instead of against them.

Commissioner Kenneth Hayne’s inquiry has exposed how banks take years to compensate customers for their misdeeds, often fighting the Australian Securities & Investments Commission as they attempt to minimise the financial fallout from scandals in areas including financial planning and superannuation.

On Friday, he also lambasted ASIC, which has endured years of budget cuts at the hands of a hostile political class in Canberra, and its sister agency the Australian Prudential Regulation Authority, for their failure to take big financial institutions to court.

He foreshadowed a leaner and meaner system of regulation that might have simpler laws but a far greater emphasis on enforcement.

Professor Fels said the royal commission’s interim report raised “a large number of big issues [which] will not be settled by February 1”, when Mr Hayne is due to lodge his final findings.

“Whether they should be handled by extending the work of the royal commission or by other means is a very difficult question,” he said. In addition to compensation for victims, he said the problems likely to be left open included whether the banks should be broken up, separating advice from product manufacture, curing a broken system of payment for financial services that put bank profits ahead of customer needs, and fixing up ASIC and APRA.

“There seem to be thousands of claims,” Professor Fels said.

“The royal commission is not well-placed to do it.

“There’s insufficient trust and confidence in the two main regulators … to just leave it to them. There needs to be some independent oversight of remediation programs.”

Dr Harris, who recently left the Productivity Commission after a five-year stint as chairman, questioned whether it was good idea to allow both the bank chief executives and the government departments responsible for constructing the laws to front up to the royal commission’s policy solutions round.

He said those tasked with making recommendations to clean up the sector needed a “fire in the belly” and a “passion for solving the problem” as opposed to the fall-back on legislative “compromise and making everyone feel comfortable”. Politicians pushed through weak laws that bent over backwards to give industry ample time to accommodate legislative change — such as the grandfathering of trailing commissions for financial advisers under the Future of Financial Advice reforms, which continue to plague consumers and drive inappropriate behaviour at planning firms.

An internal royal commission implementation taskforce is currently being set up at Treasury to lead the expected legislative overhaul, but when asked who was leading the taskforce, a spokesman for the Treasurer said: “A senior Treasury official.”

At the same time as the legislative imbroglio, the boards of banks and financial giants have ticked off on remuneration structures that run counter to good consumer outcomes.

“Regulation isn’t going to be the total cure here, but at the same time the rules are going to have to change,” Mr Harris said.

“There’s going to have to be something in the law that forces boards to be better informed about the behaviour inside banking institutions,” he said.

Despite its attacks on the competence of ASIC over its failure to take on crooked corporations, the government has hobbled the corporate regulator with a series of budget cuts and inconsistent, piecemeal funding.

Although it recently injected $70m into ASIC’s coffers for its new surveillance work across the finance sector, the government was recently attacked by Labor for apparently carving out $26m from the regulator over three years in this year’s federal budget.

The Coalition’s 2014 budget also cut $120m from ASIC’s budget over five years, with then-secretary to the treasurer Steven Ciobo flagging scope for the industry to “self-regulate more”. This was then reversed by then-treasurer Scott Morrison in 2016 after former ASIC boss Greg Medcraft complained the cuts would kill its ability to carry out proactive surveillance.

ASIC is now midway through shifting to a “user pays” model.

With a Thursday deadline for companies to submit information to the regulator, a substantial number are yet to do so.

More recently, ASIC has had to lobby for the laws to be changed to clamp down on corporate misconduct.

Despite repeated calls from ASIC itself for the government to fast-track its proposed laws taking aim at the predatory payday lending industry, Canberra has failed for two years to push legislation through parliament after buckling to lobbying by backbenchers.

Labor MPs took the unusual step of introducing the government’s own payday legislation into parliament in a bid to get the laws passed. It failed.

As treasurer, Mr Morrison said the government was giving “very serious consideration” to a Productivity Commission proposal, made in Mr Harris’s last review of the financial system, of establishing a “principal integrity officer” at all lenders, who could report to the corporate watchdog if bank boards ignored pleas to overhaul remuneration in conflict with good customer outcomes.

Mr Harris sided with Mr Hayne on the need to simplify the law and enforce values-based rules. “I do think this idea that telling the banks they legally now have to act in the best interest of their customers (is a good one), and where they are paying money that is going to create a conflict, they’ve got to monitor that in a way that says they can’t say they were unaware of it,” Mr Harris said.

“There’s got to be rules in every marketplace. That’s how we all trade effectively with one another, because there are rules. That needs to be strengthened.

“The rules are a combination of what the black letter law says and how the board insists upon performance standards.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout