CBA makes extra $355m provision as big banks’ remediation bill set to pass $1bn

CBA has added another $355m in total provisions to its tally, as it seeks to cover compliance costs and repay aggrieved customers.

The scandal-prone Commonwealth Bank has added another $355 million in total provisions to its growing tally as it seeks to cover compliance fixes, repay aggrieved customers and account for delays in completing the sale of its life insurance arm.

Offsetting the new provisions are $135m in recoveries CBA made on its professional indemnity insurance, which reduces the latest bill to $220m.

The insurance recoveries relate to penalties and legal costs for incidents such as its $700m settlement with Austrac for facilitating money laundering and terrorist financing.

Across the big four banks, while the figures are accounted for slightly differently, the compensation and compliance bill related to wrongdoing has already topped $1.4 billion.

That excludes a CBA provision of $55m, largely attributed yesterday to transaction and separation costs on a revised completion date for the sale of Comminsure Life.

The remediation came after the Hayne royal commission exposed a spate of misdemeanours across the sector, including charging fees for no service and charging dead people.

In a statement to the ASX yesterday, CBA provided an update on insurance recoveries, customer remediation costs and transaction and separation costs that would have an impact on earnings for the half-year ended December 31. The new provisions span several business units, including those slated to be spun off, such as financial planning and mortgage broking.

The recoveries will be recognised as a benefit within operating expenses.

The bank said a provision of $100m would be recognised to cover the “higher than expected total cost of the multi-year financial crime compliance Program of Action and other ongoing compliance and remediation programs”.

In a sign that royal commission-led and other customer repayments are set to balloon, CBA set aside an additional $200m for its financial planning, wealth and mortgage businesses, which are set to be demerged next year. That will be classified as an “indemnity provision” and will cover historical remediation to CBA customers and program costs.

The $55m comes after CBA agreed to sell its life insurance unit to pan-Asian giant AIA in a $3.8bn deal announced last year.

Morgan Stanley analyst Richard Wiles told clients the new CBA provisions and recoveries would hit reported cash profit by $255m after tax and continuing cash profit by about $115m.

“Our forecasts already include $500m pre-tax of refunds and remediation in financial year 2019, although we have not factored in insurance recoveries or additional transaction separation costs,” he said.

The new provisions did not materially affect his CBA earnings estimates, Mr Wiles said.

Shaw and Partners banking analyst Brett Le Mesurier estimated CBA would have a lot more to do on remediation and related program costs. He put CBA’s bill, including the Austrac fine, at more than $2bn and estimated CBA’s three rivals would fork out more than $1bn each.

Mr Le Mesurier said CBA’s $200m provision for the entities soon to be demerged “was likely to be the bigger issue going forward”.

All of the provision amounts are pre-tax and add to earlier sums flagged by CBA.

Provisions of $270m were made public by the bank in October to cover repayments to customers who received poor or no financial advice and were charged fees. Earlier this year, CBA announced $16m in remediation to customers who held credit cards and insurance products that the royal commission had highlighted provided little customer value.

The other banks have also confessed their sins to investors as they assess customer files. Westpac had warned its customer remediation program and other legal issues would affect cash earnings by $281m.

NAB said in its full-year results that customer-related remediation would cost the bank $360m, compared to the $314m it estimated in October.

ANZ said its customer remediation program would cost in the region of $377m.

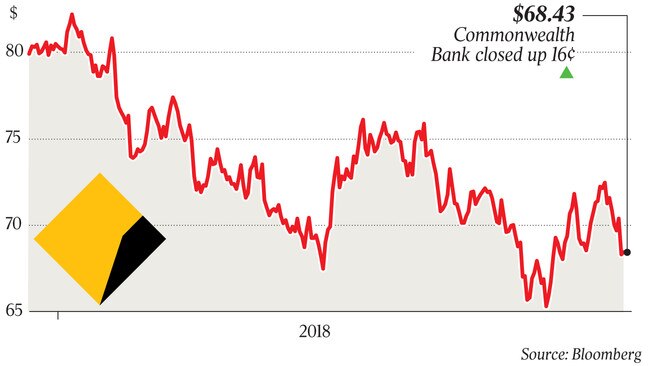

CBA’s shares closed 0.2 per cent higher at $68.43 yesterday but the stock remained 14.8 per cent lower this year.

In a separate announcement, CBA chairman Catherine Livingstone appointed Genevieve Bell as an independent non-executive director from January 1.

Professor Bell is a former Intel executive who is now an academic at the College of Engineering and Computer Science at the Australian National University.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout