CBA executive Marianne Perkovic coy on customer rip-offs

Senior CBA executive Marianne Perkovic has been accused of dissembling in her evidence to the banking royal commission.

Senior Commonwealth Bank executive Marianne Perkovic has been accused of dissembling in her evidence to the financial services royal commission to cover up the fact it took Australia’s biggest bank two years to tell the corporate regulator that it was ripping off customers by charging them fees for services they did not receive.

Commissioner Kenneth Hayne had to repeatedly remind Ms Perkovic, who for many years was closely involved in CBA’s deeply troubled financial advice business, to answer the questions posed by counsel assisting the commission, Michael Hodge QC.

The commission has heard that between 2007 and 2015, CBA and its financial planning subsidiaries failed to provide annual reviews to more than 30,000 customers.

It again put pressure on the business models of the banking sector, probing the multiple levels of fees charged on investment wrap products at both AMP and CBA.

Since this second session of hearings opened on Monday, more than $1 billion has been slashed from the market capitalisation of AMP, which has admitted to deliberately gouging fees for no service from financial advice customers and misleading the Australian Securities & Investments Commission about it 20 times.

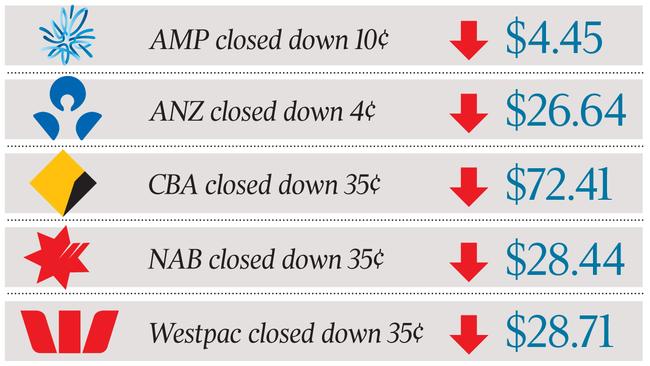

As its share price fell another 2.2 per cent yesterday to $4.45, AMP issued a second “unconditional” apology for its misconduct.

CBA shares fell almost 0.5 per cent, to $72.41, the steepest fall among the big banks yesterday.

Ms Perkovic, who is now the head of CBA’s private bank, was taken to documents from mid-2013, when she was at the company’s financial advice arm.

At the time, CBA’s main advice subsidiary, Commonwealth Financial Planning (CFP), was subject to an enforceable undertaking it had agreed to with ASIC to clean up its compliance systems following the discovery of crooked behaviour by planners, including its most notorious adviser, “Dodgy” Don Nguyen.

The enforceable undertaking would ultimately fail to cure the CBA’s financial planning woes, which have since been the subject of several rounds of customer compensation sparked by media reports and parliamentary inquiries.

Mr Hodge asked Ms Perkovic about a memo written by risk management executive Jaime Henderson in April 2012 and sent to her on May 3, 2012.

Head of financial planning Annabel Spring, who left CBA in September last year, had asked for an update on “any potential or unknown issues that we have in the business”, Ms Perkovic told the commission.

The Henderson memo revealed that CFP had no reliable method of tracking whether clients of advisers who had left the business were still being charged for ongoing services, such as annual reviews of their investment position.

Her “initial and very brief analysis” revealed 257 clients who were paying ongoing fees but getting nothing in return, Ms Henderson said in the memo.

Ms Perkovic initially agreed that this did not suggest the problem was limited to 257 clients, but then went on to give a long explanation that at the time the business was “going through significant transformation”.

Mr Hodge asked: “Ms Perkovic, is the reason that you are dissembling in answering my question in order to attempt to pre-emptively explain why it is that CFPL took more than two years to notify ASIC of its breach?”

“So, at the point in time in 2012 there was no known breach,” Ms Perkovic replied.

“When we knew the breach had occurred in 2014, that is when we notified ASIC.”

However, the commission was shown other documents, including draft reports prepared by consultancy Deloitte and minutes of a risk committee meeting, that show the issue was regarded as a high risk in 2012 and early 2013.

Earlier, the head of CBA division Colonial First State, Linda Elkins, admitted it would be “unlikely” that her operation would kick a fellow bank subsidiary such as CFP off its investment platform if it had done something wrong.

Ms Elkins acknowledged that the scandals at CFP meant it had breached the Corporations Act but said Colonial had not considered kicking it off the platform.

“No, knowing the action the entity was taking satisfied us we didn’t need to take any further action,” she said.

She said she was focused on the remediation efforts undertaken by the CBA planning groups.

Counsel assisting the commission, Mark Costello, put it to her that it was “inconceivable” that Colonial would kick a fellow bank subsidiary such as Commonwealth Financial Planning off its platform.

“I would have to agree that’s unlikely,” Ms Elkins said.

“I don’t know that it’s inconceivable.”

“You’d be the gold medallist if ASIC was handing out medals for fee for no service,” Mr Costello said.

“Yes,” Ms Elkins responded.

AMP’s head of platforms, John Keating, admitted the company has the ability to stop ongoing fees being charged through its investment platforms in order to comply with laws that say clients have to opt-in to paying them every two years, but has not done so.

It has also not produced a benchmark report, checking whether the fees charged through its investment platforms are competitive with the rest of the market, for 18 months.

And it has not reduced fees on two platforms internally benchmarked as “red”, or uncompetitive, the commission heard.

Mr Keating said the company relied on audits of financial planners to detect when unauthorised fees were being charged.

Asked by counsel assisting the commission, Michael Hodge, QC, if there was any technical reason why AMP could not automatically require advisers to confirm clients had opted in every two years, Mr Keating said it was “certainly possible to do”. Asked if AMP had considered taking this approach across its platforms, he said: “Not to my knowledge.”