Banks get busy on customer payouts

At least two major banks have started repaying thousands of customers for raking in incorrect fees or interest.

At least two major banks have started repaying thousands of customers for raking in incorrect fees or interest, even outside areas the Hayne royal commission focused on.

Letters sent to customers by ANZ and Westpac, and seen by The Australian, relate to wrongly charged foreign exchange fees and home loan interest.

The banks are ramping up customer remediation efforts after the royal commission exposed scandals, including the charging of financial advice fees when services were not provided, as well as levying dead people’s accounts.

The measures underscore the importance of bank customers checking their statements.

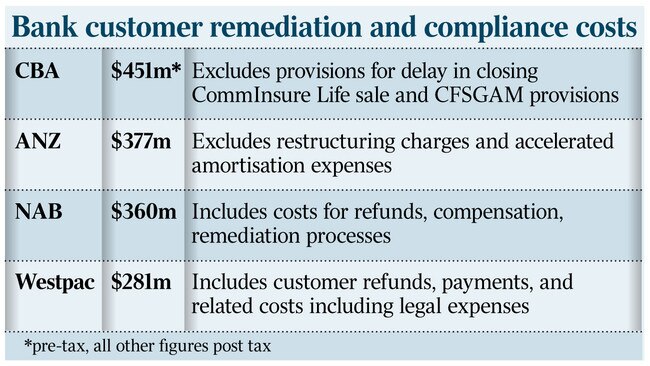

So far, the banking sector’s compensation and compliance bill, across the big four banks, has swelled to more than $1.4 billion. The total when the royal commission’s work ends is expected to be multiples of that.

Among its latest remediation programs, ANZ has written to thousands of customers, including those holding its Frequent Flyer Platinum credit card accounts.

The letter, outlining a refund amount payable to the customer, says: “We have reviewed your credit card account and identified that you were charged overseas transaction fees on certain credit transactions when it was not clear that the fee would apply.

“This includes a refund of the incorrect charges and an additional amount in recognition of any inconvenience caused.”

An ANZ spokesman said: “We have already written to many of these customers to explain why we are refunding them and to sincerely apologise.

“When we make errors such as this, we do our best to make it right.”

ANZ’s action comes as the competition regulator probes foreign currency conversion services, after announcing an inquiry in October.

The Australian Competition & Consumer Commission’s statement cites World Bank figures showing Australians sent about $8.8bn overseas in 2016, and this market was the third most expensive G20 country for consumers and small businesses to send money from.

It is unclear if the ACCC’s inquiry includes credit cards, but it is targeting big banks.

The regulator said: “We will be examining why major companies in Australia, including the big four banks, seem to be able to consistently charge high prices … Core to the ACCC’s inquiry will be the way prices are presented to customers.’’

Westpac has reviewed thousands of mortgages and advised customers of refunds after mistakes were made. One group involved refunds on closed home loans where excess interest was charged after a fixed-rate period came to an end, and the applicable variable rate “was not correctly applied”.

Westpac is repaying the excess interest customers paid and the letter also cites compensatory interest. A Westpac spokeswoman said the bank had identified the home loan issue and “proactively notified” the corporate regulator.

Westpac has contacted all of the 1468 customers affected and paid out 98 per cent of refunds, she said.

“We are committed to a review of our products and services to ensure we get it right for our customers,” she said. “We apologise … for this error and are … providing refunds to affected customers, including compensatory interest, to ensure they are not financially disadvantaged by our mistake.’’

The remediation costs were included in Westpac’s full-year results, handed down last month.

The Hayne royal commission has prompted large remediation programs at the big four banks and wealth group AMP.

Earlier this month, CBA added provisions of $165 million, net of insurance recoveries, to cover compliance fixes and to repay aggrieved customers.

Provisions of $270m were made public by the bank in October to cover repayments to customers who received poor or no financial advice and were charged fees.

Westpac disclosed a cash earnings hit of by $281m, NAB said customer-related remediation would cost $360m and ANZ revealed a $377m customer remediation program.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout