Banking royal commission: too little, too late for broker victims made homeless

‘What the commission heard about people losing their homes or their farms was just the tip of the iceberg.’

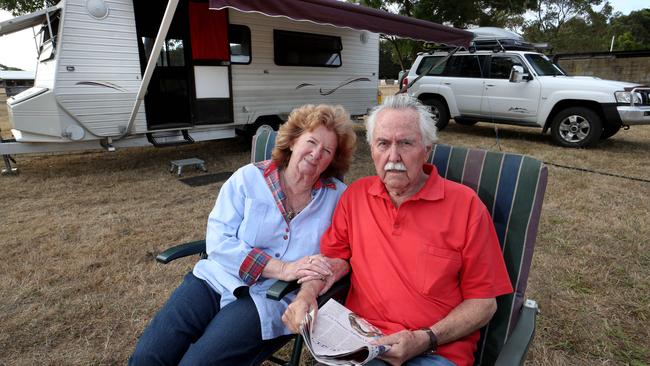

For Peter and Anne Harwood, the “rivers of gold” flowing to mortgage brokers and financial advisers the banking royal commission wants stamped out represent more than metaphorical avarice: for them it represents their house, furniture, share portfolio and financial future.

And the royal commission’s calls for mortgage brokers to be legally required to act in the best interests of customers, decades after they became a prominent part of the financial system, is met with a wry scepticism.

“We have found the whole commission pretty weak,” Mr Harwood, 81, said yesterday from the caravan he and Anne call home.

“What the commission heard about people losing their homes or their farms was just the tip of the iceberg.

“They really didn’t get into the nitty gritty of household mortgages. There were only 20 or 30 witnesses when they received 10,000 submissions.’’

The Harwoods lost their home and were forced to move into the caravan after, nearing retirement, they approached a financial adviser who encouraged them to borrow heavily to buy an investment property.

The adviser introduced them to a mortgage broker who set them up with a subprime-style so-called “low-doc”, or low-documentation, loan, which requires little if any proof of a borrower’s ability to repay.

Within months of the loans being granted, the couple fell into arrears and their spiral into homelessness began.

Mr Harwood said after extensive wrangling with CBA, the couple obtained their loan application forms and found their income and assets had been vastly inflated, with claims they were earning $342,840 a year.

Following publication of their plight by The Australian, CBA said it would again “investigate” their case and later agreed to forgive about $205,000 in debt, much of it interest payments.

The Harwoods have contested, seeking $500,000, enough to put them somewhere near the position they were in before the dealings with the adviser and mortgage broker, but say their past four letters have not even drawn a response from CBA.

The Hayne royal commission yesterday recommended the large sums of money that flow to mortgage brokers and financial advisers, often for no or very little work, should cease and mortgage brokers should be legally forced to act in the best interests of clients, as financial advisers are supposed to.

Mr Harwood said he had been deeply frustrated by the refusal of the federal government to call the royal commission, even though widespread cases of banking malfeasance had been publicly exposed.

“If they didn’t want one, what was there to hide?” Mr Harwood said.

“They want to create royal commissions for all sorts of things, and some of them lasting many years, but for banks they didn’t want a bar of it.

“(Malcolm) Turnbull didn’t want a bar of it and Scott Morrison was dragged kicking and screaming to the table.’’