Banking royal commission: Hayne demands CBA explain document blunder

Ken Hayne has demanded an explanation from CBA over a document blunder that delayed the start of today’s hearings.

Commonwealth Bank’s barrister Charles Scerri has cast confusion over the royal commission, after claiming to have discovered new documents overnight that revealed further misconduct of a bad banker, and then clarifying that the bank’s legal team had possession of them for more than a month.

Royal Commissioner Kenneth Hayne has demanded a written explanation by Tuesday from CBA that explains why they were only tendered to the royal commission overnight despite being given to the legal team a month ago.

Mr Scerri opened Friday’s hearing by telling the royal commission CBA lawyers “discovered” the documents yesterday when it was searching for the performance review of a Bankwest bank manager, who the commission heard had been inflating property valuations to meet lending targets and gain bonuses.

The new documents showed not only had the bank manager, whose name was suppressed, inflate farm valuations but he had also kept inaccurate information in his files, engaged in mis-selling and fudged numbers to garner bonuses. Other customers were found to have problems with the same banker, after they contacted his clients when his phone was handed in.

On Thursday, the royal commission heard the “champion” bank manager at CBA subsidiary Bankwest, whose target-beating lending won him a trip to Hayman Island, later left the company after he was found to have allegedly overvalued loans.

The royal commission on Friday morning heard the banker gave two unconditional letters of finance approval when the loans had not actually been approved and a number of times gave verbal commitments for finance. He also arranged and allegedly advised an elderly customer to withdraw a $350,000 term deposit early then transferred the funds to another customer.

Bankwest became aware of the issues around the time the manager resigned in March 2012.

The royal commission heard the banker may have entered into CBA’s conduct register, known as its “Genysis” system, to reset the number of “dishonours” marked against him to zero.

Documents also presented at the royal commission on Friday showed retired CBA non-executive director Harrison Young, who was chair of the bank’s risk committee, was briefed on the Four Corners investigation of Bankwest and on the behaviour of the banker, as part of a review into the Toowoomba operations in 2012.

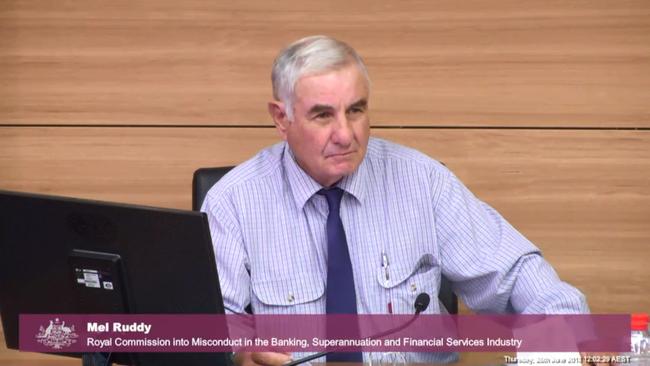

In the case of Mel Ruddy, a Queensland cattle farmer, the Bankwest manager was set to double his take-home pay through the bonus payments.

The Bankwest manager in western Queensland convinced the farmer to take a larger loan on his two cattle properties when he had originally planned to sell one of them, after valuing the properties at a generous $2.3m.

But after signing with Bankwest in late 2011, Mr Ruddy’s farm was hit by a savage drought and cattle prices plunged after the government’s 2013 live export ban.

A 2014 revaluation of the properties by Bankwest saw them valued at $1.65m and outside the lender’s loan-to-valuation ratio limit, forcing Mr Ruddy to sell one of them. Mr Ruddy ended up needing to borrow $160,000 from his mother to cover costs and sell farming equipment to stay in business after the debacle.

Mr Ruddy said he would not have entered the deal if the banker hadn’t approached him. “But Bankwest offered such a good deal. Being an optimist I thought I would give it a go,” Mr Ruddy said.

The banker had been named “Rural and Regional Champion” at the bank for exceeding sales targets in 2011 and was sent on a trip to Hayman Island after he lent $33.5m against his $25m target.

However, the next year the banker left the business after several “conduct issues” were raised that included “overstated valuations” and inaccurate information in case files. Three “major risk” incidents tied to the banker also resulted in Bankwest losing almost $400,000. He acted as the sole valuer on Mr Ruddy’s loan.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout