Banking royal commission: bank greed deemed ‘criminal’ as charges recommended

Kenneth Hayne recommends criminal charges against three financial institutions and asked for probes into 15 more.

Kenneth Hayne has recommended criminal charges against three financial institutions and asked for investigations into 15 more in a final report that sets up an election battle between the Morrison government and Labor over which party can be tougher on the banks.

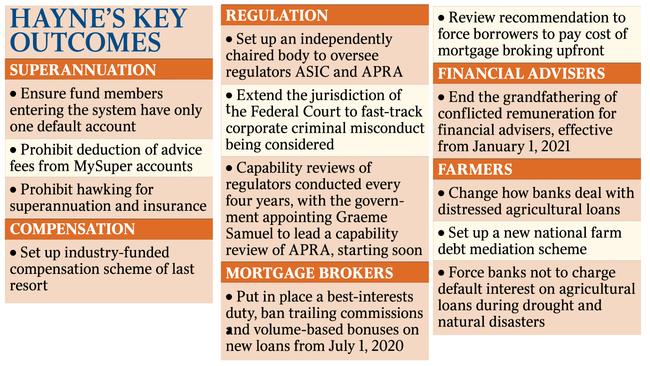

The royal commissioner made 76 recommendations involving sweeping changes to laws governing the financial industry in a bid to put an end to misconduct uncovered by the royal commission that included institutions charging dead people fees, banks turfing hundreds of farmers from their land and selling unwanted funeral insurance to a man with Down syndrome.

The royal commission heard explosive revelations that some of Australia’s largest financial institutions repeatedly lied to regulators and charged fees where no service was provided, a practice that has left them exposed to a possible compensation bill of up to $2 billion.

Josh Frydenberg yesterday declared that the banks had been “driven by greed”. “From today, the banking sector must change. And change forever,’’ he said.

Across the period of royal commission hearings, large financial stocks lost $80bn in sharemarket value.

Mr Hayne’s proposed overhaul of the financial sector — publicly released yesterday — would end kickbacks to mortgage brokers and financial advisers, and trigger a shake-up that could make it tougher to secure home loans.

He also delivered a stinging rebuke to National Australia Bank, its chairman, Ken Henry, and chief executive Andrew Thorburn over the bank’s poor conduct and their unwillingness to grapple with the bank’s problems while giving evidence to the commission.

However, Mr Hayne stopped short of calling for one of the industry’s most-feared reforms: a ban on big banks making and selling financial products — vertical integration — saying it would be “both costly and disruptive”.

Scott Morrison said yesterday the government had “agreed to take action” on all 76 recommendations and in some areas was “going further”.

“The government is confident that the actions announced today will put in place the necessary legislative framework, providing regulators with the power and resources to hold those who abuse our trust to account,” the Prime Minister said. The Treasurer said the government would fully implement all but one of Mr Hayne’s recommendations, baulking at the commissioner’s demand that borrowers, not banks, pay the fees of mortgage brokers. He also opened the door to increased funding for the Australian Securities & Investments Commission, a move that could cost the government as much as $1bn a year.

The report sets up the potential for a fierce political battle in the weeks before the expected May election. Opposition Leader Bill Shorten moved quickly to claim that Labor would be tougher on the banks than the Coalition.

“The banking royal commission’s report is a dark day for Australian banking, and a terrible indictment on the greed in the industry,’’ he said. “Unlike the Liberals, Labor accepts in-principle all of the recommendations in the report.’’

The ACTU took to Twitter late yesterday to criticise the report, claiming it was “wholly inadequate’’ and was too soft on bank executives.

With only 10 sitting days left before the election is expected to be called, and only five for the Senate, Mr Frydenberg all but conceded the government did not have time to implement a full response to the recommendations.

“We only have a couple of weeks left before we get into the budget sittings,” the Treasurer said. “So they are decisions that the government will take in due course about timing arrangements.” The government, which originally opposed calls for a royal commission from Labor and some Nationals MPs, yesterday warned that the findings represented a “scathing assessment of conduct driven by greed” and uncovered “behaviour that was in breach of existing and fell well below community expectations”.

“There have been broken businesses and the emotional stress and personal pain has broken lives,” Mr Frydenberg said.

“The nation has heard evidence presented before the commission of hundreds of millions of dollars in fees for no service; companies misleading and obstructing regulators; the charging of dead people; (and) the sale knowingly of worthless insurance policies.”

Labor accused the government of voting against the royal commission 26 times, saying this had delayed action for more than 600 days and that the Coalition’s now-shelved corporate tax cuts would have rewarded the banks’ misconduct with a $17bn handout.

Labor Treasury spokesman Chris Bowen criticised the “part-time parliament” for delaying a comprehensive response to the report. He challenged the government to open a round of discussions with Labor on prioritising legislation for the key recommendations that could be passed immediately “if we have enough sitting days”.

“It’s distinctly possible nothing gets passed before an election (and) it’s all left to an income government,’’ Mr Bowen said. “There are elements here which, if the Treasurer and I sat down and had a discussion, I’m sure we could agree on fairly quickly.”

Mr Bowen said Labor accepted, in principle, all 76 recommendations, including overhauling the link between the industrial relations and superannuation systems to ensure workers could be defaulted only once into a superannuation account through bargaining agreements.

The government response is targeted around four key objectives: strengthening protections for consumers, small business and regional communities; raising governance standards; enhancing the effectiveness of regulators; and delivering remediation for those harmed by misconduct.

Key steps Mr Frydenberg identified for immediate implementation included amendments to the Coalition’s superannuation package, which is currently before the parliament, to ensure that trustees and directors of super funds are subject to civil penalties for breaches of best interests obligations.

The Treasurer, who said he would prohibit hawking for superannuation and insurance, will also make an immediate direction to the Australian Financial Complaints Authority to ensure it has the authority — for the next 12 months — to accept applications for disputes dating back to January 1, 2008. This will be used to underpin the new compensation scheme of last resort for consumers and small businesses ripped off by financial firms, with $30 million to be paid out to about 300 consumers who have already received a favourable determination by the authority’s predecessors.

The government has also unveiled a capability review of the Australian Prudential Regulatory Authority to be chaired by former chair of the competition watchdog Graeme Samuel. Australian Banking Association chief executive Anna Bligh said the recommendations pointed to a “massive overhaul” for the financial services sector. “There is no stone that has been left unturned by Commissioner Hayne,” she said, adding it included some “very tough medicine” for the banks.