Bank execs ‘off to jail, I hope’: keen interest in Hayne report

Australians are keenly awaiting the outcome of the financial services royal commission.

Australians are keenly awaiting the outcome of the financial services royal commission and overwhelmingly believe the recommendations of the inquiry will be good for ordinary people, according to polling exclusively obtained by The Australian.

The polling, conducted for the industry superannuation sector, reflects political pressure on the Morrison government not to backslide on its commitment to adopt in full the recommendations that are expected to reshape the finance industry, to be handed to it by commissioner Kenneth Hayne today.

It also reveals changing community attitudes towards the royal commission and the finance industry as hearings dominated headlines last year, shifting from complaints that the inquiry was toothless “froth and bubble” in February through to a consensus that its hearings had revealed widespread “dishonesty” among the banks and a need for far tougher regulation in December.

“A whole bunch of senior bank executives are going to jail — I sincerely hope!”, one respondent said in December.

The research, conducted by UMR for umbrella group Industry Super Australia, draws on a monthly survey of more than 1000 people that was most recently conducted in late November and early December, as the commission was taking evidence from bank CEOs and regulators in its final round of hearings.

In a message to politicians not to back away from reform of the sector, the survey found that 75 per cent cared about the result of the royal commission, with 68 per cent agreeing that the outcome would be good for ordinary Australians.

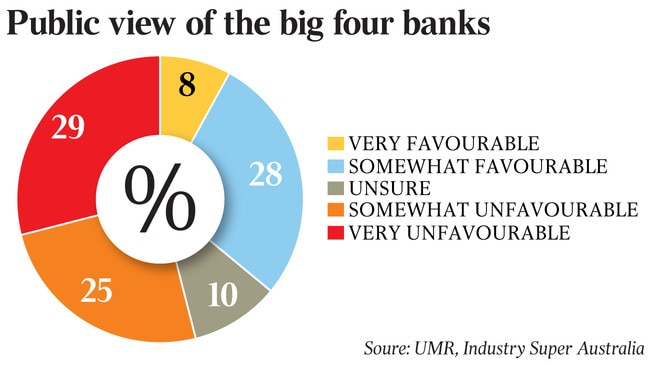

Over the course of the survey, favourability towards the big four banks plunged from 51 per cent to a historic low of 32 per cent in August, before clawing back some ground to 36 per cent in December.

As The Australian reports, Josh Frydenberg said it was the government’s intention to adopt all Mr Hayne’s recommendations.

This came close to matching a similar commitment given by Labor’s Chris Bowen, who last week pledged to adopt all the report’s recommendations, without having seen them.

The survey also reflects the body blows the hearings delivered to individual institutions, with Commonwealth Bank and AMP repeatedly savaged in comments from respondents.

“I heard a long ‘laundry list’ of things that the banks and AMP did which was immoral or even illegal, such as charging dead people for services, etc,” one respondent said in July.

“AMP majorly screwed up and lied, another said. “The big banks generally suck.”

“CommBank has hurt customers disgracefully,” said a third July participant. A December respondent said the commission showed that “banks such as AMP, ANZ and NAB have a policy of charging fees to customers who are deceased”.

Along with fees charged to the dead — revealed by CBA, NAB and AMP during hearings in May, August and September — the more general issue of fees for no service was also high on the list of things people remembered about the commission, along with shoddy financial advice.

“Banks charging fees on accounts of dead people, banks charging for services that they did not provide, financial advisers working for banks have sent people broke,” one respondent said in December.

“Useless” insurance and commissions — “kickbacks” — to brokers also raised hackles, as did mistreatment of Aboriginal communities by insurers.

Some respondents were more general still, describing the banks as “bloodsucking vampires”, “morally repugnant”, “ripping people off hand over fist”, “bastards”, “grave robbers and cheaters”, “thieving scum”, “absolutely disgusting”, “cheats and liars in a very big way” and engaging in “institutionalised criminal behaviour”.

“The banks f..ked us all over and they get away with it,” one participant said in July.

Meanwhile, views of industry super funds, which were only lightly criticised during the commission, barely budged, with 69 per cent having a favourable view in December 2017, dropping to 65 per cent a year later. The research also shows that awareness of the commission in the community was high, with 65 per cent aware one was to be called in December 2017 and 77 per cent aware of its existence following 12 months of front-page headlines.

In November, 32 per cent of respondents were aware the commission had demonstrated the banks had engaged in misconduct.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout