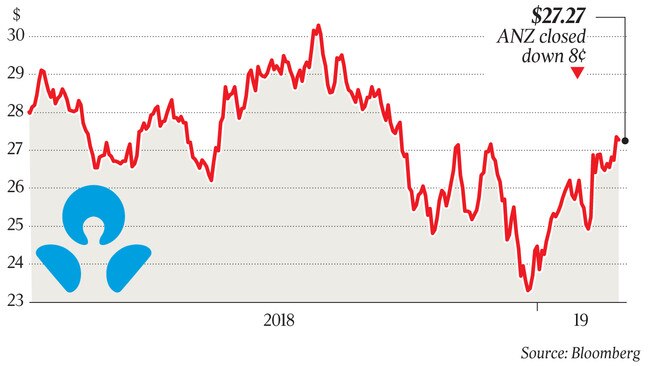

ANZ on front foot for Hayne reforms

ANZ will scrap overdrawn and dishonour fees on pensioner accounts as part of its response to the Hayne inquiry.

ANZ will implement 16 initiatives as part of a first response to the Hayne royal commission, including scrapping overdrawn and dishonour fees on pensioner accounts.

In a statement, ANZ said the measures would improve the treatment of retail customers, small businesses and farmers and ensure public reporting when failings were being rectified.

ANZ, like its big bank counterparts, was intensely scrutinised during the royal commission.

The commission looked at misconduct including wealth customers being stung by excessive fees and delved into ANZ’s poor record for reporting breaches to the corporate regulator.

Among ANZ’s initiatives are removing overdrawn and dishonour fees from pensioner accounts, acting as a “model litigant” in court action against retail and small business customers and creating a phone service for indigenous customers.

For farmers, ANZ is pledging early access to farm debt mediation as well as favouring “workouts” over enforcement or appointing external managers.

It will also not charge default interest in areas hit by drought or other natural disasters.

Analysts told The Australian the measures were unlikely to cause a notable rise in costs at ANZ or a large drop in fee revenue. The bank is said to have a team of people working on the implementation.

“The royal commission, including the final report, has led us to reflect more broadly on the issues we face in reshaping our bank,” ANZ chief executive Shayne Elliott said.

“These issues includes how we govern the bank, how we pay our staff, how we hold people to account, our products and how we provide them.

“We are not treating our response to the royal commission as a compliance exercise.

“Rather, we are taking action now to respond to many of Commissioner Hayne’s recommendations that directly impact customers as well as the spirit of his final report.

“I’m confident these initial reforms will provide our customers with a fairer banking service.”

ANZ fared better than many of its rivals in the royal commission’s final report, copping two breach notices compared to Commonwealth Bank with 12 and AMP with nine.

ANZ’s 16 initiatives also included references to “ongoing work” on several of the Hayne recommendations.

The finding that all financial services firms review the design and implementation of pay for frontline staff at least annually was one of those.

The bank also vowed to add additional assessments and audits of its culture and adopt further governance processes to “act on identified cultural failings”.

Mr Elliott said the initiatives were a “first step” in improving ANZ.

“I acknowledge that the cultural changes we need to make will take several years. However, we will continue to make the investments needed.”

Among other initiatives, ANZ plans to contact customers who pay little off “persistent credit card debt” to encourage a move to lower cost options.

ANZ’s royal commission announcement comes after it pledged on Tuesday to lift lending to investors, admitting it had hit the brakes too hard on mortgages.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout