Bankers expect bumper M&A in 2025, after the spike in withdrawn attempts last year

Rate cuts and post-federal election policy stability should trigger a greater number of deals in 2025 after the highest volume of withdrawn transactions in 14 years, industry experts say.

Mooted rate cuts this year and potential policy certainty after a federal election will spur bumper deal making in 2025, after improved volumes last year were marred by the highest annual tally of withdrawn transactions in 14 years.

That’s the view of investment bankers canvassed by The Australian, who said they had high expectations for activity levels in 2025. That is particularly the case if interest rates ease and lead to improved consumer and business confidence.

Bankers tip announced mergers and acquisitions this year will outstrip 2024’s volumes, given many vendors and buyers failed to agree on price over the past 12 months.

There is also $18.4bn in dry powder to be deployed in this market across private equity, venture capital and private credit. Those buyers typically benefit from lower financing costs as monetary policy is eased.

Deutsche Bank’s investment banking coverage and advisory chief, Emma-Jane Newton, said preliminary activity leading into 2025 suggested this year could be the busiest for M&A in some time.

“The number of RFPs (request for proposals) that are coming through and conversations with corporates and (financial) sponsors on wanting to get sale processes launched into market or wanting … to execute upon transactions in the first half, is at a level that I haven’t seen for many years,” she said.

“Rate cuts should be supportive … and hopefully we continue to narrow that valuation gap that’s existed (between buyers and sellers).”

Citigroup’s Australia, Japan and North Asia vice-chairman Tony Osmond echoed that view.

“Our pipeline is up 50 per cent going into 2025. It’s actually pretty exciting,” he said.

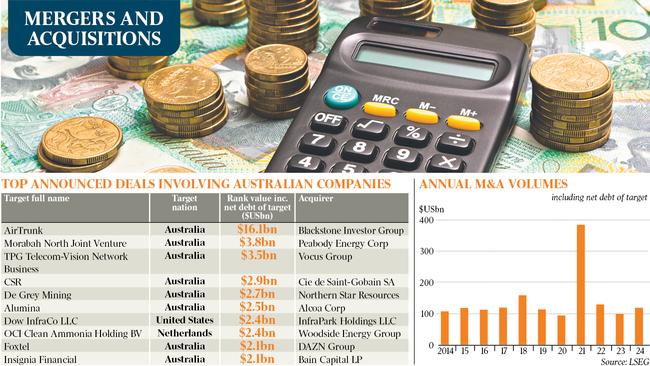

Announced M&A with any Australian involvement that includes outbound and inbound deals increased 19.7 per cent to $US118bn ($190.1bn) in 2024.

London Stock Exchange Group, formerly Refinitiv, data showed 2024’s announced deal volumes did, however, trail 2022 and were down on the 10-year annual average.

Completed M&A with any Australian involvement edged up just 3 per cent in 2024.

Withdrawn transactions soared to $US70.9bn, the highest annual total since 2010, reflecting 57 deals.

Withdrawn deals through 2024 included BHP’s almost £39bn ($78bn) Anglo American tilt, a share-based offer that was rebuffed by the target, and REA Group pulling its takeover proposal for British property portal Rightmove. ASX-listed fund manager Regal Partners in December abandoned its pursuit of Platinum Asset Management.

A string of sale processes for private equity-owned assets – including radiology giant I-MED and clinical research firm Novotech – stalled last year, after failing to attract bids that would get transactions across the line. Those processes have been pushed into 2025.

Reports last week also had the sale of Craveable Brands – owner of Red Rooster and Oporto – falling over after private equity buyer Affinity Equity Partners decided against proceeding with an acquisition.

“Deal completion risk now is as high as it’s ever been in terms of just getting things done,” JPMorgan head of investment banking Julian Peck said.

“People haven’t come to a meeting of the minds on valuation and deals just push to the right or don’t happen … converting activity into transactions feels slower and harder.”

Mr Peck is optimistic, though, that 2025 will develop into a better year for M&A activity and deal completion.

“Every sector has got a decent level of activity. So 2025 seems more broad based,” he said. “The bid-ask spread that we’ve seen over the last two years, you would think would most probably start to close in 2025 … people are hoping for a lower rate environment.”

The biggest Australian transaction of last year was the $24bn acquisition of data centre operator AirTrunk by Blackstone and its Canadian partner.

That was followed by Anglo American’s divestment of a portfolio of Australian steelmaking coal mines to Peabody Energy and TPG’s sale of its enterprise, government, wholesale and fixed business and fibre network assets to Vocus.

The LSEG Australia data excluded deals such as the $9.1bn acquisition of ASX-listed Altium by Japan’s Renesas Electronics, given the former is headquartered in the US.

The AirTrunk transaction also ranked highly globally, as the tenth largest completed acquisition in 2024.

Internationally, announced M&A volumes rose 9.7 per cent to almost $US3.2 trillion last year, from a weak 2023.

Goldman Sachs head of M&A Marissa Freund said she believed the deal-making environment was improving but “not in a linear way”.

“We do expect 2025 to be again better than 2024,” she said, noting that stable or lower interest rates would buoy the confidence of company management and boards.

“The biggest driver of M&A activity is confidence.”

Goldman Sachs also expects improved levels of M&A by private equity firms this year.

“One of the big tailwinds we’ve got for inbound (activity) is the fact that at least on the private capital side, on the (financial) sponsor side, there is more capital being allocated to Australia, Japan and South Korea as markets,” Ms Freund said.

Citigroup’s Mr Osmond expects a busy year for private capital in 2025, spanning infrastructure and superannuation funds, private equity, venture capital and private credit funds.

“This private capital theme is a freight train,” he said, noting that category could account for more than 50 per cent of Australia’s M&A volumes this year.

Mr Osmond cited strong debt markets and declining interest rates as positive factors for deal making.

The Australian dollar’s slump – it is hovering near five-year lows – may also make acquisitions by offshore suitors more attractive, but bankers said the impact tended to be marginal.

“From time to time, it impacts in particular sectors or the way people invest, but by and large I don’t think (currency movement) is a big driver of activity,” JPMorgan’s Mr Peck said.

UBS head of power, utilities and infrastructure Chris Nicholson said positive settings for M&A in 2025 included stabilising inflation and equity markets trading close to all-time highs.

“When we think about the various factors that impact activity, they all seem to be heading to a good place for activity in 2025,” he said. “That will likely lead to relatively broad activity.”

On the potential for a federal election to cause a short-term pause in M&A activity, Mr Nicholson said: “Companies have obviously seen what’s occurred with elections globally and they prepare for a range of different electoral outcomes and a range of different policy outcomes, so that they are planning their business appropriately.”

Ms Newton noted the US saw “some pause” in M&A in the lead-up to the presidential election last year, but that had been brief.

“Post-election there’s been once again people picking their pens … and pushing forward at an accelerated pace,” she said.

Once a federal election is called here, and the government enters caretaker mode, agencies such as the Foreign Investment Review Board do not announce sensitive decisions around M&A.

Mr Peck noted participants in the energy sector would be closely monitoring policy announcements during the federal election campaign.

“You can’t hedge political risk, so all you can do is not invest,” he said.

“Continual political uncertainty doesn’t help investment in the (energy) sector at exactly the same time that the country probably needs to import a lot of capital to make the transition … Investing if you think the rules are going to change is hard.”

Mr Peck is also of the view the competition regulator’s new merger notification regime will bring forward some transactions this year.

“We might see a bit of a mini-run of M&A ahead of that and then you might see a little pause towards the end of the year … if (the deal is) complex, you probably don’t want to be the first transaction there,” he said.

The overhauled merger regime comes into effect from January 2026, but allows for parties to use the new process on a voluntary basis from July.

Mr Osmond said regulators and the Australian Taxation Office were more “forward leaning” regarding deals and related rulings last year, leading to elevated M&A risks.

Bankers interviewed by The Australian said the biggest risks to M&A this year were those linked to geopolitical shocks, rather than anticipated macroeconomic outcomes or unexpected regulatory policy changes.

Goldman’s Ms Freund said more broadly future M&A would draw on “super cycles” and changes in the way businesses and economies operated.

“AI (artificial intelligence) … that’s obviously driving a lot of the digital infrastructure and the data centre upswing,” she said, noting the energy transition and the outlook for the resources sector were also in focus.

“As we go through the transition, capital keeps needing to be put to work to pursue that end goal.”

Deutsche’s Ms Newton expects M&A activity to pick up in the consumer sector this year as rates decline.

“Consumers will start to feel more optimistic … then consumer businesses will be more interesting,” she said. “Participants will always want to buy ahead of that cycle rebounding.”

Mr Nicholson noted 2024 had seen a host of bidders opt to use cash and scrip or even all shares to pursue targets.

“We are seeing that shareholders are receptive to those scrip and mixed offer consideration transactions,” he said. “We expect that will continue.”

Among the examples cited by Mr Nicholson was New York-listed Alcoa’s scrip bid for Alumina.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout