That was clear yesterday, when NAB got on the front foot to further punish executives for the misdeeds of prior years.

NAB announced a new cut to directors’ fees in 2019 as part of its Hayne royal commission accountability measures, while executives take a further pay hit with up to $5.5 million of variable pay earned across 2016-2018 forfeited by most of the leadership team.

But coming up with a post-Hayne royal commission remuneration model that fits with the times will be more difficult.

The conundrum is that the banking regulator wants banks to incorporate non-financial risks into their pay structures, while investors largely want quantifiable financial performance measures and incentives.

Institutions are, of course, all for clawback mechanisms to strip executives of bonuses or other benefits retrospectively.

So NAB has a delicate balancing act after last year’s disastrous 88.1 per cent strike against its pay report at its annual meeting.

Over at AMP, where a second strike was avoided yesterday on pay, the under-fire group is in the process of formulating its new structure.

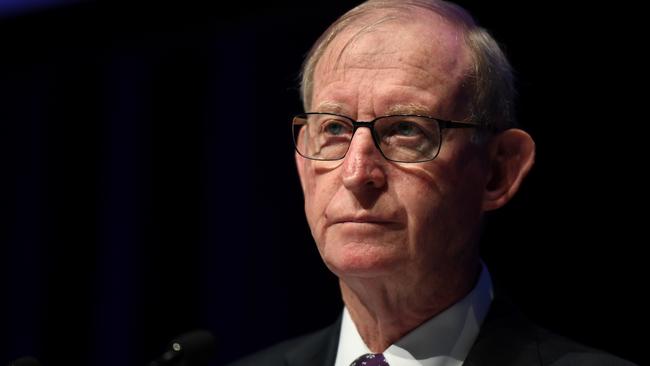

Chairman David Murray wouldn’t put a time frame on the release of the remuneration framework yesterday, but said the wealth company had expended a lot of energy on it and was focusing on longer-term outcomes.

“We’ve put a lot of effort into it, we’ve sought the views of investors and others,” he said.

“All I can say at the moment is that the way we structure remuneration from now on will be weighted towards the longer-term outcome, because we have a substantial amount of work to do over the next three or four years.

“We want the key management personnel to be focused on the result over that time, from now.”

In contrast, ANZ — which suffered a much smaller strike from investors last year — seems to be holding ground on pay after changes in 2018. Any tinkering may be at the margin this year.

In 2018, the David Gonski-led board implemented a 20 per cent reduction in board fees and clawed back unvested equity from five former executives as part of ANZ’s royal commission punishment.

Either way pay frameworks, which the royal commission showed are explicitly a driver of behaviour, will again be a hot-button issue in the latter half of 2019.

Across the ditch

The proposed higher capital requirements being considered for banks in New Zealand have spurred heated debate already this year, and the banks aren’t resting on their laurels.

ANZ, which has the largest exposure of its peers to New Zealand, was set to make two submissions on the matter — one via its local NZ entity, which counts former prime minister John Key as chairman, and another through its main Australian operating business.

Retreating from New Zealand is not said to be on ANZ’s agenda, but working through the changes has halted any capital management and will tie up resources.

In January, UBS labelled the mooted New Zealand measures as “unnecessary and potentially damaging”, saying they could prompt Australia’s major banks to cut dividends.

The proposed changes have already prompted the Reserve Bank of New Zealand to extend its consultation timeline by five weeks until today.

The RBNZ changes — as they stand — materially increase the amount of capital held by New Zealand banks, with the RBNZ suggesting increases will range from 20 per cent to 60 per cent.

The proposals may change risk weightings applied to the assets and drive a jump in the so-called “prudential buffer” banks hold. That would see a tier-one capital requirement equal to 16 per cent of risk-weighted assets for large banks imposed.

The requirements are hefty, but RBNZ has proposed a five-year implementation time frame, providing some breathing space and it appears consultation and engagement is genuine.

ANZ has previously said the changes implied a potential capital increase of $NZ6bn-$NZ8bn.

The top echelons of National Australia Bank are understood to have held numerous meetings in NZ last month with the RBNZ and government representatives on the proposed changes.

The tougher capital requirements are likely to see Australian banks shift more capital to their NZ entities or raise new capital, depending on the final shape of the requirements. Another consequence will be a marked shrinking of lending operations in New Zealand by Australian banks or sharp repricing of loans.

Australian banks account for 88 per cent of the New Zealand banking system’s assets, giving them plenty of skin in the game.

National Australia Bank and AMP have a lot of work to do to formulate pay structures for their executives that will appease regulators and keep investors at bay.