Virgin Australia needs federal help: Lindsay Fox

The billionaire who nearly rescued Ansett from collapse says the government needs to play a role in the resurrection of Virgin.

The billionaire who nearly rescued Ansett from financial collapse almost two decades ago, trucking magnate Lindsay Fox, says the federal government needs to play a role in the resurrection of Virgin Australia to ensure the nation has two viable domestic carriers.1`

After its collapse following the September 11 terrorist attacks, Ansett resumed limited services in October 2001 with help from the government and, while negotiations took place with Mr Fox and his business partner, retail magnate Solomon Lew, to rescue the airline, the talks fell through in March 2002.

“I’ve been in the situation of looking at Ansett and we went very close. We were stopped buying it by the prime minister of the day because we couldn’t get access to Sydney airport — without that, it didn’t work,’’ Mr Fox told The Australian.

“Virgin is a case of where they should look at the history (of government ownership of TAA and Qantas). We need two airlines here and other governments of the world have helped airlines to stay in business. I’m sure the government here will be looking at how they can do the right thing without being stupid.”

Virgin’s move to enter voluntary administration on Tuesday came after the government rejected its initial request for a $1.4bn bailout after the coronavirus pandemic grounded virtually all the airline’s domestic and international fleet. The collapse in bookings had made the airline’s $5bn debt load unsustainable.

While the NSW and Queensland governments have said they would be willing to provide financial support to Virgin, Josh Frydenberg said the federal government wanted a “market-led solution to have two commercially viable, major domestic airlines operating in Australia”.

Deloitte administrator Vaughan Strawbridge said on Tuesday there had been an “extraordinary” amount of interest in buying Virgin, with more than 10 parties involved. He expected to have a bidder within two to three months. However, bondholders and other creditors were expected to take a significant haircut.

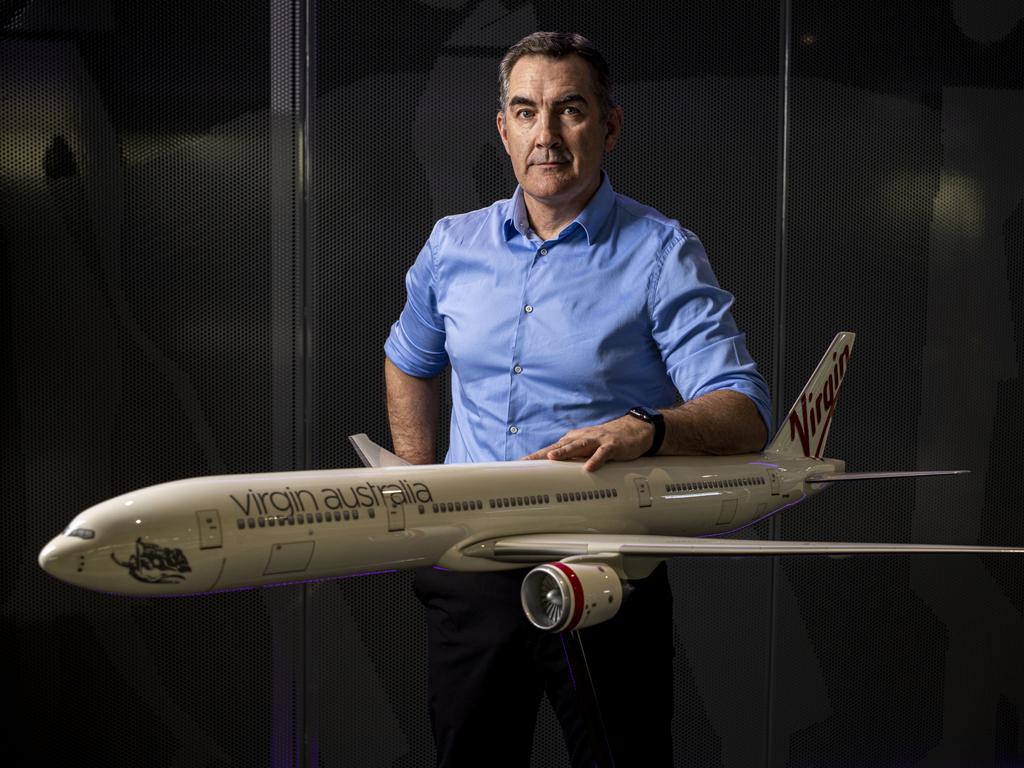

The Virgin management team headed by chief executive Paul Scurrah would continue to run Virgin Australia on a day-to-day basis and Mr Strawbridge said there would be no redundancies.

Mr Fox said he hoped government assistance could be made available “for a period of time and when things get back on track, it can make an exit”.

“I am not expecting the government to hand over money for nothing,” Mr Fox said. “But there must be some way, with smart people in the markets, to work out a way. You go into hospital and you get better. The same should happen with Virgin. We need two airlines flying in this country.”

Mr Fox’s comments were backed by Virgin Australia’s former chairman Neil Chatfield, who with former chief executive John Borghetti helped assemble the airline’s heavyweight share register that supported Virgin through its transformation into a full service carrier and in the brutal domestic capacity wars with Qantas that followed.

But four of those international shareholders — Singapore Airlines, Etihad Airways and China’s HNA Group and Nanshan — were not prepared to put more money into the loss-making airline, leading to its collapse.

“Virgin is just such an important part of Australia’s infrastructure,’’ Mr Chatfield said. “To go down to one airline would be terrible for tourism and moving around the country. In the upcoming recovery period from the coronavirus pandemic, it will be critical to have an efficient and competitive domestic aviation market.”

There was speculation this week that Richard Branson’s Virgin Group, which owns 10.42 per cent of Virgin Australia, was willing to put up between $200m and $250m into the airline but would only do so with federal government support.

There is talk Sir Richard, who earns about $15m a year from the Australian carrier for using the Virgin name, could be part of the restructured group that emerges from the voluntary administration later this year.

Sources close to the airline’s boardroom also speculated that Singapore Airlines could be part of the new Virgin, but supported Mr Fox’s view of the need for some form of government assistance.

“It may well be that given the uncertainties of when the skies will re-open, it will ultimately need some form of government support — state or federal or both,’’ the source said.

But former Ansett chief executive Rod Eddington, who also ran British Airways and Cathay Pacific over a long career in the aviation sector, said he would not favour the government providing equity support to Virgin.

“Government is always involved in aviation — it is the regulator, full stop,” Sir Rod said.

“I don’t think it should be an equity holder in airlines. I have seen enough government-owned airlines up close to see that they make some very strange decisions and most of them end up coming back to government expense — that is, the government ends up footing the bill.’’

Australia has some of the most profitable domestic routes in the world, including the Melbourne, Sydney, Brisbane so-called “Golden Triangle”, which aviation industry experts believe should be capable of supporting two profitable airlines.

Sir Rod said a new Virgin would probably look more like its predecessor, low-cost carrier Virgin Blue, which was in operation when Ansett collapsed.

But he said there were two important differences between now and the Ansett situation.

“One of the differences between Ansett and now is that Virgin was already in existence so it could grow into the space that Ansett vacated,” he said. “It is not clear there is anyone now who can grow into the space. That is a difference we need to be mindful of if we want the domestic aviation industry to be a two-horse race.’

“And if this was normal circumstances and Virgin collapsed, our TV screens would be full of stranded passengers at airports across the country and the world. There is none of that. This will give the administrators sufficient time hopefully to allow a reborn Virgin to take its place on the aviation stage here in Australia when the market picks up.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout