Sydney Airport ‘four years away from pre-pandemic traffic’

Domestic travel will underpin a recovery in passenger numbers for Sydney Airport.

Domestic travel will underpin a recovery in passenger numbers for Sydney Airport with international travel not expected to return in a meaningful way until at least the middle of next year.

But it could be four years before Sydney Airport’s passenger numbers return to the pre-COVID experience.

That’s the assessment by brokerage Macquarie Equities which has warned that even if a COVID vaccine is available by later this year this will not be a “silver bullet” for air travel.

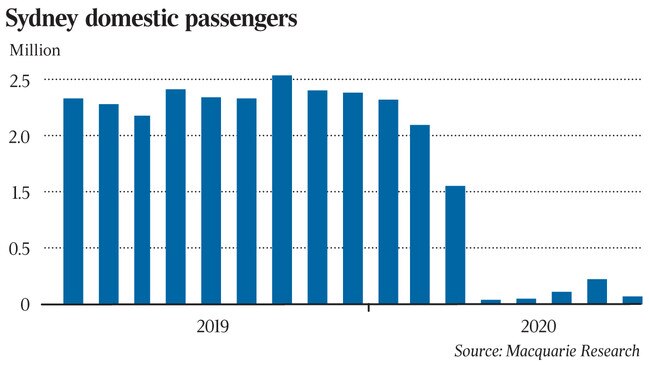

The comments follow a collapse in passenger numbers at Sydney Airport this year, as the pandemic grounded air traffic around the world.

Industry superannuation funds are also closely watching the pace of recovery at Sydney Airport, given many own significant stakes in airports including Melbourne and Brisbane.

The comments follow Sydney Airport’s latest figures released this month which shows in August domestic passenger numbers were down 96 per cent on the year and international travellers were off 97 per cent.

Macquarie’s base case is a recovery in passengers starting in November with traffic averaging about 50 per cent of the June half 2019 volumes, as domestic borders — particularly the border with Queensland — start reopening and domestic tourism drives activity.

Macquarie notes that one issue for international recovery in numbers is travel insurance, which could present a barrier to travel unless countries have reciprocal healthcare agreements.

Even with an Australia-New Zealand “travel bubble” expected to be put in place at the end of the year, any outbreaks can trigger abrupt exclusions, as seen with Britain recently excluding Spain, undermining traveller confidence in booking trips ahead of time.

Macquarie said the long term value for Sydney Airport is not so much the exact timing of reopening over the next 12 months, but where passenger numbers end up stabilising.

“Fleet downsizings by airlines and pauses on new aircraft deliveries put a ceiling on the medium-term recovery observations from global airports ... (this) suggests passengers may not reach 2019 levels until between 2024 and 2026, with steady growth resuming thereafter.”

Countries where the domestic market has outperformed are those that have been able to suppress the virus nationally with minimal community transmission, as well as having unrestricted travel across regional borders.

It notes New Zealand is an example of this, with Auckland Airport taking only three to four months to recover. Following a resurgence in cases and a step-up in restrictions, August passenger numbers fell back down to 80 per cent on the year.

Over the weekend the Morrison government outlined a $250m tourism package to help boost domestic tourism, including support for regions hard hit by the drop in international tourism.

Macquarie points to surveys of traveller confidence which provide further optimism for pent-up domestic demand.

This will be driven by passengers visiting friends and relatives initially, which account for about 33 per cent of domestic overnight trips. Holidays account for 39 per cent of trips.

Business travel, which accounts for about 22 per cent of trips, will start to re-emerge, albeit at a slower pace, Macquarie said.

“Technology may impact the amount of travel for internal meetings however we expect client contact will start to increase and ultimately conferences will re-emerge,” Macquarie said..

Macquarie kept a $6.66 target on Sydney Airport stock, which closed on Friday at $5.78.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout