Rescue race down to three as bids roll in

The race for Virgin Australia will come down to a short list of three from early next week.

The race for Virgin Australia will come down to a short list of three from early next week as the airline’s administrator, Deloitte’s Vaughan Strawbridge, and his team spend the weekend working through around eight “non-binding indicative bids” lodged on Friday.

Mr Strawbridge told The Weekend Australian that he expected to receive eight bids by close of business last night, a result he described as a “really strong outcome”.

The four strongest bidders in the group of eight are the $17bn AustralianSuper and the Ben Gray-backed private equity firm BGH, Canadian infrastructure investor Brookfield, private equity firm Bain Capital and Indian investor InterGlobe Enterprises (IGE).

The other four bidders were believed to be from smaller parties, possibly including the private financial interests of FMG founder Andrew Forrest.

The short-list of three to emerge next week is expected to come from the top four bidders with other smaller players circling the airline, seeking to do deals with the short-listed players as they emerge next week.

The aim is to have three strong potential bids for June 12 when the binding bids are due, with the sale completed by the end of June.

Queensland Investment Corporation chief executive Damien Frawley has already confirmed to the Australian he plans to start talking to short-listed bidders next week as part of the Queensland government’s offer of a $200m package of support for bidders who would keep the airline’s headquarters in Brisbane.

Mr Strawbridge said there was “plenty of competitive tension” in the indicative bids received yesterday, after some 19 parties were given access to the Virgin data room.

Separately, several Virgin bidders are also believed to be pushing for the federal government to provide a guarantee for ticket sales to ensure that travellers can make bookings with confidence in the event the airline goes into receivership.

Such a government guarantee was secured during the administration of Ansett in October 2001, which allowed the carrier to resume limited services between major cities.

The guarantee was provided to Ansett to help attract a buyer for the business and generate revenue, but the business was eventually put into administration after a bid by Melbourne billionaires Lindsay Fox and Solomon Lew to buy the airline failed.

The Australian understands Virgin discussed the issue of a ticket guarantee with the federal government last month as a means of keeping the airline alive before it was placed into administration.

But the request was rebuffed by Transport Minister Michael McCormack.

Mr Strawbridge said he would not be releasing the names of the eight groups that submitted indicative bids on Friday, and would not release the names of the three parties when they were short-listed early next week.

InterGlobe, which is led by Indian billionaire Rahul Bhatia, who co-founded Indian budget carrier IndiGo, confirmed to the Australian on Friday that it had “signed an agreement to participate in the sale process” for Virgin.

But it said it was “unable to say any more at this stage” as it was bound by confidentiality.

Singapore’s sovereign wealth fund, Temasek, which owns 55 per cent of Virgin shareholder Singapore Airlines, is a financial backer of the BCG/AustralianSuper consortium but it will not to be an equity participant in the Australian Super/BGH bid.

But Singapore Airlines is believed to be keeping a close eye on the process, despite the fact that it, like all the Virgin shareholders, will have seen all its equity in Virgin wiped out as a result of its move into voluntary administration.

Mr Strawbridge said the review process for the bids, which would take place over the weekend, would include assessing which of Virgin’s existing liabilities the bidders were prepared to take on.

“We will need to understand what the bids are and what liabilities they will assume, including aircraft leasing, and what money will be left over to pay a dividend (to creditors).”

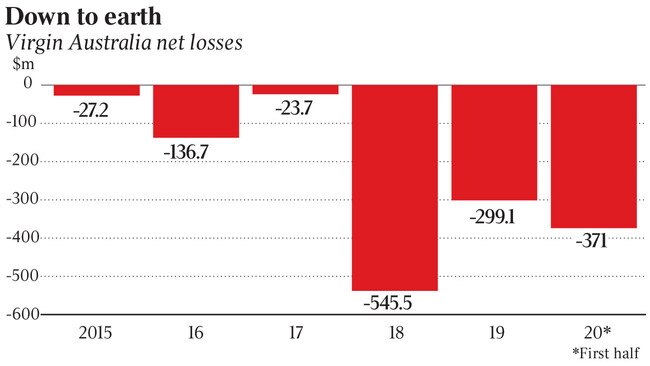

Virgin was placed into voluntary administration on April 20 with debts of some $7bn.

Its creditors are expected to have to agree to a major haircut, particularly the unsecured creditors, owed $2bn.

Mr Strawbridge confirmed this week that none of the former Virgin shareholders — Singapore Airlines, Etihad, Richard Branson’s Virgin Group, China’s HNA and Nanshan as well as Australian investors — would get any money back from the process.

He said his team had not set a price for Virgin, with the onus on the bidders to come up with their best offer.

“We have been very careful not to say what is the price needed to say ‘here is the price which you need to pay to participate’,” he said.

“It is up to them to put in their best offers.”

He said the level of competitive tension evident in the eight indicative offers was “what’s needed to drive the best outcome, an outcome that preserves as many jobs as possible and the best result for all creditors”.

He and his team will spend the weekend sifting through the detail of the bids submitted on Friday.

He told The Australian that there were “no surprises” in the bids received on Friday.

“We will be working over the next three days with the bidders with a view to developing a short list so we can take a smaller number through to the next stage,” he said.

“We don’t want a lot of parties.

“We need the right parties who have done an intensive amount of work and have followed it up with their bids which we can work through over the next month.”

Some bidders are concerned that the voluntary administrator, Deloitte, could run out of cash in six weeks’ time, after this week winning approval from the Federal Court to extend the administration until August 18.

The ruling deferred a second creditors’ meeting which had been scheduled to take place in the last week of May.

But Mr Strawbridge said he had had been able to “unlock funding from around the Virgin group, which was locked up in various cost structures” which had “created the liquidity we have needed to be able to continue to trade through this sale process.”

“There will come a time when we require additional funding, but not now.”

Deloitte said the airline had at least $100m in unrestricted cash to last until at least mid-June.

But beyond that, it said, it would look at other mechanisms to get liquidity into the business if it was needed.

While the Queensland Government this week announced plans to contribute a possible $200m to a bid for Virgin, it did not lodge a bid on Friday.

Queensland Investment Corporation chief executive Damien Frawley, who has been asked to oversee the Queensland bid, told The Australian this week that Queensland was “good for $200 million at least” for the right bidder.

He said the Queensland government had “strategic objectives” for its bid, including maintaining Virgin’s headquarters in Brisbane and making sure the state had access to two competitive airlines, critical for its tourism industry.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout