Qantas climbs to record profit

Qantas boss Alan Joyce has declared the economy is starting to fire on all cylinders after posting a record first-half profit.

Qantas boss Alan Joyce has declared the Australian economy is starting to fire on all cylinders after posting a record underlying first-half profit, but says Australia risks an investment drain after Donald Trump’s tax cuts.

After unveiling an interim underlying pre-tax profit of $976 million, Mr Joyce said there had been growth and that made it important to focus on keeping the economy competitive.

“What we are seeing is good demand in all segments,” Mr Joyce told The Australian yesterday.

“The business market and the big corporates are travelling quite well, we are seeing the financial services, the construction industry, government side doing very well. The part that was weak was the resource sector and that is starting to show the signs of green shoots, which would mean it fires on all cylinders.

“If the Australian economy does well, Qantas does well as we’ve seen in the last few years.”

Mr Joyce yesterday outlined a plan for another $500m to be returned to shareholders, consisting of an on-market buyback of up to $378m and 7c per share in unfranked dividend.

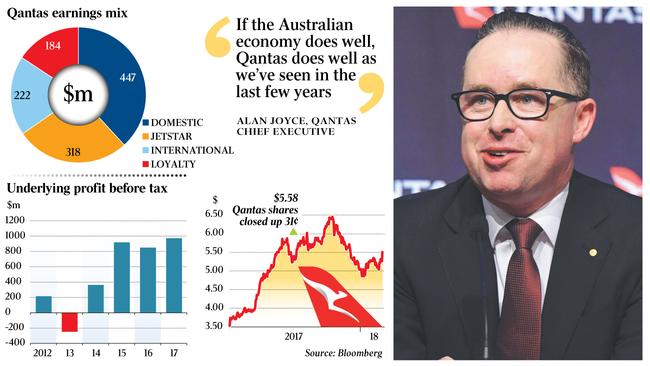

Underlying profit before tax — which strips out one-offs and is Qantas’s preferred measure — was up 14.6 per cent at $976m. This exceeds the $921m announced in the first half of the 2016 financial year. Statutory profit after tax was up 17.9 per cent at $607m.

The results again highlight just how much of a turnaround Qantas has made since its $2.8 billion full-year net loss detailed in 2014.

Since then, the company has sharply cut its cost base, including laying off staff, turned to lucrative markets such as China, and shed its loss-making routes.

Accounts released yesterday also show the carrier had soaked up its near $1bn pile of tax loss credits, which at the end of December stood at $368m. This suggests the company is likely to resume paying corporate tax next year.

Investors reacted positively, with Qantas shares closing up 31c at $5.58 yesterday.

Moody’s Investors Service said Qantas had continued to show a “solid operational and financial performance despite the increase in fuel costs and continued international capacity growth over the period”.

The fuel bill for the 2018 financial year is expected to be $3.24bn, up from $3.04bn the year prior, when oil prices were lower. Mr Joyce said if the oil price rally was linked to strong economic growth, that was positive as more people travel.

The domestic division, which includes both Qantas and Jetstar’s domestic routes, reported an underlying earnings before interest and tax (EBIT) of $652m.

Qantas Domestic posted a 20.5 per cent rise in underlying EBIT to $447m on revenues — a stark contrast to what happened during the bitter capacity war with rival Virgin a few years ago.

The growth was partly on the back of “modest” revenue growth from the resources sector for the first time since 2014; Qantas had previously redeployed planes away from unprofitable routes in the resources sector.

Mr Joyce said the resources sector “was letting us down for the last few years” because of a “significant” decline, but now for the first time in more than three years there was growth.

“Small growth, but growth and that’s a good indication that the Australian economy is starting to fire on all cylinders,” he said during a media briefing yesterday.

“That’s why it’s important that we keep a focus on maintaining the competitiveness of this economy. That’s why we’ve been out there as big vocal supporters of maintaining the competitiveness of the corporate tax situation because it is critical to the success of the economy.”

Mr Joyce said that, in the wake of the US company tax reforms, the worry was “there will be an investment drain out of Australia and this will lead to further investment in the US”.

That, he said, was “not great for salary increases and that’s not great for Qantas”.

His comments also come after new Wesfarmers chief Rob Scott this week said there was “no question” that lowering the corporate tax rate “will flow through to Australian workers”.

Asked about Mr Scott’s comments later by The Australian, Mr Joyce said Qantas wanted lower corporate tax rates “to make sure the Australian economy is competitive”.

“A successful Australian economy will mean aviation in Australia is successful,” Mr Joyce said.

“If aviation is successful then our employees benefit out of that.”

He said the benefits of Qantas’s recovery in recent years included $220m paid in bonuses to staff, recent hiring and staff wage increases of 3 per cent, which is above the inflation rate, while “the biggest pay increase a lot of our people can get is through promotions”.

“Pilots get the biggest pay increase when they become captains, first officer is 55 per cent of the captain’s salary. The way to get to be a captain is to have growth,” Mr Joyce said.

“That only happens when a company is investing in new aircraft. That only happens when the company is investing in growth ... We won’t be able to do that if the Australian economy goes south, we won’t be able to do that if the economy suffers.”

On the international front, underlying EBIT was down from $234m to $222m, a 5.5 per cent fall, though revenue was slightly up. Analysts at Citi said the international operations “are likely to see continued volatility in earnings, particularly as fuel prices climb”.

Mr Joyce said Qantas International had “held its own” in a market characterised by some “extremely low airfares”, as well as “the challenges of rising fuel prices and more seats in the market”.

He said the international business was in a “transition year” as it picks up Dreamliners and makes network changes including using Singapore and Perth as hubs and starting the non-stop Perth-London service.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout