HNA Group mulls Virgin stake sale, SIA, Nanshan weigh bids

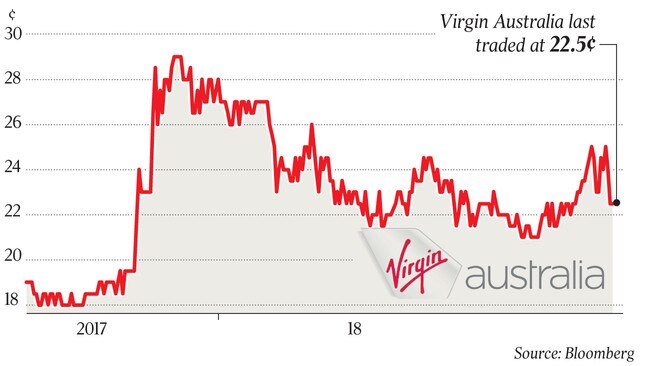

China’s HNA Group is reported to be receiving expressions of interest for its 19.8pc stake in Virgin Australia Holdings.

Chinese conglomerate HNA Group is receiving expressions of interest for its 19.8 per cent stake in Virgin Australia Holdings, according to a report from Bloomberg.

The report said that HNA’s stake in Virgin had been “drawing interest” from possible buyers as it had been selling down many of its non-core assets to reduce its debt, which is estimated to have peaked at around $US90 billion ($125bn) as a result of a global spending spree.

Bloomberg said HNA, a conglomerate which owns China’s fourth largest airline, was not actively working to sell its stake in Virgin, but that the group was “open to offers.”

It said Singapore Airlines and Nanshan Capital, the other Chinese shareholder in Virgin — each owning around 20 per cent — were “weighing a bid” for the HNA stake.

The report comes as HNA undertakes a massive sale of assets estimated to be worth some $US17bn this year so far, as it seeks to reduce its debt and also responds to pressure from Chinese regulators who have been alarmed at the spending sprees of some private companies, including insurance group Anbang, which bought the Waldorf Hotel in New York for $US1.95bn in 2014.

The HNA selling spree has included office buildings in Sydney, shareholdings in Deutsche Bank, land in London and Hong Kong, a stake in Hilton Worldwide Holdings and a major stake in the Radisson Hotel Group, which was sold in July to China’s Jin Jiang group for some $US2bn. In August it sold a 30 per cent stake in New York listed air leasing company Avolon for $US2.2bn.

HNA is one of two Chinese shareholders in Virgin which each have just under 20 per cent, the other being Nanshan.

HNA bought its stake in the Radisson group in 2016, as part of a global asset buying spree which included stakes in Deutsche Bank, airline catering company Gategroup, aviation servicing company Swissport and properties around the world.

The company has also been reeling from the accidental death in July of its chairman and co-founder, 57-year-old Wang Jian, who fell over a cliff while posing for a photo while on holiday in France.

One of the company’s arms, Hainan Airlines Holding, was temporarily suspending from trading on the Shanghai Stock Exchange in January this year pending news of a restructuring.

Several of its Chinese and Hong Kong listed corporate arms have been under market pressure this year. In July it was announced that HNA would not be going ahead with a $200mdeal to buy the refrigerated logistics business of the ASX-listed Automotive Holdings Group.

The company’s origins date back to 1993 with the founding of Hainan Airlines by Chen Feng and other Chinese businessmen. Hainan Airlines itself owns more than 300 aircraft and serves more than 1400 domestic and international routes.

In interviews with The Australian earlier this year, Virgin Australia chief executive John Borghetti said he saw HNA as a long-term shareholder in the airline.

Mr Borghetti said the link with HNA had also been important in helping feed traffic into its new routes flying from Sydney and Melbourne to Hong Kong. The Melbourne-Hong Kong leg started last year with the Sydney-Hong Kong service starting several months ago.

While HNA has been selling off non-core assets such as property and its hotel interests, it sees airlines as its core business, a view which would also be taken by Chinese regulators.