Bidder Bain outlines ‘hybrid’ plan to revive struggling Virgin

Bain Capital is considering relaunching Virgin Australia as a hybrid airline, sitting between a full-service and a low-cost carrier.

Bain Capital is considering relaunching Virgin Australia as a hybrid airline, sitting between a full-service and a low-cost carrier, which would continue to fly regional routes and internationally in future, with the potential backing of Sir Richard Branson’s Virgin Group.

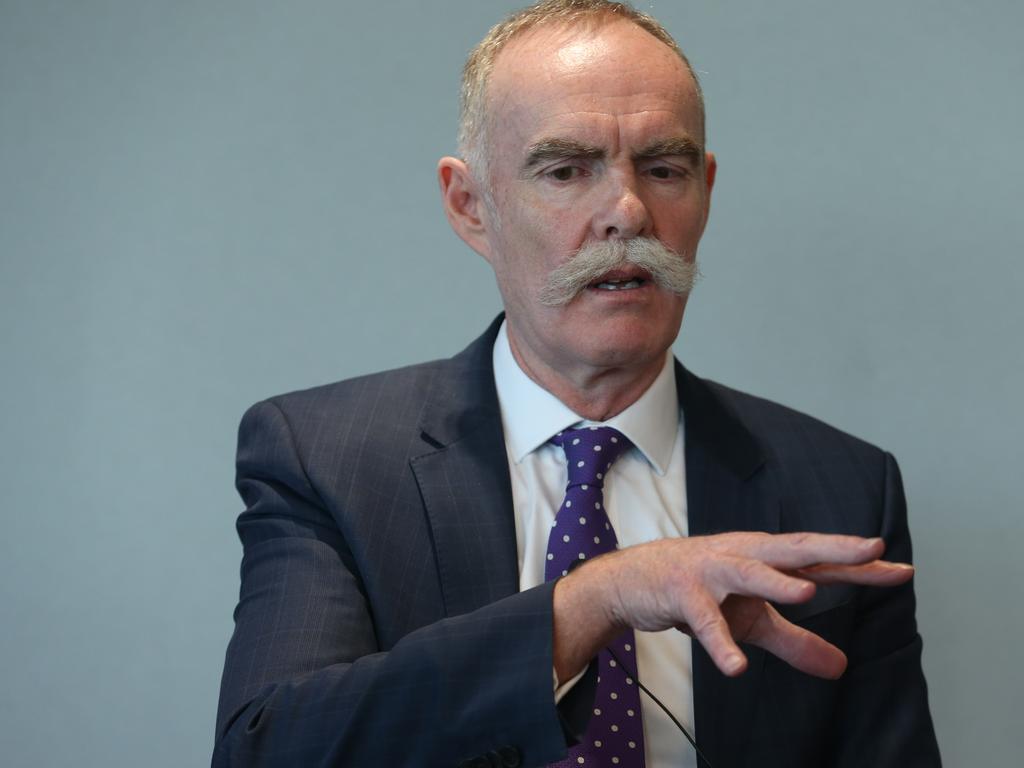

In a wide-ranging interview with The Australian, Bain Capital’s Sydney-based managing director Mike Murphy also revealed the firm wanted to make changes to Virgin’s Velocity frequent flyer scheme and said Bain had already engaged with unions, the Queensland government, federal government adviser Nicholas Moore and the Foreign Investment Review Board about its Virgin bid.

The Boston-based private equity group is one of four bidders that have been asked by Virgin’s administrator Deloitte to submit “second-round” indicative bids by Friday night ahead of the shortlist being cut to two over the weekend.

The others are a consortium involving BGH Capital and the $170bn AustralianSuper; New York-based Cyrus; and Phoenix-based Indigo Partners, which is partnering with Oaktree Capital Management.

Canadian infrastructure investor Brookfield, which is the majority owner of Oaktree and was not part of the Virgin shortlist following its concerns over aspects of the bidding process, is continuing talks with the administrator Vaughan Strawbridge.

Mr Strawbridge is said to be keen for Brookfield to return to the process and it is understood Brookfield Australian managing partner Len Chersky and Mr Murphy had an introductory discussion ahead of first-round bids being lodged earlier this month.

Brookfield had been the preferred bidder identified by the Transport Worker’s Union before it dropped out of the process.

“At the moment I think we and others are keeping to ourselves. From an ability to fund this transaction perspective across our private equity and credit funds there is plenty of firepower, so we don’t need additional capital to be able to write the cheque,’’ Mr Murphy said when asked about working with Brookfield.

“Brookfield I assume is the exactly same, they are a giant … They have the ability to do big transactions on our own. Clearly this coming Friday is a real milestone and we are hoping to be one of the final two. We will assess how the landscape looks early next week.”

Bain has a team of 60 advisers working on the Virgin deal — a single Zoom meeting last week had more than 50 people online — and on Friday it will submit a 12-page document to Deloitte with its proposal to resurrect Virgin.

Mr Murphy said Bain, which has about $10bn of its $150bn global portfolio invested in Australia after he established the firm’s Sydney office in 2016, had Virgin on its radar for some time ahead of its collapse into administration.

Bain has been involved in several aviation recapitalisations, including Atlas Air, America United and Northwest.

“We didn’t approach the company or its advisers before administration. But 30 minutes after it was announced, I was on the phone to Deloitte to express our interest,’’ Mr Murphy said.

There has been ongoing speculation that Bain will adopt a low-cost carrier model for Virgin after it said on Sunday it wanted to bring the “fun” of the initial Virgin Blue low-cost culture back to the company.

Unions and others have warned this could lead to lower choice in the market and hand the bulk of international tourist traffic and all corporate and government demand to Qantas.

It could also undermine the value of the Velocity program and have implications for Virgin’s employees, tourism, corporate customers, and the regulators.

Mr Murphy said the “facts are out there and they are public” that the full-service era for Virgin under former chief executive John Borghetti was a much less profitable period for the business.

“At the moment we are still evaluating where the positioning of the business should be vis a vis Qantas and Jetstar. It is too early for us to declare whether full service is the winning strategy or low cost is the winning strategy,’’ he said.

“It might be some blend of both that could make the most sense. But we are still evaluating.”

Presentations to the bidders by chief executive Paul Scurrah have highlighted the savings in Virgin moving to a “single aircraft type” fleet of Boeing 737s, which Mr Murphy said Bain “definitely” supported.

Mr Scurrah has also proposed that the airline in future buys a fleet of long-range Boeing Dreamliner 787 aircraft to replace its current Boeing 777 and A330 international fleet. Mr Murphy said he would not rule out a Bain-owned Virgin continuing international services.

“We are analysing route by route performance and viability and it is clear there is quite a spread of health within the international routes. They have done a good job with LA; Hong Kong has been much tougher. So we are going through it route by route to try to determine what makes sense.

“There also has to be a time-phased approach to this as well,’’ he said.

He described Virgin’s regional services as “very important”.

“A lot of regional performs really well. That is great. Where the performance isn’t as strong, I guess our lens is ‘What can we do about that?’,’’ he said, noting Virgin could find partners on those routes.

“As a category we agree that regional coverage is very critical.”

He said the Velocity Frequent Flyer business, now 100 per cent owned by Virgin after it bought out its private equity partner last year, had more potential.

“One thing we would love to explore is whether there could be a closer brand relationship between Virgin and Velocity. We come at that from the customer experience; having those tied up a little closer could be a more seamless experience from both the web and app perspective for customers,’’ he said, noting one option would be to have one common app and website for both brands.

High hopes

Deloitte and Virgin management have told bidders that the relaunched business could make $1.2bn at the EBITDA line in the 2022 financial year, which would be Virgin’s first full 12-month reporting period following the COVID-19 outbreak.

“It is ambitious, that is for sure,’’ Mr Murphy said of the forecast.

“I like the fact Paul … and the team are shooting for the stars. (But) it has to be put in the context of what the business has earned in past five years (which is between $800m and 900m). I love the aspiration. We are starting to tease apart whether we think that is too aspirational or not enough. But what I will say is it is more than the business has achieved before.”

Bain and Virgin Group have a joint venture in the cruise industry with Virgin Voyages, while rival bidder Cyrus invested with Sir Richard in Virgin America in 2005 after he established the airline.

Mr Murphy said Bain would definitely retain the Virgin brand and revealed there were discussions on the nature of the current agreement with the Virgin Group and “what that should look like on the other side”.

Virgin Australia was paying Sir Richard about $15m a year to use the Virgin brand before it collapsed.

“We have a close institutional relationship with the Virgin Group. There is a good relationship of trust. We would be very interested in the Virgin Group being a shareholder in this business alongside us,’’ Mr Murphy said, before noting it was up to Virgin whether they wanted to retain their current 10 per cent interest.

He said Bain had also held “brief introductory conversations” with Virgin investors Singapore Airlines and Etihad relating to their current alliance agreements with the Australian airline.

Bain has also drafted in Goldman Sachs, Virgin’s long-time adviser, on its bid. Mr Murphy said its role focused on providing valuation advice — especially longer-term advice on key valuation metrics, and how they changed over time and through cycles.

“Really it’s to give us more confidence in, when we do eventually exit, what range of valuation multiples could we realistically expect,’’ he said.

While the Future Fund is an investor in Bain’s offshore private equity funds through the more than $26bn it invests in the asset class, Mr Murphy said it would be unlikely it would play a direct co-investing role in Bain’s Virgin bid in the way AustralianSuper has joined with BGH.

“We are off working out which pockets of capital this gets funded from. But conceptually both the private equity funds and the credit funds would combine and it would be a combination of US funds and Asia funds. But sitting behind all that from an investor perspective is a significant amount of Australian capital,’’ he said.

Mr Murphy is one of the 15 partners who manage Bain Capital’s suite of Asia Private Equity Funds, which have collectively raised $US11.5bn. There are no country-specific allocations from the funds.

Rival bid

BGH has championed the “Team Australia” composition of its bidding group, especially with the involvement of AustralianSuper, in its discussions with Deloitte.

However it will still need to get Foreign Investment Approval for its bid given its significant foreign backers, including the Singapore government’s investment arm Temasek, which owns Singapore Airlines.

Mr Murphy said Bain submitted its application to FIRB a week ago but was hopeful that given Virgin was more than 90 per cent foreign-owned when it collapsed, there would be no onerous conditions placed upon any of the bidders.

“The administrator is trying to have FIRB somewhat expedited so there are no conditions precedent as it gets to the implementation deed point. We are pushing that along as well.

“We have been through FIRB lots of times,’’ he said. Business Council of Australia president and former MYOB chief executive Tim Reed, who knows Mr Murphy from Bain’s investment in the accounting software group for more than seven years, said foreign ownership considerations should be secondary in the Virgin sale process.

“The most important thing here is that Australia ends up with two domestic airlines to serve the nation and keep competition in the market. Whether that 90 per cent (foreign ownership) goes up and down is not really important compared to the ambitions and capabilities of the owner to make this a sustainable business.”

Mr Murphy said Bain had its first discussions with the Queensland government this week after it offered a $200m sweetener to any bidder prepared to guarantee the airline kept its headquarters in Brisbane, where more than 8000 of Virgin’s staff are based. He said Bain was also open to talks with other state governments.

While he said there had not been any substantive discussions with the federal government, he was hopeful it would continue to assist the embattled aviation sector through route and JobKeeper subsidies.

“We are not holding out hope for a bespoke Virgin-only support package,’’ he said, noting there had been “a little bit” of dialogue with former Macquarie Group chief Nicholas Moore, who is the government’s “emissary” in the sale process.

“We are staying in touch to make sure we are abreast of what is happening. But they have not been substantive conversations,’’ he said.

Mr Murphy was one of 2000 applicants for a role at Bain & Company in 2002, fresh from his commerce-law degree at Bond University. Following a seven-stage interview process he was one of the seven successful candidates that year.

Before that, at the age of 18, he famously placed fourth in the 3m springboard diving competition at the 1992 Barcelona Olympic Games. Two years later he won two gold medals at the Commonwealth Games.

Asked what diving taught him for his corporate life, he replied: “Not accepting the conventional wisdom of what is possible. It gave me a lot of confidence I could step into a whole new level of what I thought was possible … pushing through that status quo.”

Tim Reed described Mr Murphy as “highly competent, thoughtful and considered”.

“There is a touch of humility in him. But clearly he is very accomplished. I have never detected a sense of arrogance in him,’’ he said.

Asked how Mr Murphy would cope with Bain’s surprise move into the public spotlight this week, Mr Reed replied: “He would be probably having a combination of excitement about the impact and the opportunity that this investment could provide for him personally, Bain and for Australia, but there would also be some degree of nerves about doing something he hasn’t done before.”

So why did Bain throw away its traditional playbook and break cover this week at such a crucial point in the Virgin bidding process?

Mr Murphy agreed it was unusual but said it was about correcting a perception about private equity — that it was looking for a “quick flick” of Virgin — as well as talking up its credentials as an investor in aviation and reassuring the company’s staff, unions and other stakeholders.

“We wanted to make the point we see this opportunity as a long-term commitment. This will take some work, multiple years to get the business back up to the strength that it was.

“We wanted to make it clear we are long-term investors. We can speak to plenty of examples of where we have had investments for 8-10 years,’’ he said.

“We are (also) often reported as a US private equity giant. We want to make it clear there is a bunch of people with Australian accents that live in Australia that are driving our Australian business as well as the strength of the global firm.”

He said Bain’s advisers in Australia were “hands-on” with their investments, although critics of the group have claimed it has little equity capital invested in the country.

“If anything Bain Capital versus our peers has kept a very low profile, probably more so that we should have in some circumstances. So we talked about this (going public) and we thought it was important to do it in the context of a very public situation,’’ he said.

But what if the pitch fails and Bain is not one of the two final bidders named by Deloitte early next week?

“It would disappointing and we are really focused on getting there,’’ Mr Murphy said, noting Deloitte had flexibility to change the process if it needed to, so all would not be lost.

“We are just trying to take an agile approach. The process at the moment has been clearly laid out. If that changes, we will reassess if we can morph into it. We are flexible,” he said.

But as Bain lodges the latest iteration of its bid, failure is the last thing on Murphy’s mind.

“There is a lot of work going on and a lot of people working around the clock,’’ he said. “We feel we can be a great partner for the airline.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout