Airline passenger revenue surges 13pc since Rex’s demise, ACCC finds

On a day the federal government has thrown Rex a financial lifeline, it has emerged Australia’s biggest airlines are making 13 per cent more per passenger, according to the ACCC.

Australia’s major airlines have made 13.3 per cent more per passenger since Rex stopped flying major city routes, the Australian Competition and Consumer Commission has found.

And the ACCC says the increased market concentration will lead to further price rises.

The nation’s largest airlines have dominated the market since Rex was placed into voluntary administration on July 31 and stopped flying 11 routes between major cities.

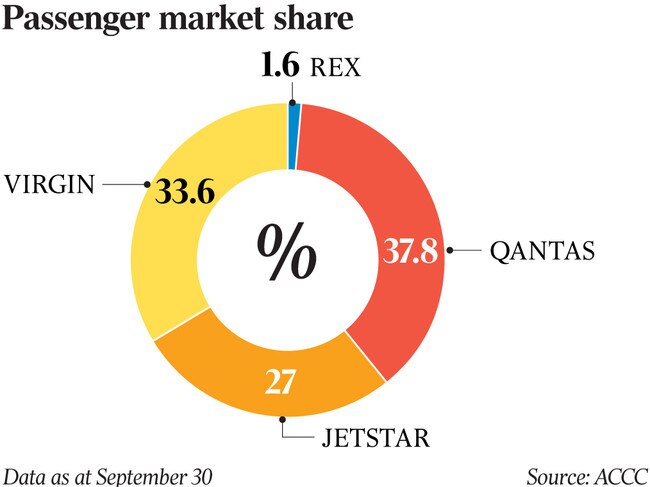

Qantas and Virgin, which service 98 per cent of the market, have picked up Rex’s share without adding extra flights, leading to more demand, fuller flights and a healthier windfall across major city routes, an ACCC report says.

It found that revenue per passenger between major cities surged from $86.80 per passenger in July to $98.40, reflecting a 13.3 per cent jump since Rex abandoned major city routes.

Rex’s exit has removed 6 per cent of capacity from major city routes since July. Overall, capacity is down 1.8 per cent since last year.

The report arrived as the federal government threw Rex an $80m lifeline.

In a joint statement on Tuesday, Transport Minister Catherine King and Workplace Relations Minister Senator Murray Watt said the financing would “support the business to continue offering critical services for regional communities”.

Employees let go during the voluntary administration would get “early access” to the Fair Entitlements Guarantee, which offers Commonwealth-backed redundancy pay in dire situations, they said.

“In addition, Rex’s administrators and main secured creditor, PAG, have advised they will pay the entitlements of former employees of the regional business who have been made redundant during the voluntary administration period,” the statement said.

Rex’s administrators wants to extend the administration period until June 30, 2025, and the government has committed to continuing “to guarantee ticket sales made throughout the voluntary administration” until the end of the extension.

“The guarantee has been effective so far and has yet to be used, with flight bookings holding up well,” the ministerial statement said.

“Today’s announcement is another demonstration of our commitment to maintaining regional aviation access, recognising the important role that Rex plays in regional communities right across Australia.”

Qantas serviced about 65 per cent of passengers in September through its own flights or its low-cost carrier, Jetstar.

The airline has defended itself against the ACCC’s findings, having accused the consumer watchdog of focusing on the increased demand on the day of the Coldplay concert in Melbourne which it believes does not reflect average prices. The airline said its price rises were in line with inflation.

“The data is from the government’s monthly fare monitoring which expressly states that it does not measure ‘average fares paid by passengers’,” Qantas domestic chief executive Markus Svensson said.

“The day selected in the latest report was 31 October, which is when Melbourne was hosting Coldplay. As such, demand was significantly higher on flights into Melbourne which means lower fares were snapped up early and the fares left available to purchase three weeks out were higher than usual.”

Mr Svensson had referred to a section in the report which found that the best discount fares had surged as much as 95 per cent on an Adelaide-to-Melbourne flight which charged $296. Fares between Melbourne and Gold Coast were up 70 per cent to $432 while Canberra to Melbourne was up 54 per cent to $298.

It also found the best discount fares to have risen as much as 171 per cent between Canberra and the Gold Coast which charged $490, while Brisbane to Hamilton Island was up 122 per cent to $871, and Cairns to Sydney was up 43 per cent to $380.

Meanwhile, a Virgin Australia spokesman has also defended the July-to-September quarter, saying it was typical for prices to vary during that period.

“The variance in fares from July to September is largely driven by the increase in demand in September due to football finals and school holidays, with a higher number of people wanting to travel interstate,” he said.

“September was one of our busiest schedules this year, with more than 11,500 flights operated across the Virgin Australia network.”

The spokesman said Virgin Australia had rebooked about 130,000 Rex passengers since the airline entered voluntary administration, and about 100,000 of those booked already have taken the flights.

The ACCC said domestic airfares were likely to rise further due to a concentrated market and that the concentration could also discourage a sizeable competitor from attempting to compete.

“It may be some time before a new airline emerges as a serious third competitor, which is likely to result in higher airfares and reduced choice for consumers,” the report says.

Qantas and Virgin have previously denied raising fares since Rex’s exit, claiming any increase was a reflection of seasonal flight increases.

In September, the Bureau of Infrastructure, Transport and Regional Economics’ monthly domestic airfare index showed both discount and flexible economy fares were up 12 per cent compared with July.

The increase meant travellers were paying about $170 for fares which were $150 two months earlier, or $400 for a fare previously $350.

Rex was placed into administration on July 30 with debts of $500m, and permanently grounded its major city services the next day.

Before entering voluntary administration, Rex was responsible for about 6 per cent of seat capacity across the country, and about 4.9 per cent of capacity between major cities.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout