Australian wine dealt new China tariffs blow

China has upped the ante in its trade dispute with Australia, piling new wine tariffs on top of hefty anti-dumping duties imposed last month.

The Chinese government has taken another swipe at Australia’s $45bn wine sector, which is already buckling beneath the weight of punishing import tariffs slapped on Australian wine earlier last month, with the powerful Chinese Ministry of Commerce announcing a new round of punitive tariffs on Thursday.

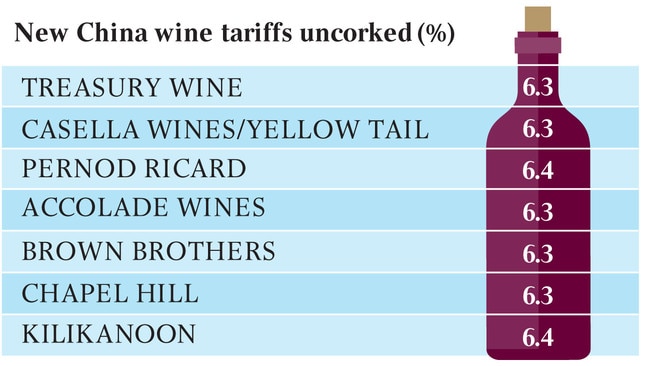

In a brief statement, the Ministry of Commerce announced preliminary findings for its investigation into alleged subsidies handed to Australian wine producers and has instigated further tariffs on Australian imported wine of between 6.3 per cent and 6.4 per cent.

The continuing trade war between Beijing and Canberra has now triggered an angry response from social media in Australia that has seen a list of 41 Australian wineries owned or partially owned by Chinese individuals and companies circulated across a number of platforms to call for a boycott by Australian drinkers.

These Chinese-owned wineries appearing on the boycott list include Seville Estate, Hollick Wines, Knappstein, Linwood Estate and Red Deer Station. But the boycott call was met by an immediate and harsh damnation by peak industry group Australian Grape & Wine which said a boycott would harm Australian winemakers, growers and others employed in the sector.

“I am outraged and disappointed that this campaign targets Chinese owned businesses,” said Australian Wine & Grape chief executive Tony Battaglene.

“The Australia-Chinese community is an important and valued part of the Australian wine sector. They make great wine, employ local people and generate money into the local and national economy.

“I would also emphasise that the Chinese consumers also continue to value our wine, but will be unable to access our wine due to the unjustified and punitive import duties that have been placed on our wine in China.’’

Mr Battaglene said if Australians really want to support the grape and wine sector, then buy a case of Australian wine for friends.

“Give it to them for Christmas and then every time you share a bottle with family and friends you will know you are helping rural and regional Australia. Let’s not unjustifiably target a group who are valued members of the community.”

Meanwhile, according to a statement posted on Thursday by China’s Ministry of Commerce, the nation’s biggest winemaker, Treasury Wine Estates — which owns powerhouse brands such as Penfolds and Wolf Blass — will have a 6.3 per cent tariff added to its imported wine. Casella Wines from Grifith, NSW, will also have a 6.3 per cent tariff as will Australia Swan Holdings. French drinks giant Pernod Ricard Winemakers, which owns Jacob’s Creek and St Hugo, will have a 6.4 per cent tariff applied to its imported wine into China. A range of other producers such as Chapel Hill, Zilzie Wines and Accolade Wine will have a 6.3 per cent tariff while all other Australian wines not on the list will be hit with a 6.4 per cent tariff.

However, the new tariffs are not expected to make much difference to the already ruined Chinese import market, given they come on top of tariffs as high as 212.1 per cent that the Chinese government whacked Australian winemakers with in November, and which have all but ruined the market worth around $1.3bn a year to Australian winemakers.

The Chinese government is conducting two investigations side-by-side into Australian winemakers, with one looking at allegations of anti-dumping — which triggered the 200 per cent plus set of tariffs — and a second investigation into subsidies provided to Australian winemakers by Australian governments, which has now triggered the new 6.3 to 6.4 per cent tariffs.

However, the new 6 per cent-plus tariffs won’t make much of a difference to Australian winemakers, who will almost completely walk away from the Chinese market following the imposition of massive tariffs last month. Under the changes, Chinese importers will have to pay a duty on Australian wine ranging from 107.1 per cent to 212.1 per cent, depending on the company that produced it.

In the last few months the Chinese government has taken aim at a range of crucial agricultural exporters, hitting them with tariffs and other impediments while also blocking the import of Australian timber, seafood and cotton. It has also blocked recent imports of Australian coal and more recently barred some Australian lamb and beef producers from exporting to China.

The wine tariffs have seen shares in Treasury Wine collapse and force it to redirect its premium and luxury wines to other markets outside of China, but it will still be pinched by the trade war with around 40 per cent of its profits coming from Chinese drinkers.

Alliance Bernstein analyst Euan McLeish said the new tariff was a “small incremental negative” for Treasury Wine but doesn’t materially worsen the fundamental situation for its China business.

“These anti-subsidy deposits will be levied on top of the ex-factory price plus dumping deposit plus VAT. In line with the anti-dumping deposits, these anti-subsidy deposits will be in place for four months and could be extended to nine months under special circumstances.

“We expect them to be in place for nine months as this coincides with the 12 month anti-dumping investigation deadline under WTO rules.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout