Australian biotechs from Telix to Envision discover a new pot of gold in the US

The little-known firm behind a cutting-edge prostate cancer test developed in Adelaide is set to make tens of millions via a deal with a US giant but men in Australia won’t be able to access it.

Australian biotechs have unearthed a new pot of gold and it has nothing to do with drugs and experimental therapies.

Testing has become the latest boom industry, generating hundreds of millions of dollars for local firms, as they win contracts in the world’s biggest health market: the US.

It comes after diagnostics was catapulted to the mainstream during the pandemic when identifying Covid-19 was at times more important that treating the virus.

For Australia’s second biggest biotech, Telix, its prostate cancer imaging product Illuccix sent the company’s revenue soaring from $3.7m to $100m in the March quarter. Meanwhile, its earnings swung to $37m from a $17m loss.

Telix chief executive Christian Behrenbruch maintains it is a therapeutics company rather than a diagnostics business but concedes Illuccix has delivered a “really big ramp up for us”.

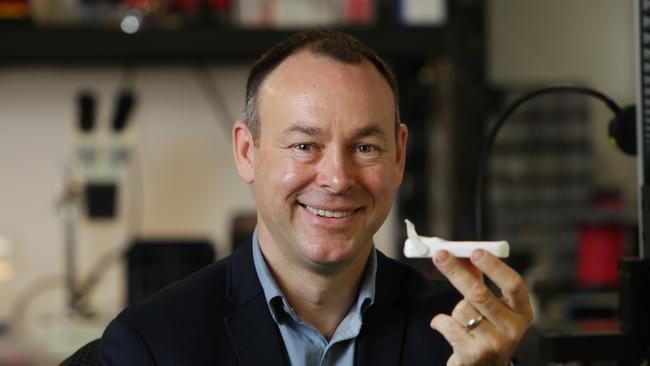

Another Australian biotech, Adelaide-based Envision Sciences, this week has signed a contract with US medical laboratory giant Quest Diagnostics to launch its prostate cancer biomarker test in America.

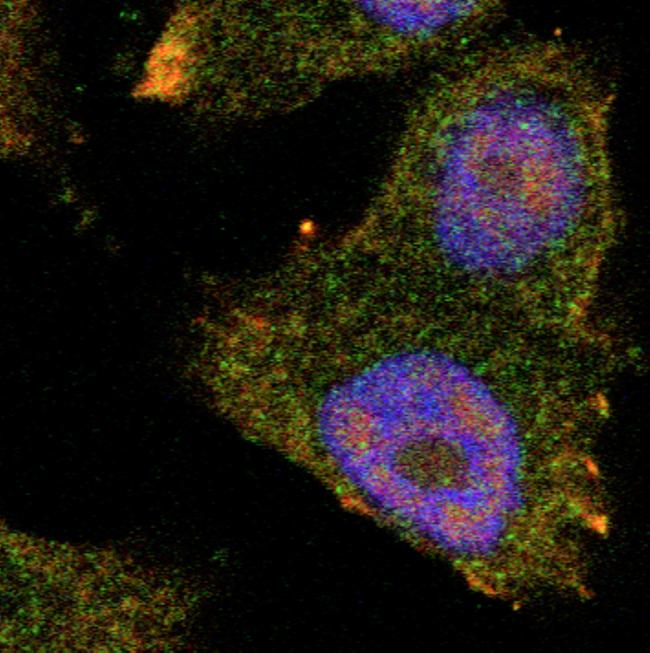

Envision chief executive Peter Pursey says the deal is worth in the tens of millions of dollars a year. Its test - which researchers from the University of South Australia developed - aims to improve the accuracy of grading prostate cancer biopsies.

But Australians will have to wait to access the technology. Unlike US funders, there is no Medicare codes for the biomarker test, meaning there is no local government reimbursement.

“The largest US tissue testing diagnostics company has taken this on because we plug an play to existing codes for reimbursement in America straightway,” Mr Pursey said.

“And they’ve got very high volumes that they want to use this test for. Quest controls about 35 per cent of the market, and they influence another 15, so overall they have access to 50 per cent of the prostate market in America, and of course that’s a multi-billion dollar market and we expect to take a percentage share of that over the next couple of years.”

According to the American Cancer Society, about one out of every eight men will be diagnosed with prostate cancer during his lifetime.

A recent Quest Diagnostics Health Trends study underscored the need for swifter and more accurate testing, revealing that diagnoses of prostate and breast cancer continue to lag behind pre-pandemic levels.

This suggests that more people are living with undiagnosed cancers now than prior to the pandemic, and despite prostate cancer being one the most common cancers globally, existing prostate cancer testing methods have limited accuracy.

Kristie Dolan, vice president and general manager of Quest’s oncology franchise, said: “We expect this service to help fill a clinical gap affecting millions of men for staging, diagnosis and treatment for prostate cancer.”

“Through our relationship with Envision, we are excited to broaden access to this innovative technology. With Quest’s national scale and industry-leading prostate cancer portfolio, we will be able to reach a larger number of patients and provide them with diagnostic insights to inform their treatment decisions.

“Our goal for this innovative prostate biomarker test is to improve the accuracy of grading prostate cancer biopsies.”

It comes after ASX-life sciences company Atomo pivoted from producing rapid Covid-19 tests to pregnancy tests earlier this year, tapping into a $2bn global market.

Atomo partnered with French laboratory equipment supplier, NG Biotech, to create a blood-based rapid pregnancy test, securing exclusive distribution agreements in Australia, New Zealand, Canada and the US - making urinating on a stick a thing of the past for expectant parents.

The company had an initial bump in its share price - hitting as high as 8c on July 4 - but has since fallen to 3.4c.

Not all companies have been able to strike it lucky. Another rapid test maker - Brisbane-based Ellume - collapsed into administration late last year.

Despite a successful launch - where it was advised by former treasurer Joe Hockey’s Bondi Partners and managed to $US265m ($389m) from the US government - its Australian arm struggled after it received “cursory engagement” and “limited interest” from the former Morrison government.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout