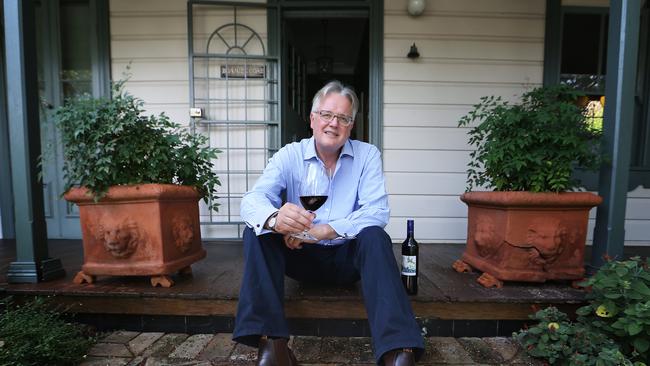

Aussie plonk has legs in China, says Langton’s guru Andrew Caillard

WOOLWORTHS’ fine wine adviser has played down concerns about the future prospects for top-end wine exports to China.

WOOLWORTHS’ fine wine adviser and the co-founder of Australia’s leading wine auction house has played down concerns about the future prospects for top-end wine exports to China, claiming they still have “phenomenal potential”.

Andrew Caillard, the fine wine principal for Woolworths Liquor and a co-founder of the Langton’s wine auction house, said Australia’s leading wine brands had not been caught up in the “rampant price increases” on wines from Bordeaux that came ahead of the Chinese government’s crackdown on corruption.

Speaking after returning from a recent trip to China, he said the first and second-tier Chinese cities were “relatively saturated with fine wine’’, so the opportunity for Australia’s leading producers was in the “third and fourth-tier cities”.

“I think Australia is extremely well-placed for the challenges of the future. We have an opportunity to play in the fine wine space within China,’’ Mr Caillard told The Australian ahead of today’s Woolworths results on the sidelines of a Chinese investment forum in Sydney hosted by advisory firm PPB Advisory.

“It is a market for fine wine that is globally recognised but does not have massive distribution. For the smaller boutique wineries in Australia there is a huge opportunity.’’

He noted that the Chinese government’s austerity measures were only for government employees, “not billionaires”.

“You can still drink good booze in China.’’

While China is now Australia’s third-largest export market behind the US and Britain, Beijing’s austerity drive has had a disastrous impact upon Australian producers, especially at the high end.

The crackdown prompted a 13 per cent drop in total wine imports by volume into China and 8 per cent for Australian producers over the past year.

But the fall in the Australian dollar below US78c from a high of $US1.10 in mid-2011, has made Australian exports more competitive.

Australian wine exports will also benefit from the recent free-trade deal, where tariffs of between 14-20 per cent for wines sold in China would be removed over four years.

In December the Woolworths Liquor Group, which includes Dan Murphy’s, BWS, and Cellarmasters, acquired China-based wine and drinks distributor Summergate Fine Wines and Spirits, a leading drinks distributor representing a portfolio of 80 global brands.

Summergate has annual sales of about $US40 million ($47.5m), with 13 offices, 11 distribution centres and more than 400 staff.

It is the third-largest importer of wine into China and also has a small fine wine retail business, Pudao, with stores in Shanghai and Beijing.

Mr Caillard said that like all players, Summergate was struggling because of the changes in sentiment towards fine wine in China. “But it has very good distribution. All the lessons we have learnt in Australia can be applied in China,’’ he said.

“Summergate in the whole scheme of things is a small business. The opportunity for the group is to learn, discover and to make small advances. The learning curve will be fairly steep. It is a very good business to cut your teeth with.’’

Mr Caillard’s comments came as Chinese state-owned enterprises are stepping back from investing abroad, leaving private companies to make moves offshore, especially Australia.

“Austerity is more an internal issue. The mindset of the Chinese investors is to diversify globally,’’ Raymond Chan, managing partner Morgans CIMB said at the PBB forum.

Shanghai’s Greenland Holding Group has four projects on the go in Australia that are worth more than $1.4bn and is keen for more. PPB Advisory director Ben Craw said that the firm had seen a definite shift from SOEs to private enterprise in agricultural sector investments.

He said Chinese investors looking at investing in a red meat processing facility were being encouraged to invest in the cattle rather than the abattoir.