Aussie diabetics stung on price for critical insulin pumps

Medtronic is charging Australians $9000 for a lifesaving insulin pump, almost double the price it charges UK patients.

The world’s largest medical device company, Medtronic, is charging Australians $9000 for a lifesaving insulin pump, almost double the price it charges British patients.

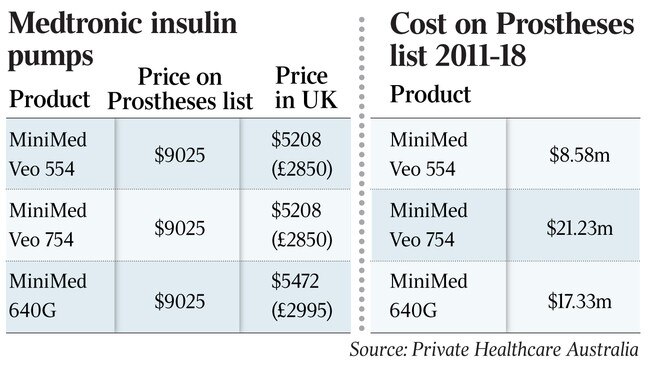

Data compiled by private health insurance industry body Private Healthcare Australia has concluded that $24.4 million could have been saved over seven years if the local cost of the device matched the British price.

The data revealed the $US124 billion ($175bn) multinational charged about $9025 on Australia’s prostheses list for three of its insulin pumps used by type 1 diabetics. The same models were priced from $5200 to $5400 in Britain.

Australia’s prostheses list sets the price health insurers must pay for medical devices, and despite reforms to address price concerns, private health insurers have called for further price cuts.

Rachel David, chief executive of Private Healthcare Australia, said fair pricing in the medical device market was a global issue.

“Even in the US they are struggling with the fact that these are multinational companies that will simply look at each market and charge what each market will bear, regardless of the value or the cost-effectiveness of that product to the patient,” Dr David said.

She said pricing was a concern because Medtronic could be in a position to increase its market dominance for insulin pumps in Australia. Dr David said Medtronic’s competitors seemed to be disappearing, and it could increase its near 70 per cent market share in insulin pumps to close to 100 per cent by the end of this year.

“Very big multinationals can sometimes monopolise a particular treatment area … if there are no competitors, it becomes hard for the prostheses list advisory committee to negotiate a good outcome,” Dr David said.

A Medtronic spokeswoman said it was inappropriate to expect that prices for medical technologies, such as insulin pumps, would be the same across different markets.

Varying factors impacted supply and purchase of medical devices in the Australian healthcare system, she said.

“In medical technology, price variations between countries occur for the same reasons as for any other product or service, as well as factors that specifically impact the medical technology industry,” the spokeswoman said.

“Medtronic believes our healthcare system must support innovation and ensure patient access to the most innovative therapies, recognising the local regulatory and reimbursement framework within which these technologies come to market.”

Federal Health Minister Greg Hunt introduced a reform in 2017 to cut prices on the prostheses list for hip, knee and cardiac devices following complaints from the insurance industry that they were overcharged, compared to Australia’s public system and comparable countries. The prostheses reform represented a $1.5bn saving to the private insurance industry over four years.

Dr David said one-off reforms addressing one or two areas would not fix the problem. “We need a system that takes account of global reference pricing, so all the products on the prostheses list are supplied at a fair price relative to what they are globally, so we aren’t paying two to five times as much,” Dr David said.

She said Labor’s promised Productivity Commission review of private health insurance, should it win the federal election, should include an examination of the prostheses list.

Dr David said the data on prostheses list pricing had already formed part of the industry body’s engagement with Labor.

“The concerns are well understood but now it is time to move to a coherent national system to evaluate the cost, the effectiveness and the safety of medical devices,” she said. “We are still behind in this area relative to the pharmaceutical sector, where the government has been able to achieve a fantastic outcome in most cases for new medicines.”

Dr David said the industry body’s investigation into the cost of the insulin pumps also revealed the pumps appeared to need replacing not long after the warranty expired.

Dr David said data from one health fund showed that out of 61 claims for an insulin pump, 32 failed in eight weeks of the warranty expiring, while 14 lasted one year after the warranty expired.

“Only one of three things can be happening; there is built in obsolescence of the product, it’s a very poor quality product to start with, or fraud is taking place,” Dr David said.

“We don’t believe the patients are committing fraud, so we need to consider why it is that this device appears to be failing in a year of its warranty expiring.”

The Medtronic spokeswoman said once available in market, the company worked in the healthcare system to improve access and patient outcomes where possible. “For example, the express warranty for Medtronic insulin pumps is four years, but lifespan can vary depending on the lifestyle of the user,” she said.

“Some pumps may encounter more drops and collisions over their lifespan, which contribute to how long the pump will work properly. We build our pumps to be used under a variety of conditions, which is why we will replace a damaged pump during the warranty at no cost to the user.”

Medtronic Australasia said it gave free insulin pumps to Australian kids under the age of 16, or people with type 1 diabetes who were economically disadvantaged and had been nominated by their healthcare professional.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout