AUKUS uncertainty under incoming Trump presidency causes anxious wait for defence suppliers

Uncertainty over the future of the AUKUS pact under the new Trump administration has defence suppliers feeling increasingly sceptical about opportunities from a submarines program.

Uncertainty surrounding the future of the AUKUS security pact is making local defence suppliers nervous and feeling increasingly sceptical about the economic opportunities likely to flow from Australia’s nuclear submarines program.

And fears Australian industry will miss out on a multibillion-dollar pipeline of work promised under the trilateral partnership are mounting as Donald Trump prepares to take back the keys to the White House in the new year.

The Republican president-elect has been noncommittal about AUKUS, and some believe he will seek to renegotiate, delay or potentially scrap a commitment to share US technology – and ultimately support the development of a sovereign capability in Australia that would allow the nation to build its own nuclear-powered submarines in the early 2040s.

Australian Industry and Defence Network chief executive Brent Clark, whose organisation represents small and medium-sized businesses across the defence supply chain, said that even if Mr Trump were to stick with the current program, Australian businesses might find it harder to break into a US-dominated supply chain.

“I think he has acknowledged the importance of the strategic relationship and I think he does see Australia as a partner, whatever a partner means to Donald Trump,” Mr Clark said.

“But the one thing we all know is that he’s incredibly transactional. We do know that his entire manifesto is about America and making sure that America gets everything.

“And so the thing that I would worry about is it will all be about America and American industry. He is going to, I believe, really push to ensure that US industry gets all the work it can possibly get, so that it doesn’t hurt the program in terms of delivering a capability, but it sure hurts Australian industry.

“I don’t think I’m being paranoid here. He’s going to put tariffs on every man and their dog, so I don’t think we could sit here and say, ‘Oh, no, that’s okay, he’ll make sure that Australian industry is front and centre for this nuclear submarine’. I just don’t think he’ll give a second thought to Australian industry.”

Under the AUKUS agreement between Australia, the US and the UK unveiled three years ago, Australia would buy three Virginia-class nuclear-powered submarines from the US in the early 2030s while building its own fleet of SSN-AUKUS submarines at the Osborne shipyard west of the Adelaide CBD.

The program is expected to cost Australian taxpayers up to $368bn.

Mr Clark said the massive investment needed to come with assurances that Australian suppliers would get their fair share of work.

“We need strength of conviction – we need our prime minister, our minister for defence and our opposition leader to publicly come out and make sure that they’re sending the strongest possible message to the president-elect that Australia is a partner in this, and their expectation is that Australian industry will be treated as a partner,” he said.

“We can’t walk away from that political resolve, but political resolve doesn’t translate to commercial reality.

“We also need to insist that in all our commercial discussions, and all our contracts, that we absolutely ensure that in those contracts, are obligations to Australian industry.

“Other countries insist upon things like that. We’ve got to get Australian industry into the commercial discussions, into the contract.”

Before joining the AIDN, Mr Clark spent more than a year as interim chief executive and Australian program director at the Australian arm of Naval Group – the French shipbuilder that had its submarine contract torn up by the Morrison federal government in 2021 when the AUKUS deal was announced.

Naval Group had been required to spend at least 60 per cent of the $90bn contract value on local Australian suppliers.

The AIDN estimates that hundreds of local suppliers which had invested in new systems, equipment, security and personnel in the hope of securing 30-plus years of work on the program were left up to $200m out of pocket when the contract was cancelled.

And that level of financial risk is currently playing in the minds of local suppliers, Mr Clark said.

“We estimated that the average Australian company, to get into the Naval Group supply chain, was about a quarter of a million dollars. They never saw that money,” he said.

“So there is scepticism, there is a reticence to invest.

“Because you can imagine, if you had invested in the Naval Group supply chain, and you’ve done your dough – if you then go into what is a bigger investment to get into the nuclear supply chain, and you are concerned that it’s not going to happen, can you take that commercial risk?”

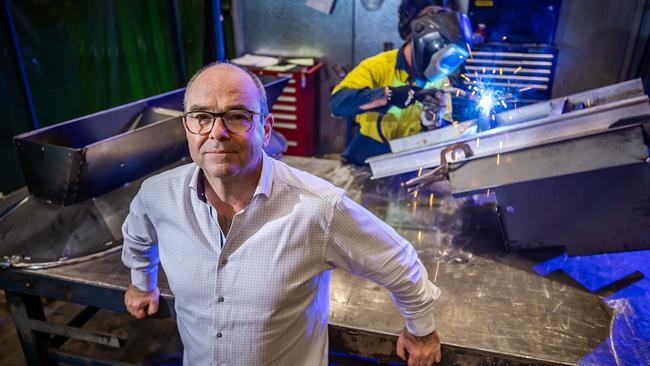

Sheet metal manufacturer Rowlands Metalworks had been building ties with French industry, and formed a joint venture with French supplier Probent, before its hopes of securing work on the Naval Group program were dashed by the contract cancellation.

Its owner, Cameron Johnston, said that while the future submarines build under AUKUS was “on my horizon”, he was taking a much more cautious approach, prioritising more advanced projects like the Hunter-class frigates program at Osborne.

“With AUKUS we figure that there’s just a huge amount of distance to travel in terms of getting there, and of course the Naval (Group) experience, if anything, puts us a little bit more on edge and probably just activated a little bit more scepticism,” he said.

“We’re interested in AUKUS, we will follow AUKUS, but before we get heavily engaged with it we will make sure that the project’s going ahead.

“I often tell people that the defence sector is a little bit like an ant eating a pumpkin – you’re just not quite sure where you get in, particularly for smaller businesses like mine.

“So I think a number of people at the smaller end of town feel the same way. They’re just waiting, or they’re doing other things, and hoping AUKUS continues on and emerges as a project, and then our interest and activity will pick up.”

Mr Johnston said the looming Trump presidency raised more doubts about the future timing and scale of the submarine program at a time, and in an industry, where decisiveness and certainty were critical.

“It’s damaging in terms of confidence more than anything, and the uncertainty,” he said.

“I certainly wouldn’t be making any investment decisions until I knew where all that was tracking.

“The best way to activate small business, and indeed any business activity in the defence industry, is to give some sort of confidence about what’s coming along.

“Using the Naval Group experience as an example, that really was completely embarrassing to ring my French colleagues and tell them that everything that we’d done was a complete and utter waste of time, and therefore my investment decisions about what we might do in this business are tainted with the same sort of scepticism.

“What we need is for the department of defence and primes to just start firing out purchase orders for whatever it is, and that will invigorate and regain people’s confidence. I think the problem is either not making a decision or changing your mind. That’s a disaster.

“If we’re going to build these AUKUS things, great, start engaging with people that you need in your supply chain much earlier, and give them some sort of confidence that they’re part of it, because otherwise we’ve got alternatives.”

While many local suppliers are approaching AUKUS with caution, 3D metal printing company AML3D has spent years entrenching itself into the US defence supply chain, and has been engaged directly by the US Navy to manufacture parts using its specialised 3D metal printing system – known as Arcemy – for the country’s nuclear submarines.

After securing more than $16m in US defence contracts, the ASX-listed company opened a manufacturing facility in Ohio in December, and raised $30m in November to more than double its US capacity, and to set up its first facility in Europe.

Managing director Sean Ebert said “the backdrop of AUKUS” was a significant factor in the company’s expansion, and it was now well positioned to capitalise on the closer ties being built between Australian and its closest allies.

“We’ve started to generate a lot of interest through the AUKUS relationships with the UK now – so they’re asking for systems to be deployed in the UK,” he said.

“And then on top of that, we’ve just finished the part for the Virginia-class submarine program … and that’ll be a bit of a showcase for the Australian government and for AUKUS.

“We’re seeing huge benefits at the moment, because for the US to increase their submarine production they have to adopt additive manufacturing (3D printing), and the budgets they’ve got in the US for adopting additive are enormous – they’re making huge investments in trying to bring the technology on stream.”

US Navy officials have stated that America’s submarine construction program is behind schedule, and falling well behind the rate needed to supply Australia under the AUKUS schedule.

Mr Ebert said 3D printing was being seen as part of the solution to fast tracking production, and having a physical presence in the US was a key advantage for AML3D.

“I think there’s always going to be a strong preference to manufacture in the US for the US,” he said.

“When Trump comes in, that re-shoring of manufacturing and building up local manufacturing capacity and capability is going to be at the forefront of his mandate.

“For Australian suppliers, I think it would be wise to have some form of manufacturing capacity over in the US, close to where they are, because they do have a preference to work local.”