ATO’s $75bn crackdown on multinational targets

The ATO has sealed deals with 12 multinational targets on related party debt, settling cases related to $75bn in debt.

The Australian Taxation Office has sealed deals with 12 of its biggest multinational targets on related party debt, in a coup that will settle cases related to $75 billion of borrowing.

Importantly for budget revenue flows, the settlements would lock in a flow of tax money in the future from the companies in question, as well as dealing with historical disputes, Deputy Commissioner Jeremy Hirschhorn told The Australian.

It builds on the ATO’s landmark Full Federal Court win in April against Chevron’s Australian arm over multi-billion-dollar borrowings from offshore associates, used to fund the company’s share of the Gorgon gas project off the coast of Western Australia.

Now, the ATO’s latest compliance review focuses on 60 of the “biggest and riskiest” taxpayers with large borrowings from offshore associates, representing $120bn of the $420bn in related party debt on issue across the economy.

“Since the court decision we’ve been really working hard with a lot of the companies with bigger inbound loans. We’ve been doing a compliance focus,” Mr Hirschhorn said. “Twelve of those taxpayers, representing about $75bn of that debt, have either settled or are about to settle in accordance with the risk ratings of the PCG,” he said.

“So we haven’t been standing still, that’s a pretty fair percentage.

“And the other element of that which has been very pleasing is that we’re not settling the past years alone, we’re settling the past only if we can also settle the future years.”

He said in some cases compliance was being locked in “10, 20 years into the future”.

“We’re just progressively working through, working down to smaller and less risky (cases).”

The ATO says it has used a draft version of a guide that gives colour-coded risk ratings to related party debt to strike the latest round of deals.

A final version of the practical compliance guide, which assigns companies risk ratings ranging from white at the lowest end to red for “very high risk”, is to be released by the ATO today.

Risk ratings in the guide are calculated on factors including whether the offshore associate is in a tax haven and how much interest it charges its Australian cousin.

Meanwhile, Mr Hirschhorn said the Chevron decision and the guide had been “very useful” in bringing big multinationals to the table. “It’s helped companies engage with us because they know what the resolution might be,” he said. “It takes away the worry in a settlement that you’re the only one.”

Before the Chevron decision, many multinationals had calculated what was a fair interest rate to charge by assuming their Australian arms would have to borrow on the open market, rather than as a member of a large group capable of striking a lower rate. However, this “orphan” was rejected by the court. “Chevron really clarified that,” Mr Hirschhorn said.

“Companies have really been seeking certainty,” he said.

“We require future years to be part of the settlement but companies have found that quite attractive — it’s locked in both ways.”

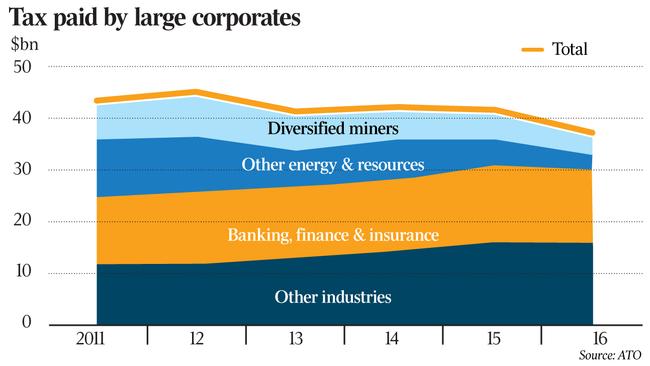

With billions poured into big projects that take years to come on stream, the ATO doesn’t expect tax revenue immediately — it could take up to five years after a project is operational to see any money flow to the government, Mr Hirschhorn said.

However, he said the settlements struck so far locked in reductions in debt levels into the future “as projects become income producing”.

“It’s important, not just the price but also the level of debt.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout