ASX may confront pay strike after proxy adviser ISS tells investors to vote against remuneration

Influential group Institutional Shareholder Services has broken ranks with its peers and urged investors to vote against the ASX’s remuneration report, citing a number of issues.

Influential proxy group Institutional Shareholder Services has broken ranks with its peers and urged investors to vote against the Australian Securities Exchange’s remuneration report, citing issues with governance and bonus structures.

In a detailed report to investors, obtained by The Australian, ISS said a vote against the ASX’s pay report was warranted “due to corporate governance concerns”, questions about the quantum of remuneration available as bonuses, as well as the rigour of performance targets and disclosures.

The ISS report puts the ASX board on heightened alert for a potential strike - a vote of 25 per cent or more - against its latest pay report. The ASX narrowly avoided a first strike in 2023, when 21.2 per cent of votes came in against its remuneration report.

ISS, which advises investors on how to vote at annual general meetings (AGMs), noted increases in the short-term bonuses available to ASX executives, including chief executive Helen Lofthouse, did not appear adequately quantifiable and measurable and didn’t gel with the ASX’s earnings results.

“This does not appear well aligned with flat or slightly negative underlying results, shareholder outcomes, and continued regulatory scrutiny,” the ISS report said.

The document comes in the wake of damaging court action against the ASX by the Australian Securities and Investments Commission, which alleges the market operator withheld critical information about the failure of its project to replace the ageing CHESS clearing and settlement system.

The maximum penalty for the alleged contravention of the ASIC Act is $555m.

ASX chairman Damien Roche last month announced he would step down amid angst over ASIC’s court action and steep writedowns linked to the bungled CHESS upgrade.

Charter Hall chair and former banker David Clarke will helm the board following the company’s upcoming AGM on October 28, where investors will vote on his appointment.

Other proxy advisory firms have been supportive of the ASX in their pre-AGM reports. Ownership Matters urged ASX shareholders to support the company’s remuneration report and the election of Mr Clarke, despite the exchange operator’s regulatory woes.

“In FY24 ASX, as previously flagged, extended long-term incentives to all executives with bonus potential reduced. This change should improve the alignment between executive and shareholder outcomes, despite an increase in executive potential pay,” Ownership Matters’ report said,

Voting intentions in the report urged investors to support all ASX board-backed AGM resolutions including the election of former Australian Prudential Regulation Authority chair Wayne Byres as a non-executive director. But Ownership Matters did not support non-executive director nominations by independent and external candidates and former ASX executives Philip Galvin and Bob Caisley.

ISS also told investors to vote against the two external candidates saying Mr Galvin did not have the skills or expertise to “enhance the overall effectiveness” of the ASX board, while Mr Caisley’s skills, expertise and experience were “not required” at the present time.

Proxy house CGI Glass Lewis didn’t back the duo either despite praising their skills and experience. CGI urged ASX investors vote in favour of the company’s remuneration report.

Still, there appears to be a strong backlash against longer-serving ASX board members that is playing out as local AGM season ramps up.

Among the first broadsides fired at a non-executive ASX director came on Monday when investors in diversified property giant Stockland chalked up a 28.1 per cent vote against the re-election of Melinda Conrad.

Ms Conrad, who was appointed to Stockland’s board in 2018, and has more than 25 years of expertise in consumer-related industries, including as a retail entrepreneur and CEO, and roles at Colgate-Palmolive and Harvard Business School, was targeted due to her role at the ASX.

Ms Conrad was appointed an ASX director in 2016 and is a member of the people and culture, nomination and technology board committees.

ISS recommended a vote against the re-election of Ms Conrad to Stockland’s board noting concerns related to failures of governance, board and risk oversight and fiduciary duties identified at ASX.

In the Stockland report to investors, ISS noted that ASIC chair Joe Longo had said: “We [ASIC] believe this was a collective failure by the ASX board and senior executives at the time.”

The vote against Ms Conrad could be replicated against other directors who sit on large company boards including Qantas, Westpac, Challenger and another property developer, Mirvac, at future AGMs. A big test will be faced by ASX director Vicki Carter, who chairs Bendigo and Adelaide Bank, and is up for re-election as a bank director in November, albeit she only joined the ASX board last year toward the tail end of the exchange’s woes with the initial CHESS upgrade.

Late last year, ASX sealed an agreement with India’s Tata Consultancy Services to replace its existing cash equities clearing and settlement system, that followed the shelving of the prior CHESS upgrade that drew on blockchain technology.

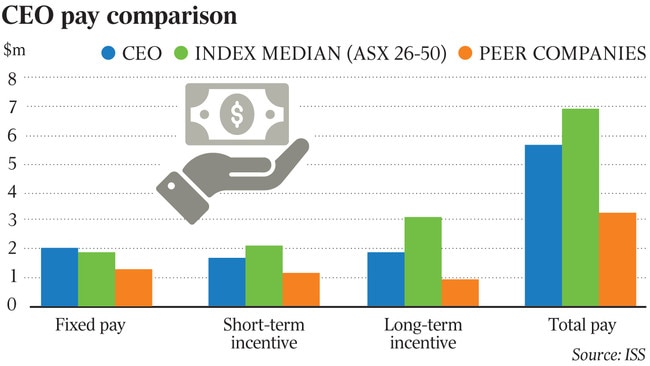

In its report to ASX investors, ISS warned $1.7m in total short-term bonus payments for CEO Ms Lofthouse represented “a substantial 70 per cent increase” compared to the prior year’s incentives. Ms Lofthouse is paid a fixed salary of almost $2m.

“Other named executives also experienced material increases in STI bonuses,” ISS analyst Isabelle Castaneda said.

She warned the ASX provided “inferior and absent disclosure of quantified and specific STI performance targets”, arguing the increase to Ms Lofthouse’s potential bonus was “not well justified”.

“Investors are left to consider broad, directional shifts in award magnitude, and the extent of board discretion,” Ms Castaneda wrote.

However, ISS backed a motion to award performance rights to Ms Lofthouse, even as the report highlighted the grant “could result in misalignment with shareholder interests and performance”.

If the ASX notches up a first strike against its remuneration report, that sends a strong message to the board. Two consecutive strikes against a company results in a vote to spill the board, putting all directors put up for re-election.

ASX awarded Ms Lofthouse 100 per cent of her targeted short-term incentives alongside chief risk officer Hamish Treleaven, who has since announced his departure.

The ASX board signed off on pay outcomes just three days after ASIC launched Federal Court action against the ASX, alleging misleading and deceptive conduct around disclosures on the CHESS project. At the time of signing off pay, the ASX board said there were no known issues to disclose, ISS said.

“While this issue is in court, given the potential monetary and reputational costs to ASX, some shareholders may disagree with the company’s statement that there were no known issues that required adjustments to remuneration,” the ISS report said.

“Bonus opportunities appear to have been increased substantially, being inconsistent with the company’s performance and shareholder interests,” ISS added.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout