ASIC on criminal charging spree as Hayne criticism bites

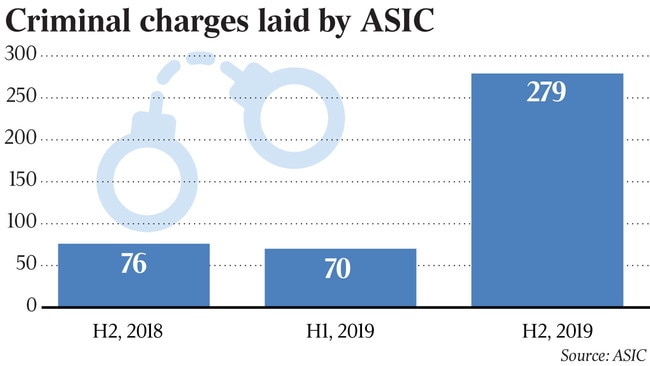

An emboldened ASIC assisted in laying an almost fourfold increase in criminal charges in the six months to December 31.

An emboldened corporate regulator, drawing on a “why not litigate” policy, assisted in laying an almost fourfold increase in criminal charges to 279 in the six months to December 31.

In its latest enforcement update, the Australian Securities & Investments Commission outlined its case numbers for the latter half of calendar 2019.

It showed it was involved in 17 individuals being charged in criminal proceedings and 279 criminal charges being laid during the six months to December 31, up from 10 individuals and 70 charges in the prior half.

“As I have emphasised over the past year, ASIC has a clear resolve and the Office of Enforcement is delivering on the public’s expectation that we hold wrongdoers to account,” deputy chairman Daniel Crennan said in the report.

The Office of Enforcement was set up in July 2019 after ASIC was lambasted during the Hayne royal commission for not strongly pursuing cases of wrongdoing.

The enforcement update noted that 10 custodial sentences, which led to eight people being imprisoned, were related to ASIC cases in the six months to December 31. There were four non-custodial sentences. The update showed there were no court-enforceable undertakings and no community benefit payments made during the period. Enforceable undertakings were heavily used by ASIC in the past to get an agreed outcome with a company without the matter going through the courts.

The jump in criminal charges in the update came as the number of individuals that were banned or restricted from providing financial services or credit dropped to 48 from 103 in the prior six months.

The number of individuals disqualified or removed from directing companies was steady at 29.

The update showed ASIC started 60 investigations in the six months to December 31, and completed 40.

It disclosed that for corporate governance enforcement litigation it had 10 criminal cases and nine civil actions against directors in progress as at January 1.

The update also provided high-profile case studies including that of Peter Gregg, a former director and Leighton finance chief, who was found guilty by a jury of two counts of contravening the Corporations Act 2001 by engaging in conduct that resulted in the falsification of Leighton’s books. Mr Gregg has lodged an appeal against his 2019 conviction and sentence.

In light of the COVID-19 crisis, ASIC has postponed some of its key regulatory projects and matters. “Our enforcement work will continue; however, some of that work will also be delayed or affected by the crisis,” Mr Crennan said.