ANZ first Australian bank to offer Apple new pay later offering as part of suite of new software update

Apple is axing its buy now, pay later service in favour of a new loan offering via credit, debit cards and lenders, with ANZ the first bank to sign up.

Apple is axing its buy now, pay later service just months after its launch in favour of a new loan offering that will be rolled out globally – including in Australia – via credit, debit cards and lenders.

“This solution will enable us to bring flexible payments to more users, in more places across the globe, in collaboration with Apple Pay enabled banks and lenders,” an Apple spokeswoman said on Tuesday.

The tech giant launched its existing pay later service in the US last October which allowed customers to split purchases from $50 to $1000 into four payments, spread over six weeks with no interest.

Apple said at the time that the service was “designed with users’ financial health in mind” and “there’s no one-size-fits-all approach when it comes to how people manage their finances”.

But Apple said the service was no longer needed after it launched its instalment offering, which it unveiled last week as part of a suite of operating system updates to its Mac computers, iPhones and iPads.

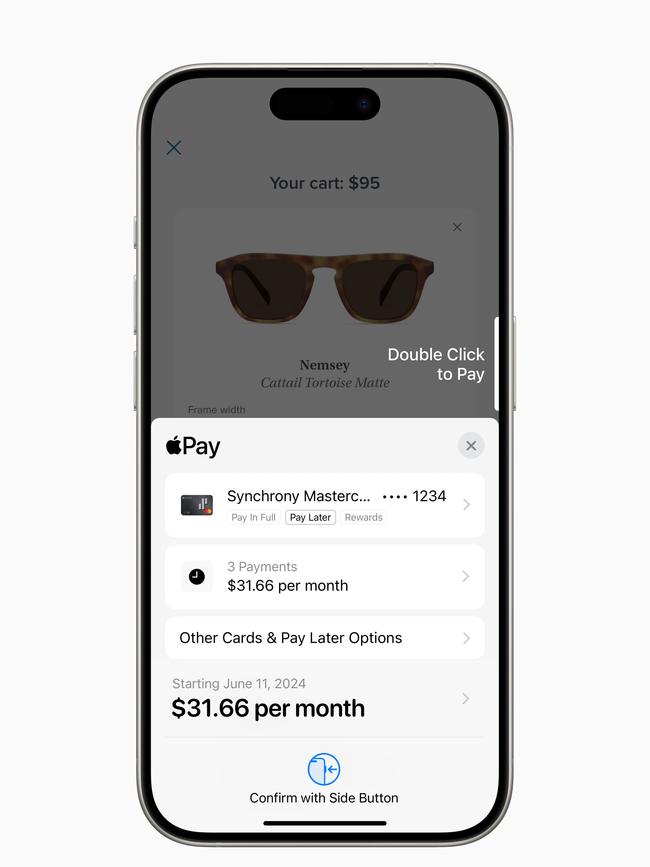

“Starting later this year, users across the globe will be able to access instalment loans offered through credit and debit cards, as well as lenders, when checking out with Apple Pay,” the company said.

“With the introduction of this new global instalment loan offering, we will no longer offer Apple Pay Later in the US. Our focus continues to be on providing our users with access to easy, secure and private payment options with Apple Pay,”

ANZ will be the first lender to offer the new service – like it was when Apple Pay was launched in Australia eight years ago.

“Apple Pay introduces even more flexibility and choice for users when they check out online and in-app,” Apple said.

“Users can view and redeem rewards, and access instalment loan offerings from eligible credit or debit cards, when making a purchase online or in-app with iPhone and iPad. These features will be available for any Apple Pay – enabled bank or issuer to integrate in supported markets.

“The ability to redeem rewards for a purchase with Apple Pay will be available beginning in the US with Discover and Synchrony, and across Apple Pay issuers with Fiserv. The ability to access instalments from credit and debit cards with Apple Pay will roll out starting in Australia with ANZ. Users in the US will also be able to apply for loans directly through Affirm when they check out with Apple Pay.”

Apple said customers will be able to use Apple Pay on any third-party web browser and computer by simply scanning a code on their iPhone to securely complete the payment.

Other updates included “Tap to Cash”, in which customers will be able to send and receive “Apple Cash” by holding two iPhones closely together without having to share phone numbers.

“For example, Tap to Cash can be used to pay someone back at dinner or buy something at a garage sale,” Apple said.

It comes as consumers could soon be paying more to use buy now, pay later services, with the Reserve Bank indicating it may compel operators such as Afterpay to ditch the no-surcharge rules currently forced on retailers.

Speaking at a payments event on Tuesday, RBA’s head of payments policy Ellis Connolly said the central bank would kick off a review of payments regulation, including on the no-surcharge rules, as soon as federal parliament passes the bill that hands it greater powers over digital wallet providers and buy now, pay later services.

The planned review will see the central bank probe whether current surcharging rules are fit for purpose, Mr Connolly said.

“In 2021, the RBA concluded that merchants should be allowed to surcharge BNPL services. The RBA’s view at the time was that any benefits of no-surcharge rules in terms of supporting new entry into the payments market was outweighed by the costs in terms of efficiency and competition in the payments system,” Mr Connolly said.

“However, it was not clear that the RBA had the power to require the removal of these no-surcharge rules. After the reforms to the Payment Systems Regulation Act, the RBA plans to revisit this issue as part of a broader review of whether the RBA’s surcharging framework remains fit for purpose.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout