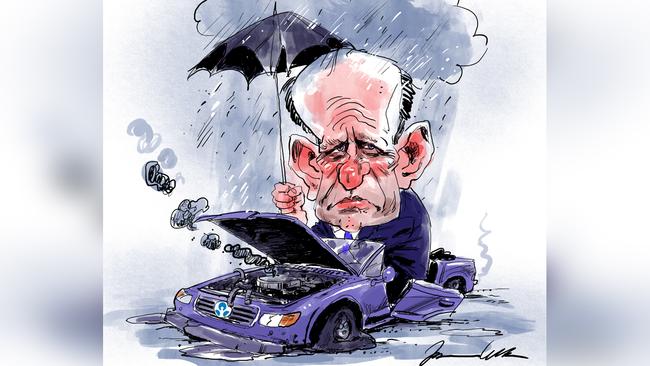

ANZ reported a fall in return on equity to 10.9 per cent, the lowest on record in recent memory, and nothing Elliott said yesterday offered hope it was about to rebound.

Politically that is acceptable.

ANZ’s stock price fell 3.3 per cent to $26.74; over the last three months it has underperformed on a total return basis by only 0.9 per cent. Extraordinarily, NAB has outperformed over three months and a year, but that is from a low base and, while the market was disappointed by the cut to franking credits in the ANZ dividend, next week Westpac’s Brian Hartzer is widely tipped to report an actual cut in dividends.

The impact on profits is shown by the fact that Australia now only accounts for 55 per cent of ANZ’s profits, down from 70 per cent five years ago, with New Zealand and Asia contributing the rest.

That explains why only 70 per cent of the 80c a share in second-half dividends will be franked.

ANZ has about 14 per cent of the home loan market, of which over half comes from mortgage brokers and only 6 or 7 per cent is sourced to the bank’s proprietary network.

Elliott confided customers prefer to use brokers because they make it easier and direct you to lower rates, which says all you need to know about the state of banking at the moment.Home loan returns have fallen in the last decade from over 30 per cent to below 20 per cent.

What Elliott plans to do over the next couple of years is use the weak market to get the ANZ house into order and ready for the next upswing.

With interest rates poised to stay low for longer, the outlook for banks continues to be weak, and it’s just not banks who are worried. Insurers are also suffering but no sector more so than savers, and this is where the federal government faces a growing problem.

Infrastructure bonds highlighted yesterday are one solution, but any way you look at it, the signals are poor for investors, and this means retirees who are a growing proportion of the voting population.

Roughly half of ANZ’s head office staff of 2100 are engaged in the remediation program to make good past snafus, underlying the extraordinary cost of the banks’ past errors and basic theft.

The banks only have themselves to blame for this exercise but its impact also clearly impedes any attempt to boost the economy.

ANZ has paid out around $1.6bn in the last two years and chief Shayne Elliott rightly notes the process is important for the bank, both because it is the right thing to do and will also help going forward.

Combined with lower interest rates and slow economic growth, Elliott is braced for a period of bunkering down, trying to get the bank up and running again.

Investment spending is up 17 per cent to $1.4bn, but the bulk of this will go to systems changes, including process improvements and better payments mechanisms.

In other words, the bank is still getting its house in order and growth is not really on the horizon.

Just as well the bad debt charges on the mortgage book are running at half “normal” levels, because on just about every other metric the bank is suffering.

Cost of capital is now around 8.5 per cent and the bank’s return on equity stands at 10.9 per cent, which is above its European peers, but Elliott said the target going forward would be in the low teens, a far cry from the high teens of a few years back.

The 2.4 per cent spread between his returns and the cost of capital at 8.5 per cent is about as skinny as he would want it to fall.

Cost cutting target of $8bn is still in place.

Banking in Australia is changing, and while the big four control the market, due in large part to their own incompetence, combined with economic reality, these are not the returns they have come to enjoy. Back in 2008 ANZ posted returns of 14.1 per cent and CBA 20.4 per cent.

Iluka’s loyalty spin-off

Tom O’Leary followed his old Wesfarmers boss David Robb into the chief executive job at Iluka three years ago and clearly the old lessons remain top of mind.

Iluka is the product of the 1998 merger between Westralian Sands and Consolidated Goldfields and the latter owned the iron tenements known as mining Area C which BHP is excited about — as shown by its $US3.6bn investment in the so-called South Flank mine.

The old Goldfields was an explorer in the Pilbara in the 1960s and while selling its Mt Goldsworthy project it retained a stake in South Flank which now earns a royalty from BHP. Last half that totalled $41m but if iron ore prices stay high and the Australian dollar remains low the royalties will increase to $239m in 2023.

To put these in context Iluka last year reported earnings before interest tax, depreciation and amortisation of $544.5m against the royalty earnings of $55.6m.

Wearing his return on capital cap, O’Leary figured as BHP ramps up production and the royalty flow increases, a vehicle with a net present value of circa $2bn could emerge under his roof.

He figured it would be better to split off the royalty stream into a separate vehicle and the stockmarket agreed, with Iluka jumping 6.7 per cent to $9.40 a share yesterday.

Just what form the royalty stream will take is yet to be decided but the principle makes sense and the value for Iluka shareholders is clear.

That would then leave a cashed-up O’Leary to work on his mineral sands assets as shareholders collect the revenue stream from his parent company’s good work 50 years ago.

5G curbs won’t help

When the government placed a blanket ban on Huawei for the 5G mobile network earlier this year it was following the US lead to a point.

The main users on Huawei in the US were regional wireless companies, and the government there is considering compensating them. The main alternate suppliers are Ericsson and Nokia, the former being the supplier to Telstra.

Locking in a single equipment supplier has obvious commercial benefits to Telstra, but if everyone in Australia is using the same network equipment supplier then consider the potential cyber risks.

Ericsson, like all equipment suppliers, has had its issues over the years in cyber crime, most notably back in 2005 in Greece.

If the government is restricting the number of suppliers then arguably the risks of cyber crime increase — they certainly don’t decrease.

Britain is allowing Huawei to build 5G in its market under strict controls.

The ACCC works on the proposition that fewer suppliers means higher prices, which is why it is keen to see TPG continue in the mobile market even though the telco said once the Huawei ban came in last August the game was over. The ACCC argues it may change its mind.

By year’s end Vodafone will tell us who it has chosen to build its 5G network and it will be either Ericsson or Nokia. Obviously fewer suppliers means higher prices so consumers lose.

The market was looking for a weak set of numbers from ANZ’s Shayne Elliott and he delivered, and the only surprise was the relatively strong performance from the banking sector.