AMP no bargain for Resolution Capital

Resolution Capital founder Sir Clive Cowdery says the valuation for AMP’s life business is the highest he has paid in 15 years.

Resolution Capital founder Sir Clive Cowdery says the valuation for AMP’s life insurance business is the highest he has paid in 15 years, rejecting criticism from analysts that helped fuel another plunge in the share price of the venerable financial services giant.

Sir Clive also told The Weekend Australian that AMP’s $1.1 billion in ongoing interests in the life business and in Resolution were included in the deal at AMP’s insistence and would help provide stability for its dividend, as well as a kicker for returns if Resolution lists on the stockmarket as planned in the next few years.

“This has been a hard deal for me,” said Sir Clive, who was knighted in 2016 for his philanthropic works.

“These guys are tough.”

AMP has sold its life insurance business — a historic pillar of the former mutual — and a book of mature products to Resolution for $3.3bn but will get to keep only $2.2bn of the proceeds after covering $320m of separation costs and repaying debt.

The sale of the largest life insurer in the market caps a widespread retreat by Australian financial services groups, with banks including CBA, Suncorp, Macquarie and NAB offloading their life businesses, largely to overseas buyers.

Analysts yesterday criticised the deal, saying AMP had sold the business too cheaply in its haste to simplify its structure.

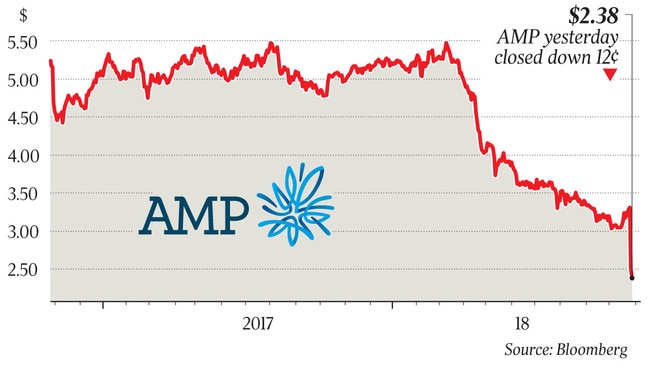

AMP shares closed at another record low of $2.38 yesterday, down 12c after a rout on Thursday that wiped out 25 per cent of its market value amid reaction to the deal and a plunge in the market. The shares rallied briefly to $2.77, but capitulated again as the broader market turned down and closed off their low of $2.28. AMP, which was advised by UBS and Macquarie, said the price represented 0.82 times the embedded value of the business, which measures the discounted value of future cash flows. But analysts said it was as little 0.35 to 0.5 times embedded value after accounting for lost profits, separation costs and lost synergies.

“AMP’s willingness to go ahead with such a deal sends a concerning signal to investors that they are prepared to write off significant value in an effort to reshape the company,” Credit Suisse said in a note to clients.

Sir Clive backed AMP’s claim of 0.82 times and said it was above the average purchase multiple of 0.70 to 0.75 paid in 15 years of acquisitions across Britain, Europe and the US.

“Nothing causes me a greater stab of pain than the idea that you guys think we have bought this cheap,” he said.

He said he had been trying to convince AMP to sell the business at the lower multiple “every Friday since the start of the year” but had been persuaded to pay more by the scale and diversification of the business, which has three million customers and $31bn of assets.

“It is really a slice of history for the Australian life insurance market, and you can buy all of this together in one transaction without having to do multiple deals to build up a diversified book,” Sir Clive said.

AMP has succumbed to a long-term trend that has seen the historic role of life insurers in underwriting post World War II reconstruction by holding government debt against their policies overwhelmed first by inflation and then by the emergence of mutual funds, pensions and superannuation.

“I am afraid the rest of the industry is doing exactly what AMP, AXA, Allstate, Swiss Life and Royal Sun Alliance is doing, which is closing the back book to new business and extract the capital so you can go an invest in your future.

“There is nothing different about AMP’s transaction to any other world-class institution of similar quality has done over the past 15 years.”

Resolution was formed by Sir Clive in 2003 when he quit as chief executive of GE’s British insurance operations and began raising capital to offer British life insurers a way out of businesses that had grown beyond their ability to generate an adequate return for their owners.

Resolution, backed by sovereign and pension funds, has deployed $US13.6bn of equity to buy 27 life companies. The deals typically deliver investors 12 per cent annual returns, with Resolution taking over responsibility for claims and renewals but not writing any new business. AMP has taken a number of options to retain exposure to any upside from the transaction, committing $515m of the sale proceeds to a 20 per cent stake in the latest Resolution vehicle in the hope of capturing upside from the annual 10-12 per cent returns backers have received and a planned float of the business.

“What AMP insisted on was an option on the growth of Resolution,” he said.

The first Resolution vehicle was bought for £5 billion in 2007 by the Phoenix Group that housed the Pearl Assurance business once owned by AMP.

AMP has also retained an effective 40 per cent interest worth $600m in the mature products business that is being sold. It will also hold $300m of preference shares in the life business that will pay 6.5 per cent in fully franked dividends.

Acting chief executive Mike Wilkins said AMP retained the right to sell the shares at any time after they were issued, with the decision to be left to incoming chief executive Francesco de Ferrari, the former Credit Suisse banker who starts on December 1.

But Sir Clive said AMP had insisted on having those shares and that they would provide a steady and reliable source of income to underwrite AMP’s dividends if it chose to keep them.

The sale leaves AMP with a much simpler business of wealth management — which includes the country’s biggest retail superannuation franchise with $132bn of assets under management — a controlling interest in the $180bn AMP Capital funds management business and AMP bank.

About 800 AMP staff will transfer to the Resolution group, which expects to take 35 years to run down the business, shrinking by 5 per cent a year.

Sir Clive, who started his working life as a life insurance salesman in the rural west of Britain, is one of the richest individuals in the nation with an estimated fortune of £146m, according to a 2016 estimate in The Times.

He is also rated as one of Britain’s top philanthropists after donating tens of millions to his charity the Resolution Foundation, which promotes social mobility.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout