Grape overproduction and cost of living squeezing the wine sector

One of Australia’s largest family-owned winemakers says inland wine regions are in a bad way as economic pressures and grape overproduction threaten their viability.

Darren De Bortoli, head of one of Australia’s largest family-owned winemakers, says inland wine regions are in the worst shape he has seen in his 40 years of winemaking, as economic pressures and grape overproduction threaten the viability of producers.

Inland wine growing regions such as the Riverina in NSW, Riverland in South Australia and Victoria’s Sunraysia were particularly struggling under the weight of a grape glut, which was forcing down prices.

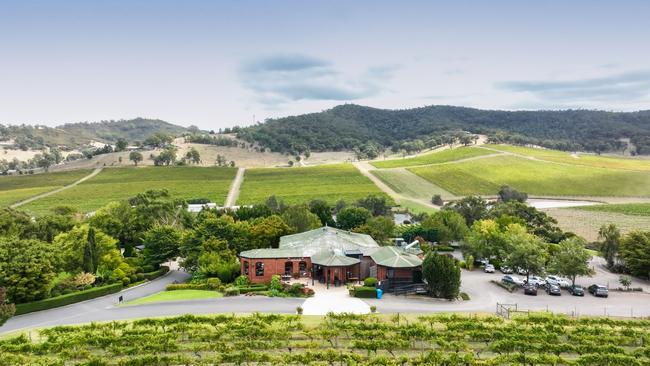

And, while visitors to Mr De Bortoli’s family’s cellar doors and restaurants in the Yarra Valley, Riverina and the Hunter Valley are still flowing, they are spending less on food and leaving with significantly fewer bottles of wine as cost-of-living pressures drain household disposable incomes.

However, a silver lining for the De Bortoli wine group – founded by northern Italian immigrants Vittorio and Giuseppina De Bortoli in 1928 – is the huge demand for its range of lighter-style and Italian wines coming out of Victoria’s King Valley and Yarra Valley, with the winemaker’s prosecco and rose sales increasing at double-digit growth rates.

Some of this success was boosted by the launch of a range of wines in partnership with pop star Kylie Minogue, which included a Yarra Valley pinot that won a number of wine awards.

In 2022 Minogue, through the association with De Bortoli, created a chardonnay and pinot noir made in collaboration with De Bortoli Yarra Valley winemakers Steve Webber and Leanne De Bortoli.

But elsewhere the trading and agricultural landscape remains tough.

Mr De Bortoli said inland winegrowing regions were facing tough conditions.

“In terms of those traditional inland areas, yes,” he told The Australian.

“So the Riverina, Riverland and Sunraysia, those traditional areas that seem to be struggling a bit … and I think for the inland particularly, it’s the oversupply, with the reds especially.

“The industry is in a really tough space and it is the toughest I have seen in my 40 years.”

And Mr De Bortoli doesn’t expect those depressed conditions to improve much over the next year, with the only key source of optimism being a weak Australian dollar, which is helping to support wine exports as well as a possible reopening soon of the Chinese market to Australian wine if punishing tariffs are dismantled.

Latest accounts for De Bortoli show a slight rise in annual sales to $159.86m for 2023, up from $149.79m in 2022, with its losses more than doubling to $9.33m.

The majority of its sales ($130m) were in Australia, while there was a strong uplift in sales to Europe which almost tripled in 2023 to $16.67m. This was countered by slowing exports to the US and British markets.

The accounts show a large leap in costs of goods sold as well as marketing expenses, which combined rose around $16m, and helped contribute to the larger operating loss for the year.

Mr De Bortoli said there were some green shoots of drinkers spending more on wine, but it was still a challenging retail landscape for wine producers.

“We saw the initial buoyancy from getting out of Covid and now we are seeing consumers tighten up again, and from where the economy is heading we are seeing conditions are getting a bit tighter and certainly seeing that in our cellar doors and restaurants,” Mr De Bortoli said.

“Definitely the feedback is the consumer is spending less, as you’d expect in the current economic conditions.”

Mr De Bortoli is holding out hope for the reopening of the Chinese market, with Beijing officials reviewing the 200 per cent-plus tariffs slapped on Australian wine from November 2020.

“China is the big one, if China opens up we might see some normality,” he said.

For De Bortoli, it is finding some shelter from the industry storm from its highly successful push into prosecco and Rosé. According to De Bortoli’s latest annual report, sales of King Valley prosecco and rose were up 29.4 per cent and 36.5 per cent respectively in 2023. In 2022 its prosecco and rose brands posted 11.2 per cent and 26.24 per cent growth, respectively.

The release of its Italian fiano wine, called “Ti Amo”, and a portfolio of reds from Heathcote in Victoria were also proving popular with consumers.

“There is strong demand for King Valley and Yarra Valley as regions. Certainly rose has been strong for a while, prosecco too. I think it is the fashion at the moment,” Mr De Bortoli said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout