The ACCC is investigating the deal and other retailers are expected to object to the combination of what are effectively the only two suppliers in the so-called chilled ready meal market.

Jewel went into liquidation this year after failing to offset the costs of a major expansion and the building of a new facility in the suburb of Banksmeadow, in Sydney’s south.

Chilled prepared meals are popular but they are also expensive to make because unlike frozen or canned foods, it is difficult to ensure they are 100 per cent safe.

Woolworths and Beak & Johnston control B&J, which is trying to buy Jewel from administration.

This would obviously be a perfect solution for the administrators, the KPMG-owned Ferrier Hodgson, because, as the nearest competitor, B&J would pay the highest price.

But the so-called failed company defence from a competitor that buys a rival that is going under rarely wins the day before the ACCC.

It argues that the administrator should look for another buyer.

In this case the Jewel factory is said to be only 60 per cent filled, which is itself an issue because new production is unlikely to enter the market when there is so much spare capacity.

Mere mention of the names Woolworths or Wesfarmers and the ACCC’s ears prick up, which can explain the regulator’s decision to appeal a Federal Court ruling that squashed its attempt to pin a misleading claims label on Woolworths over its sale of a range of “eco-friendly” picnic ware.

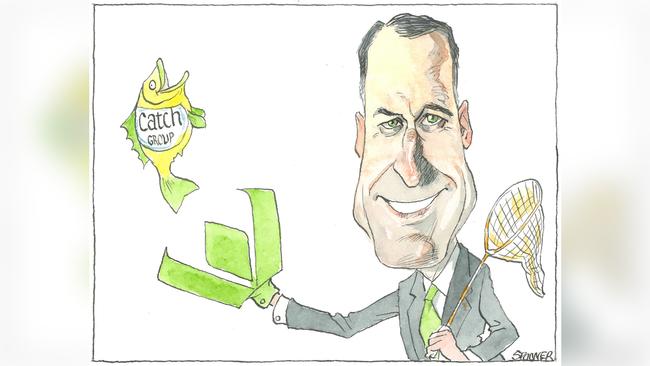

Separately, as expected, the ACCC cleared Wesfarmers’ acquisition of the Catch Group.

The $230m deal by Wesfarmers boss Rob Scott was aimed at improving the conglomerate’s online capability, even if the talent walks out the door each night.

Catch was on the market for some time so Scott was seen as something of a saviour.

The tricky one is the appeal lodged yesterday against the Federal Court’s dismissal of a case the consumer watchdog has lodged against Woolworths over claims about the biodegradability of certain plastic products.

It appears the products are only biodegradable when handled in a very selective matter; if you dump them in your rubbish bin then they have none of the claimed qualities.

The court threw out the case on technical grounds because the question of whether it was compostable would only be decided in the future when the products were being dumped.

The court said the plastic forks and other products were eventually biodegradable, just not in the time frame the ACCC was talking about.

Woolworths was not making future claims so therefore had no case to answer.

That is plainly a nonsense argument that explains why the ACCC is appealing.

In a statement, the ACCC said: “These claims were about future matters and that Woolworths did not have reasonable grounds to make them.

“The trial judge found that the likely performance of Woolworths’ picnic products was not a ‘future matter’ because the reference to ‘biodegradable and compostable’ was about the inherent characteristics of the product rather than a prediction, forecast, promise or opinion of a future event. Accordingly, the court was not required to consider whether Woolworths had reasonable grounds for making the claims.

“The court did, however, find that if Woolworths had made the claims in the terms alleged by the ACCC, it would not have had reasonable grounds to do so.”

The ACCC is not having a great time in the environment sector, as shown by its separate appeal in the Kimberly-Clark flushable wipe case. The ACCC said the claims that the Kleenex Cottonelle wipes were flushable was misleading because they were not. The court had required evidence of harm.

There are some who wonder whether the ACCC has bigger issues to engage in, to which the answer is “of course”, but there are important issues of principle involved. The ACCC is a consumer regulator and if big companies are making false claims about their products, they should be held to account.

All in it together

The ANZ board has taken formal control over the bank’s 40,000-odd staff in a new pay system whereby staff will receive bonuses based on group, rather than individual, performance.

The bank will roll out the new rules to staff today, stating that, apart from the most senior staff, the only variable pay will be a group performance dividend.

This will be set on a range of metrics including customers, people and reputation issues in a framework set by the board.

No decision has yet been made on executive pay, which will be subject to final rules set by APRA.

Under the plan released last month, executives will receive bonuses based at least 50 per cent on non-financial metrics, with no single item like total shareholder returns accounting for more than 25 per cent.

The biggest shareholder complaint about bonuses is not so much about how they are made up but there is no accountability.

ANZ’s Shayne Elliott defended executive bonuses yesterday, saying that his top executives had changed roles completely in the past three years ago and those in the job now were fixing up other people’s mistakes.

Short-term executive bonuses last year were paid at between 60 and 90 per cent of potential despite the full flush of the royal commission playing out.

Elliott received fixed pay totalling $2.1 million and a short-term bonus of $1.75m.

Some suggest the short-term bonus should have been zero.

Elliott is spending this week in New Zealand talking with the Kiwi central bank about proposed capital changes and hosting a series of staff town hall meetings dealing with the fallout of the David Hisco saga.

The former New Zealand boss was forced to forfeit $1.4m in shares following the approval of perks like company chauffeurs and wine storage on top of $644,000 in expat benefits for the New Zealand national.

Hisco has left the bank but the saga could well cost former prime minister John Key his chances of being the bank’s next chairman.

The changes to staff pay are an attempt to simplify arrangements, make them more transparent and increase accountability.

Digital consultation

The federal government has formally given notice of its consultation period on the ACCC’s digital platforms inquiry, with submissions due to be lodged by September 12.

The fast-growing $660 million prepared-meal market is in a state of flux as the country’s top producer, B&J, 23 per cent controlled by Woolworths, tries to take over its nearest competitor, Jewel Fine Foods.