The reason was to bring the case as quickly as possible to counter alleged activity that has already reaped dividends, given Qantas has dropped the deadline for unused ticket claims.

ACCC enforcement boss Liza Carver and chief Gina Cass-Gottlieb are both highly experienced legal practitioners who took the Qantas case in house for speed and more control, which of course also raises the bar against them should they lose the case.

The dream team has so far posted wins at every start, thanks in part to results from past cases.

If past practice is any guide, Qantas would have known about the intended action for the past few weeks, but a flurry of initial section 155 discovery notices focused primarily on the Covid fight closures, not the subsequent company action that is the focus of the coming action.

But the ACCC would have notified Qantas at least a few weeks ago, which in light of the allegations makes it even more surprising the company is happy to let the matter run unchecked.

The ACCC investigation on the issue has been running for up to 12 months.

Given the heinous allegations against Qantas, that it sold tickets on flights it knew would not happen, the ACCC could have repeated the 2004 criminal case against Chubb Security for similar alleged behaviour.

Criminal cases are handled “outside” by the Director of Public Prosecutions.

The Qantas board met on Friday morning to consider the ACCC case and it seems clear it will let the judicial process unwind and take its time to respond.

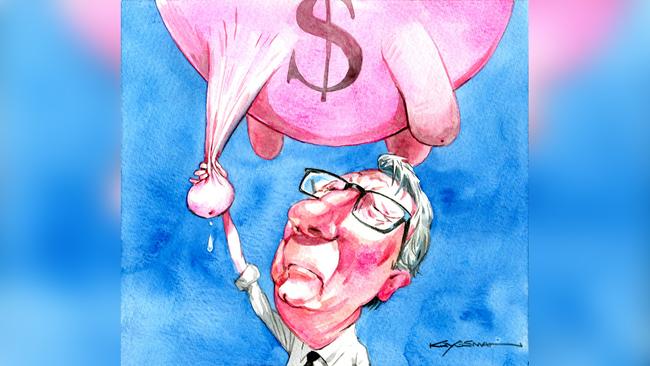

The same day, it was business as usual, issuing a notice showing Alan Joyce will received 1.7 million shares as part of his long-term bonus, as part of a 42.7 million executive retention and long-term bonus plan.

This release comes ahead of next week’s annual report release.

In June this year in the middle of a stock buyback, Joyce sold 2.5 million Qantas shares for $16.9m.

The board has already indicated, before this week’s ACCC press release, that executive bonuses would be down 20 per cent because customer satisfaction numbers failed to hit targets but no other penalty is planned at this stage. Consumer satisfaction accounts for 20 per cent of the bonus.

Joyce is leaving the company with the worst record for consumer complaints to the ACCC, but chair Richard Goyder has already walked this path from his days running Coles when it allegedly engaged in unconscionable conduct against suppliers in 2011. Coles settled before the matter went to court.

Qantas argues its own customer metrics are improving from an albeit low base.

The board is taking the attitude as the case plays out that the best response is won from the ground floor by delivering good service.

The action comes in a big week for the regulator after the landmark penalty against BlueScope and former executive Jason Ellis, in which Federal Court judge Michael O’Bryan specifically banned the use of any company indemnity or insurance to pay Ellis’s $575,000 fine for attempting to establish a steel cartel.

This message would be a wake-up call to company officers and directors around town that if found guilty of a breach of the competition laws, any fine must come out of their own pocket.

The court also fined BlueScope $57.5m for the cartel attempt. The company is considering whether to lodge an unlikely appeal.

Justice O’Bryan also issued a warning to company bosses noting that Ellis’s boss at the time, present BlueScope chief Mark Vassella, should have been alerted to the possibility that the strategies discussed “may have resulted in employees engaging in cartel conduct or attempted conduct”.

He added “there was no evidence that Mr Vassella took any steps to confirm or verify”.

The government also released its consultation for the proposed unfair contracts amendments, which lower the threshold from unconscionable contracts cases.

At the annual Law Council Competition conference in Melbourne this weekend, the ACCC has at least focused talk on its successful enforcement program.

The Competition Tribunal also extended the deadline for its ANZ-Suncorp appeal until February next year.

Deaths at Woolies

Woolworths had two fatalities among its staff last financial year: one a cleaner at a Newcastle area store and another at its Minchinbury distribution centre.

The tragedies highlight a little recognised fact that working in retail stores can be as dangerous as working in a mine site.

Companies report injuries as total recordable injury frequency rates (TRIFR), which are the number of hours lost per one million, and at Woolworths excluding the deaths the figure went up 1.1 hours to 12.24 hours.

By comparison at Bunnings the number went up from 11.3 hours to 16.5, Kmart from 5.5 to 7.2 and at Officeworks it went down from 5.8 to 5.4. At Wesfarmers, chief Rob Scott, CFO Anthony Gianotti and Bunnings boss Mike Schneider all saw bonuses cut 10 per cent because of the increased injury rate at Bunnings.

After two deaths at Woolies, CEO Brad Banducci’s bonus was also cut by 10 per cent.

TRIFIR is a crucial indicator on just how well the company is being run.

Consumer-facing companies across the board are reporting a significant increase in angry consumers post-Covid, but the TRIFR numbers relate to staff rosters, whether there are enough people to handle work, safe equipment and training on lifting and handling.

Dairy price gap

The Australian dairy processing industry is at a crisis point with an unsustainable gap between the price paid to farmers of $9.20 per kilogram of milk solids, or 70c a litre, and the New Zealand price of $6.20 a kilogram.

The extraordinary price gap means dairy products like cheese from across the ditch will flood the Australian market and processors will be unable to match New Zealand-based Fonterra’s export price for commodity products such as milk powder.

On September 14, the ACCC will decide whether Coles can formally assume control of two Saputo milk processing plants, which will undoubtedly help increase the supermarket giant’s share of the market milk sector in Australia.

Dairy farmers are backing Coles because it pays the highest farmgate prices in Australia to guarantee a slice of the dwindling local supply, with production now at around eight billion litres a year, against a near-term peak of 12 billion litres. Farmers are also enjoying lower fertiliser prices, which soared by a factor of 2½ times at the start of the Ukraine war from $90 a tonne, and post-Covid more available labour.

The industry is split on what the ACCC should do, with most saying Coles effectively runs the Saputo processing plants in Melbourne and Sydney now, so there is no effective change.

But in the longer term, Coles will get increased control because it paid the farmers on the spot for their milk but pays the processors in two months for their product.

If there is to be a rationalisation of the processing market, Bega’s Barry Irvin will have a battle winning shareholder support for more acquisitions. His last capital raising for the $534m Lion Dairy deal in 2020 was at $4.60 a share and the price is $2.99 a share.

The ACCC chose to use its consumer law powers against Qantas rather than a criminal case in pursuit of speed to trial and hopefully a $250m-plus penalty if successful as a deterrence to other companies.