In its annual telecommunications review released on Tuesday, the ACCC draws its line in the sand, saying it “would be concerned if NBN’s revenue growth undermined the key policy intent of the NBN to provide affordable high speed broadband to all Australians”.

The warning comes as the report underlines a 47 per cent increase in data downloads last year, with streaming services including Kayo and Netflix accounting for 88 per cent of all downloads.

Importantly, those relying just on mobile have fallen from 23 per cent five years ago to 16 per cent last year. Meanwhile, unlimited data plans have risen from 6 per cent to 19 per cent over the period.

The report comes ahead of next month’s landmark ruling from Justice John Middleton that is widely expected to overturn the ACCC’s rejection of the Vodafone-TPG merger.

The growth of the NBN has hardly dented Telstra’s NBN service market share, which fell last year to 49 per cent, from 51 per cent. TPG was next at 22 per cent, down from 24 per cent.

The likes of Aussie Broadband are edging up at 5 per cent, but when you consider Telstra has 55 per cent of fixed wireless and 41 per cent of mobile, its stranglehold on industry profits is unshaken and boosted by billions of dollars in taxpayer payments for its fixed-line business.

The ongoing revolution in the industry continues, led by data, but the industry structure remains intact with the obvious exception of the NBN.

The ACCC regards monopoly infrastructure providers with natural suspicion, which explains why it will jump every time NBN boss Stephen Rue lifts his arm inappropriately.

Trivago and beyond

As noted in Tuesday’s column, the lesson from the Trivago case is that consumers were led to believe the placing of hotel prices was for their benefit, when in fact it was found to be for Trivago’s purposes.

Trivago earns money from clicks on its websites and the hotels paid different rates that determined which room rates were put where.

To underline the point, the comparison service compared standard rooms with luxury suites just to really confuse matters.

The impression created was that Trivago was showcasing the lowest available rates — but its tactics were found to be deceptive and misleading.

The delay in the release of Justice Mark Moshinsky’s decision was caused by his caution at releasing confidential information and Trivago’s paranoia about a competitor getting a view of its famed algorithms.

Given the clear-cut case against the Germany-based company, interest now lies in the penalty as the offences date to back before, as well as after, changes to the penalty regime.

The ruling may also be considered in other cases, given Google and others have argued that consumers should be well aware of their privacy policies.

In Google’s case, the ACCC found that excluding the links to a separate web page, it would take 20 minutes to read the privacy policy and is said to require a university degree to understand it.

Google admitted that just 0.03 per cent of users spend more than 10 minutes looking at the policy, which makes you wonder about the validity of its defence.

The Trivago case, it should be noted, involved some heavy hitters, with Norman O’Bryan for the ACCC and Neil Young QC for Trivago.

Back to packaging

Back in 2015, Pact chairman Ruffy Geminder figured so-called contract manufacturing was a fragmented market and an ideal roll-up candidate where he could build a base to supply his packaging customers.

The business is now up for sale through Citicorp, with Geminder figuring that while the roll-up opportunity is still there, someone else is better able to pull it off.

This follows a review of the company by Port Jackson Partners that argued Pact is a packaging and recycling company, and that’s where its focus should be.

The manufacturing business worked in part on the theory that Pact was selling the little bottles, so why not supply the vitamins and shampoo, etc, that fill them?

The business, with revenues of about $372m and earnings before interest, tax, depreciation and amortisation of $25m, supplies house brand shampoo and other personal care products to Aldi, Woolworths and Coles. Rivals include the branded goods suppliers.

The market liked the sign of renewed focus, with the stock lifting as much as 5.6 per cent during Tuesday’s session to $2.84, or back to levels last seen in August, after which the stock had fallen as low as $2.22.

Judo throws a few

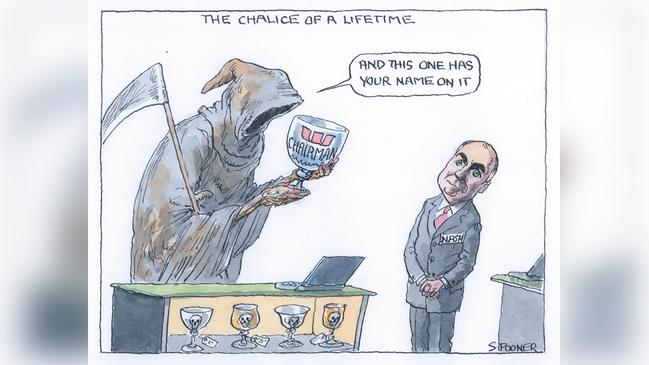

As the Westpac board prepares to decide on its next chairman, upstart bank Judo has hit the ground running with $1bn in deposits after just nine months of operation.

Judo Bank co-chief Joseph Healy is confident of raking in at least $3bn by this time next year, which would be a good base to grow the business. The bank, which is devoted to small business loans, already has more than $1bn in loans outstanding.

Judo’s deposit take is tiny compared to the majors, with National Australia Bank, for example, having $424bn in customer deposits. ANZ has about $64bn in commercial deposits, with roughly $43bn classed as small business. Its small business loan book is $15bn.

Judo has raised the money by paying above market with its six-month deposit rate at 1.95 per cent, compared with the big banks at 1.25 per cent.

Healy said the big banks have had 150 years to build their bases and Judo just nine months. So its rate of growth, which is important, and Tuesday’s figures, show it is getting traction. About 40 per cent of the deposit base is retail.

Importantly, the milestones show the bank has gained market credibility at a time when the big banks are suffering.

The Melbourne-based Judo has about 165 staff, with offices in Sydney and Brisbane, and plans to open in Perth in coming months.

Meanwhile, Westpac’s board is still in the early days of its hunt for a chairman to replace Lindsay Maxsted, with his former KPMG colleague, Peter Nash, the obvious internal candidate given his background covering the industry.

The board will also look externally and the process is said to be a matter of weeks away.

The chairman will be settled before a new chief executive is selected to replace Brian Hartzer.

Former CFO Peter King has agreed to stay until a successor is found and is also the key internal candidate for the job.

Bessell on the market

IAG veteran Ben Bessell is leaving the firm after working on a restructure of the insurance company that eventually saw him report to Australian boss Mark Milliner.

The 27-year veteran is expected to be snapped up by a rival company after a long career through CGU and a range of commercial insurance roles.

A battle is looming large between the competition regulator and the NBN as the government-owned carrier nears the end of its rollout and moves to upgrade its services.