A $5.6m payment could put paid to a controversial management structure at Beston

A management agreement which paid two of Beston’s directors about $2m a year is set to be shelved, with the help of a $5.6 termination payment.

Beston Global Food Company will pay its chairman and a director $5.6 million in cash and shares to buy them out of a controversial management agreement - however a pending annual meeting may be a fly in the ointment.

Adelaide-based Beston has never turned a profit since listing in 2015, and was this year facing a possible second strike at its recent annual meeting after a thumping 64.9 per cent vote against its remuneration report last year.

This year’s meeting, scheduled to be held last month, was shaping up to be an interesting affair, with dissident shareholder Kunteng, which owns more than 10 per cent of the company, vying for a seat on the board.

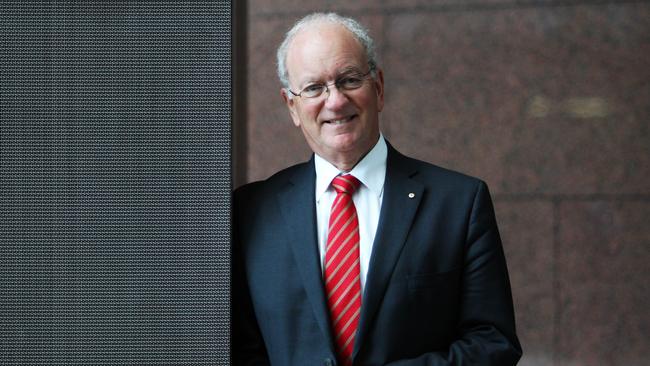

But chairman Roger Sexton shut the meeting down after 70 seconds, saying the board needed to get legal advice about “possible voting associations in the proxies’’.

The company’s independent directors have also this year been examining how to unpick the management agreement which has existed since the company listed, which pays Dr Sexton and fellow director Stephen Gerlach about $2 million a year, through their company Beston Pacific Asset Management (BPAM), to manage the company and advise on investment decisions.

Senior staff such as the chief executive are remunerated via BPAM, which is paid based on a management fee calculated as 1.2 per cent of the value of Beston’s portfolio of assets.

For 2019-20 BPAM was paid $2.13 million, putting the portfolio value at $178 million.

This compares with the current market capitalisation of the company of $51.82 million.

The independent directors of the company earlier this year decided against terminating the management agreement, however a statement to the ASX on Friday says an agreement has been struck to terminate it in August 2021, for $1.13 million in cash and 21.1 million shares with an implied value of 21c.

The termination will need to be ratified at an extraordinary general meeting in May.

This could be problematic, as the replacement annual meeting required under the Corporations Act must be held within two months of the aborted AGM, meaning it must be held before the end of January. The threat of a second strike vote and possible spill vote remains a live issue.

The BPAM agreement will not be terminated until 90 days after the May meeting, should it go ahead, meaning BPAM will be paid for this financial year.

Beston earlier this week announced two of its board members would be replaced, with Cathy Cooper stepping down and Jim Kouts withdrawing his nomination for re-election.

Beston said “the board changes being announced are not related in any way to the current corporate disagreements with Chinese shareholder Kunteng, or to the matters which have been referred to Australian regulatory authorities, but are a part of the normal board renewal program’’.

The Advertiser attempted to contact Dr Sexton. Beston shares close 4.6 per cent higher at 9c.