$8.6bn bid ‘undervalues’ Caltex

Major shareholders have told Caltex’s board a $8.6bn bid from Canada’s Couche-Tard significantly undervalues the company.

Major shareholders have told Caltex’s board a $8.6bn bid from Canada’s Couche-Tard significantly undervalues the company, piling pressure on the fuels retailer to reject the offer in the coming days.

Two of Caltex’s biggest investors — the $9bn fund giant Investors Mutual and $7bn Airlie Funds Management — backed the decision of chairman Steven Gregg to deliberate over the $34.50 a share offer but said they held price concerns.

“The price is not a bad starting point but we see a valuation somewhere between $38 and $40 a share as the sort of level you would want to look at,” Investors Mutual founder Anton Tagliaferro told The Australian.

Caltex phoned major shareholders on Tuesday and Wednesday to gauge their initial reaction to the takeover tilt after it had earlier rejected a $32 a share offer. It also sought investors’ opinions of its own $1bn spin-off of its petrol sites announced on Monday.

“They phoned major shareholders yesterday to find out views but didn’t offer their own opinion,” Mr Tagliaferro said.

Airlie Funds Management said the current price undervalued the company.

“It’s a very asset heavy business that we’ve felt has been undervalued for a number of years,” Airlie portfolio manager Matt Williams said.

“If value gets unlocked either way — via this approach or via Caltex management themselves which were on a path to doing that — we think that’s good.”

Caltex this week revealed plans to embark on a $1bn property sharemarket float containing a half stake in 250 retail sites as it seeks to tap shareholders chasing yield amid a backdrop of low global interest rates. Couche-Tard plans to axe the spin-off should it prevail with its takeover, raising doubts over momentum for the initial public offering.

Investors Mutual said it had been actively lobbying Caltex management to pursue the IPO for the last few years.

“We’ve thought Caltex could lighten its load in property and see that strategy as a good deal,” Mr Tagliaferro said.

Part of Couche-Tard’s pitch for the Caltex deal is unlocking $830m of franking credits with plans to pay a special dividend of up to $8.41 a share to release the credits with the potential to boost the deal value by up to $3.61 per share. Airlie said that could form an extra incentive for the deal.

“If a deal does come to pass, the Caltex board will make the franking credits part of the whole process. That’s the cherry on the top if you like and goes to why we’ve felt the business is undervalued,” Mr Williams said.

Analysts expect a bid hike will be needed to win over investors.

“We think Couche-Tard need to bump its offer by $2-plus to win board approval,” CLSA analyst Daniel Butcher said.

The suitor can justify paying significantly more than its current offer, with a $38-plus a share bid achievable based on Couche-Tard making an earnings increase in Caltex’s convenience retail business, which has underperformed in recent years.

Caltex should reject the $34.50 offer which feels too low, MST Marquee said.

“With a history of a -10 per cent earnings compound annual growth rate, it is a better business than the average Australian industrial, yet on the average Australian industrial’s multiple you are at $41 a share. The board needs to be strong,” MST analyst Mark Samter said.

Still, a deal is more likely than not to proceed given a significant premium to pre-proposal trading and the absence of obvious red flags in terms of competition concerns, Credit Suisse said.

“The probability of a transaction proceeding rests primarily with the willingness of Caltex to engage,” the broker said.

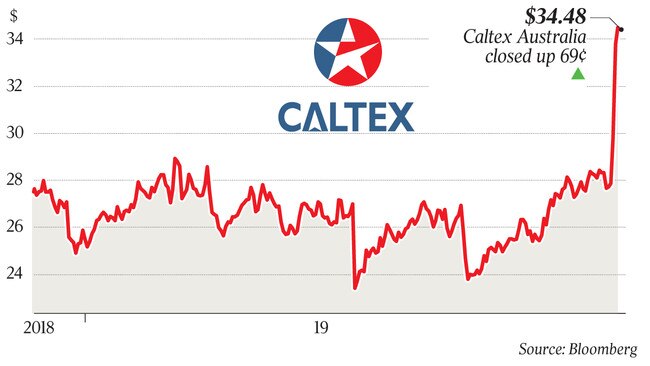

Caltex shares rose 2.04 per cent to close at $34.48.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout