$4bn Transurban raise to fund WestConnex toll-road buy

Transport giant Transurban says a $4.2bn equity raising to fund its share of Sydney’s WestConnex is within normal limits.

Transport giant Transurban has defended the size of a $4.2 billion equity raising to fund its share of Sydney’s WestConnex motorway as within its usual deal parameters, with Australia’s biggest toll road deal set to double its toll network in Sydney.

Transurban and its consortium partners — AustralianSuper, the Canada Pension Plan Investment Board and the Abu Dhabi Investment Authority sovereign wealth fund — will pay $9.26bn for a 51 per cent stake in WestConnex to beat a rival bid led by infrastructure heavyweight IFM Investors.

Transurban won critical clearances from the competition regulator for the deal on Thursday after agreeing to share toll data with its competitors.

Transurban will raise $4.2bn through a rights issue and a further $600m through a placement to its partners AustralianSuper and ADIA, marking a much larger raising than the $3bn the market had been expecting.

It will fund the 33km motorway initially with equity rather than debt upfront before releasing funds as construction of the remaining stages is completed and cash flows start to build.

“We don’t take anything for granted and we understand the scale and size of what we’re asking of our investors, and we believe we will deliver the outcomes we’ve been discussing,” Transurban chief executive Scott Charlton said yesterday. “So far all the discussions have been quite positive with our investors.”

Transurban, which still needs approval from the Foreign Investment Review Board, has retained the commitment made at its full-year results to pay a 59c a share dividend for the 2019 fiscal year compared with 56c for the previous year.

Transurban shareholder Vertium Asset Management said the equity structure of the deal made sense given the deal ran over a 42-year concession, although its success would depend on the level of cash flows, which are not due to start until the 2028 financial year.

“It really comes down to have they bought well and on the surface it seems OK,” Vertium chief investment officer Jason Teh said. “They’ve used their financial prowess and bought this asset quite well.”

The NSW government will own the other 49 per cent of WestConnex and must offer the stake to the Transurban consortium first should it decide to sell its share once construction completes.

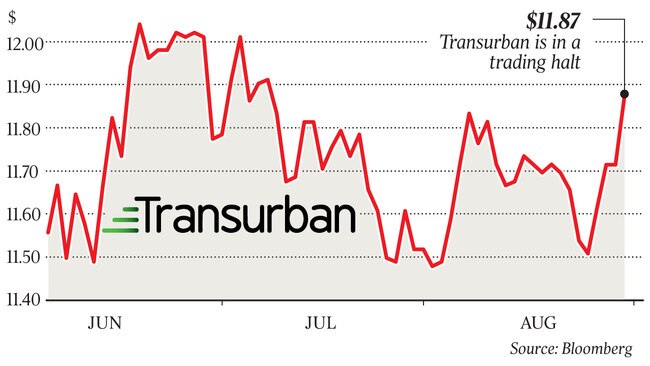

Transurban shares, which last traded at $12.06 on Thursday, will remain in a trading halt until Wednesday as institutions take part in the rights offer with shares being offered at $10.80 each.

The overall $9.3bn being paid to the NSW government will be split four ways with Transurban paying $4.1bn for its 50 per cent stake. AustralianSuper and Canada Pension Plan Investment Board will tip in $1.7bn each for their respective 20.5 per cent holdings and ADIA $700m for 9 per cent. Some $1.1bn of additional debt raised by the consortium will round out the purchase price.

Transurban’s dominance of toll roads — it runs seven of the state’s nine toll road concessions and 15 of 19 nation-wide — had raised concerns it would fail to get competition clearance from the Australian Competition & Consumer Commission.

However, a deal to share traffic data with its rivals satisfied the ACCC that others could successfully compete for new toll road concessions, with the regulator’s chairman Rod Sims saying the company’s scale was not a competition problem.

The deal is the latest plank in the NSW government’s $40bn privatisation scheme. Treasurer Dominic Perrottet will use the proceeds to fund the M4-M5 final stage of WestConnex and future infrastructure across the state.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout