Billion-dollar postcode paying its way

Analysis shows Sydney’s 2088 paid a staggering $400m more than the next-highest postcode in income tax a year | TABLES

When Bill Shorten revived the politics of an income class war this week, it was the residents of Sydney’s 2088, the nation’s only postcode paying more than $1 billion in income tax a year, that he had in his sights.

Mosman and its surrounding harbourside suburbs contributed more than $1.1bn in government revenue in one year alone, a staggering $400 million more than the next-highest postcode.

Analysis by The Weekend Australian of 2014-15 Australian Taxation Office data, released last month, shows 2088 is the ultimate “lifter” postcode, with residents paying the equivalent of one-sixth of the four-year cost of the government’s new levy on the five biggest banks — or covering the cost of the dole payments for 79,079 single unemployed people in one year.

While postcode 2088 poured more than $1.1bn in income tax into government coffers, the next-biggest total was $729.5m for the residents of 4680 in Queensland, centred on the mining port of Gladstone. By comparison with the 15,620 taxpayers of 2088, the 15,710 taxpayers in postcode 6260, based around Morley in Perth, paid $240.5m in income tax.

These are matters of demography and access to education and jobs, but the data throws into relief the two sides of a coming battle over income tax.

The Coalition has proposed a half-percentage-point hike in the Medicare Levy in 2019 to fully fund the $22 billion National Disability Insurance Scheme while taking the deficit tax off.

The Opposition Leader, in his budget reply speech, revealed he wanted to keep both levies, applying the Medicare hike to earners in the top two income tax brackets.

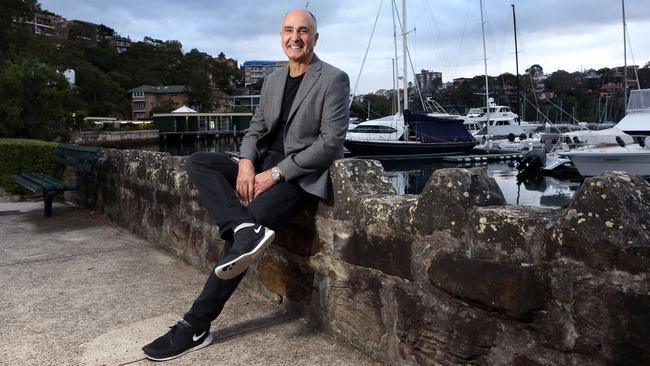

Retired businessman and part-time investor Ed Smouha, a Mosman resident, bristles at the idea of a 49.5 per cent top tax rate as proposed by Mr Shorten.

“It just feels like we’re all getting slugged more for income tax, either directly or indirectly,” Mr Smouha said yesterday. “Now see, I’m happy to pay my bit, but I disagree entirely with a top rate of 49.5 per cent. Look at what happened with those vocational training colleges (rorts) and problems with the welfare system.

“Are they spending it properly? No. The hardest part of course is balancing how to help people who need it the most without spending other people’s tax dollars on those who don’t deserve it.”

With the Coalition proposing a 0.5 percentage-point rise in the Medicare Levy from 2019, residents of 2088 will be hit the hardest, having collectively paid about $60m through the levy in 2014-15.

Down by Balmoral Beach, former accountant Zrinka Lovrencic, now a management consultant, is used to being “worse off” every budget, but she wants to pay her way, and society’s.

Ms Lovrencic, who also lives in postcode 2088 and runs Great Place to Work, said Mosman was clean, virtually crime-free and when people needed to get around “they can afford an Uber”.

“At the end of the day of course I am happy to contribute to the NDIS,” she said.

“As a single-income household with no kids and a mid-sized business, I don’t get any tax breaks, just a hike each year. However, in general I do feel we have an obligation to leave a better place for future generations.

“So even though every budget I end up worse off, what bothers me is when spending isn’t targeted at safeguarding the future.

“I take issue with the big company tax cuts. I have been around business and finance for a while and I know it does not trickle down.”

Mr Smouha wondered why the rich-list suburbs of Point Piper and Vaucluse on the other side of the harbour didn’t eclipse Mosman’s heroic contribution to income tax.

“They must be better at minimising their tax over there,” he said. “Whenever I get my tax return and it gives you the little coloured graph about what you’re paying for, I always think to myself ‘my God, I am paying a lot of money’, but that’s the system.”

For the record, the tax take in Vaucluse’s 2030 postcode was $704m and Point Piper’s 2027 was $447.2m, but both had far fewer taxpayers. Bondi’s 2026 hit almost $600m.

In Melbourne, postcode 3186 centred on Brighton was the highest-ranking in Victoria, with an income tax take just shy of $700m but $13.5m more than residents of Toorak’s 3142 paid.

The tax data is from two financial years ago but Mr Smouha is confident things are still on the up in Mosman.

“We’ve got our fair share of Porsches and Ferraris and a few Teslas have also started appearing. I counted three in the past few months,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout