Budget 2016 Live Coverage: The reaction

The super industry warns of carnage for the self-managed sector after being caught out unaware by the budget.

- ‘Budget gives young people a go’

- What MPs think of budget

- ‘Great budget for millionaires’

- Morrison defends 10-year tax plan

- PM keeping quiet on election call

- Super cuts ‘appropriate’

- Hard sell begins for Treasurer

BUDGET 2016: Follow live reaction the day after Scott Morrison handed down his first budget. What do you think? Tell us in the comments section below.

6.05pm:Bishop asked to resign to protect Abbott

Philip Ruddock said goodbye to the Federal Parliament yesterday and Bronwyn Bishop quietly said her farewells today.

The former speaker revealed she was asked to resign to protect former prime minister Tony Abbott. Delivering her final speech to the parliament, Mrs Bishop said her “moving” time as Speaker came to end when she resigned to protect the man she’d worked with and respected for many years. “There is much more than meets the eye in that saga. But not for now,” she told parliament.

5.45pm:Budget revenue raising limited: Moody’s

Global ratings agency Moody’s Investors Service says there were “no significant surprises” in terms of revenue measures revealed by Treasurer Scott Morrison in the Federal Budget, and is forecasting larger budget deficits and lower future revenues than the government is anticipating.

Speaking to The Australian after yesterday’s budget was handed down, Moody’s senior vice president Marie Diron — who authored last month’s warning that Australia’s triple-AAA credit rating was under threat thanks to a lack of revenue measures flagged by Mr Morrison ahead of the May budget — said the measures aimed at increasing government income were “relatively limited”.

5.20pm:Putting Australia’s economy into gear

The budget, of course, wasn’t the only big financial story to drop yesterday. BusinessNow editor Chris Kohler explains how historic rates and the ANZ’s decicision to cut its dividend tell you everything you need to know about where the Australian economy is going.

4.55pm:Palmer’s farewell

Clive Palmer has left open a run for the Senate after announcing he would not stand again for his federal seat of Fairfax. And Mr Palmer cited ‘stopping the 2014 budget’ as one of his great acheievements.

“I believe I have the courage today to leave the House of Representatives, satisfied with what Palmer United Party has done and knowing it would have been a different Australia if we hadn’t stopped the 2014 budget and the Newman government in Queensland,” said Mr Palmer, who added of the Senate ‘that’s where the action is’.

During his speech to parliament, coalition MP Ewen Jones - who represents the Queensland Nickel-based city of Townsville - heckled Mr Palmer and held up a sign which read: “Where is QNI workers’ money, Clive?” Mr Palmer insisted he personally offered millions of dollars to keep the refinery open, but the offer had been rejected.

4.25pm:Alternative ways to accumulate wealth

The changes to super certainly the big talking point on The Australian online today and Clearview chief executive Simon Swanson says Australians looking to “accumulate wealth” will start looking at other strategies outside of superannuation.

He said the changes would mean middle and higher income people would look at other forms of investment, including putting more money through small businesses and looking at products such as insurance bonds.

3.50pm:Who won Budget Question Time?

Malcolm Turnbull and Scott Morrison have faced their first Question Time since handing down the budget and political correspondent David Crowe reckons it has been a show of strength from the government.

“Turnbull and Morrison now have an economic plan to fight for and went on the attack at every opportunity.”

You can read the five key points we learned from Question Time HERE.

3.15pm:Super industry digests changes

Last night’s budget changes will “send shock waves” through the self-managed superannuation sector, and “severely reduce the ability of people to save for retirement,” chief executive of the Self Managed Super Fund Association, Andrea Slattery has warned.

Accounts and financial planners this morning were sending out advisories to clients who are only just beginning to real the full extent of the Budget changes.

Ms Slattery said the changes had been announced at a time when the self managed super sector “was hoping the broad parameters of the system had been settled.”

You can read Glenda Korporaal’s full report HERE and check out James Kirby’s reaction to super changes below.

2.48pm:Bowen questions 10-year plan

Opposition treasury spokesman Chris Bowen asks the first question from the Labor benches on the budget, focusing on the government’s plan to cut business taxes. “My question is to the Treasurer. The budget states that the enterprise tax plan will be phased in over 10 years, but the Budget fails to outline a 10-year cost … what is the 10-year cost of your 10-year plan?” He is persisting with this question.

Scott Morrison points out the budget is over the forward estimates, not 10 years. (This hasn’t stopped the government from estimating the revenue collected from a 12.5 per cent tobacco excise over a decade - $28.2 billion.)

Despite props not being allowed during question time, the Treasurer pulls out Mr Bowen’s book Hearts and Minds and reads it to the chamber. “It says ‘promoting growth through cutting company tax’, Mr Speaker. That is what it says!

“We don’t need to have the lowest corporate tax rate in the world. We do, however, need to be concerned if our company tax rate is on the higher side of the world’s advanced economies. While 30 per cent sounds low, compared to the rate that Paul Keating inherited, it is how the rate compares to those of our competitors to what counts.”

The 10-year costing is ignored.

2.10pm:PM, Morrison pressed in question time

Bill Shorten kicks off question time asking Malcolm Turnbull about his housing advice to ABC radio host Jon Faine. “I quote: ‘Well you should shell out for them. You should support them. A wealthy man like you.’” Is that really the Prime Minister’s advice for young Australians struggling to buy their first home? Have rich parents?”

The PM doesn’t go near the question, instead accusing Labor of misleading young Australians about the impacts of its negative gearing policy.

There’s a theme developing in the Opposition Leader’s line of questioning. “Can the Prime Minister confirm that in the past two weeks his advice to young Australians struggling to buy their first home is to have rich parents or to have parents who but you a home when you turn one? Prime Minister, just how out of touch are you?” He’s referring here to a family whose home Mr Turnbull visited to announce the government would not touch negative gearing.

The PM is apparently unimpressed he hasn’t received a question on the budget from the opposition.

“There has never been an opposition that has surrendered so totally to a budget as this one,” Mr Turnbull declares. “Here we are, the day after the budget, and not yet one question on the budget itself.”

The budget again takes a back seat when Greens MP Adam Bandt questions Immigration Minister Peter Dutton about the two asylum-seekers on Nauru who have set themselves on fire in the past week.

“Will you finally accept the consequences of putting desperate people in a situation even worse than the trauma they are fleeing? Minister, aren’t you just showing pure cowardice by blaming the advocates helping the vulnerable, instead of accepting responsibility for your actions? Can’t we do better than this Labor-Liberal policy of not drowning, but burning?”

The last part of the question is ruled out of honour, as MPs on both side show their distaste for the “deeply offensive” suggestion.

Mr Dutton responds: “I am sure I speak for all honourable members and, in fact, for every Australian when I say we don’t want to see people self-harming, not in our country, we don’t want to see them self-harming on Nauru or Manus or anywhere else. Equally, though, Australians don’t want to see people drowning at sea.”

2.08pm:Concerns over ‘$4-hour’ internships

Under the plan unveiled in last night’s budget, young unemployed people can get a $200 top-up to their fortnightly welfare payment if they participate in a business-led internship program.

While the measure has been cautiously backed by social services groups, unions have slammed it as a “$4 an hour” US-style internship program.

They dismissed it as “breadcrumbs” to deal with the nation’s major youth unemployment problem.

“(It) amounts to a taxpayer-funded youth exploitation scheme,” ACTU secretary Dave Oliver said.

2.00pm:‘Liberals hate pensioners’

In response to the budget, Tasmanian independent Senator Jacqui Lambie calls for the Liberals to halve Australia’s ten year Foreign Aid Budget and boost the Aged Pension.

1.05pm:‘Negative result for tourism’

Backpackers heading Down Under will flee to New Zealand to work instead of Australia after the government held onto the backpacker tax in its budget, the tourism industry has warned.

The sector is bitterly disappointed that the Turnbull government has upheld the hefty income tax for people on working holidays. “This budget locks in a tax which will deliver a negative result for Australia’s tourism industry and which will drive our backpacker visitors into the arms of our New Zealand competitors,” Australian Tourism Export Council managing director Peter Shelley said on Tuesday.

National Tourism Council manager Steve Whan echoed his concerns. “We’re very disappointed by this failure to revise the tax, which we’re concerned will hurt labour supply in regional areas,” he told AAP.

The tax, due to kick in on July 1, will see tourists slugged 32.5 per cent from the first dollar earned.

1.00pm:‘Budget gives young people a go’

Scott Morrison has used the story of a struggling young Sydney man to pitch the merits of his first budget.

Mr Morrison told the National Press Club in Canberra today that the unnamed man had been homeless, in trouble with the police and not completed school.

But the Project Youth organisation in Miranda - in the treasurer’s electorate of Cook - had linked the man with a local small business, helped him get a driver’s licence and he now works full-time with the business.

“Small business, growing, backing young people, giving them a chance - everybody wins,” Mr Morrison said.

Mr Morrison welcomed the cut in interest rates announced by the Reserve Bank just before his budget was delivered yesterday. “Yesterday’s 25 basis-point cut in the cash rate to address recent inflation outcomes is to be welcomed as it will further support our economic transition, including support in the near term for consumer spending, housing investment and exports,” he said. The government was upbeat about the economy.

“But we are very mindful that around the country this transition is being felt more acutely in some places and by people in some occupations and some industries more than others,” Mr Morrison said.

The treasurer was cautious about returning the budget to balance in 2021, saying the figures were “just projections”.

“I’m not placing any more on that than what I have just said - they are just projections and how those projections turn out in the years ahead will depend on how we continue to perform as a nation,” he said.

Mr Morrison said one in eight children under the age of 15 were growing up in the family where no one had a job.

“The country can’t afford that,” he said.

“But we need to try new things.” The Jobs PaTH program outlined in the budget - to provide training, internships and wage subsidies - would spearhead the government’s plan in this area, the treasurer said.

12.56pm:Stocks will be hit by super changes

Surprise changes to Australia’s superannuation system revealed in the budget are bad news for the million Australians who self-manage their super funds and will likely hit stock values on the local sharemarket, says respected Credit Suisse analyst Hasan Tevfik. Read the full story here.

12.52pm:‘Budget just a bandaid’

Barnaby Joyce’s independent predecessor and election rival Tony Windsor says the budget is “short term in nature” and designed to set up the government’s election campaign. “This is only a funding bandaid to get past the election,” he says. But he’s not entirely dismissive of the document. While he’s unhappy about the “little mention of improving the standard of the National Broadband Network”, for example, he likes the training and internship program that he says will encourage those aged over 65 to “play a productive rule”. “To that end, I am volunteering to re-enter the political workforce,” he reminds us.

12.51pm:Smoking for a nation

“On a quick flick through the Budget papers I can see I am going to have to smoke a lot more,” writes The Australian’s Jack the Insider, as Scott Morrison’s first budget gets tough on smokers. Read the full story here.

12.34pm:‘A very sneaky budget’

Deputy Greens leader Larissa Waters said it was “actually a very sneaky budget”.

“They’re keeping most of that awful 2014 budget but they’re trying to repackage it. It’s clearly a budget that benefits the big end of town and forgets about ordinary Australians and the environment and does absolutely nothing to tackle climate change,” she said.

Australian Motoring Enthusiast Party senator Ricky Muir, who is more likely to lose his seat under new Senate voting changes, said the nation should prepare to hear the word “mandate” a lot.

“This budget is their policy document. I suspect that they would expect everything that’s in it to be passed and the word ‘mandate’ will be thrown around at an incredible rate if they were to be re-elected,” he told ABC radio.

12.30pm:‘First-time buyers failed’

The federal budget has failed homeless people, struggling first home buyers and renters, a South Australian social services group says.

AnglicareSA chief executive Peter Sandeman says the internship program unveiled in the federal budget, which aims to help 120,000 young people currently on the dole, is a welcome change to the government’s unemployment strategy.

But there is nothing to help the state’s homeless population or ease the housing affordability crisis, with Reverend Sandeman saying less than five per cent of Australia’s rental properties being within reach of families on income support.

“The budget’s failure to address our growing housing crisis highlights the continued lack of planning and action to increase levels of affordable housing stock for low-income households,” he said today.

12.25pm:The NT ‘got nothing’

The Northern Territory “got nothing” in the federal budget, says a Labor politician.

Luke Gosling is Labor’s candidate for the federal seat of Solomon and was very unhappy with Scott Morrison’s first budget: “We got nothing in the territory,” he told Mix 104.9 radio today.

“We literally got nothing in the way of infrastructure, in the way of education cuts being restored, there was only a tiny amount there.

“The Liberals ripped out $309 million from territory schools over the forward estimates and what, they just put back $40 million of that, and they want congratulations for that?” Mr Gosling said the $77 million earmarked for roads would pay for only 77km of roads, and criticised the federal government for its lack of direction on developing the north, the subject of a much-touted white paper released by former Prime Minister Tony Abbott last year.

12.24pm:Disability cut ‘robs’ people

Australians set to be cut out of the disability support pension will lose $170 a week and risk becoming homeless under a new budget measure, advocates warn.

The federal government will pay for funds to lock-in savings for the national disability insurance scheme by shifting thousands from the more generous welfare payment and onto unemployment benefits. “It’s robbing Peter to pay Paul ... those people are potentially spiralling into crisis and homelessness,” People with Disability Australia chief Craig Wallace told reporters in Canberra on Wednesday.

12.23pm:‘A treading water budget’

Popular independent South Australian senator Nick Xenophon has labelled the Turnbull government’s first major economic blueprint a “treading water budget”.

“The government actually wants us to forget about this budget by this time next week,” he tells ABC radio. “They don’t want to campaign on the budget, this is bland after the shock of two years ago where we’re still talking about the 2014 budget and the broken promises and the potential damage it could’ve done if it was passed. I think the government wants us to forget about it, focus on the electioneering.”

11.33am:‘Whyalla doesn’t need cash splash’

South Australia’s struggling steel making town of Whyalla doesn’t need a cash splash, federal Treasurer Scott Morrison says on the back of a budget that sidestepped troubled steel and mining group Arrium completely.

“What people in Whyalla and places like that don’t need is a treasurer to get up at a budget and splash a whole lot of money around and put up taxes to try and pay for it,” he told Adelaide’s 5AA radio on Wednesday.

Mr Morrison said putting $50 billion towards a 1280km section of rail line between Tarcoola and West Kalgoorlie was the most practical thing the government could have done for Arrium.

11.24am:Morrison is a ‘unicorn farmer’

Labor MP Ed Husic has described Scott Morrison as a “unicorn farmer”. That’s right, a unicorn farmer. What is he on about?

In February the Treasurer promised not to “sell the public a unicorn” on the prospects for swift budget repair. Since then, Labor has taken up the phrase and used it to ridicule Mr Morrison.

In the latest instalment, Mr Husic says one of the weird things about the 2016 budget was “an attempt by the government to define that a small business could earn up to a billion dollars”.

Under changes in the budget the lower tax rate of 27.5 per cent for small businesses will be extended to all businesses by 2023-24, before gliding down to an across-the-board rate of 25 per cent in 2026-27. Labor says this measure means the government has redefined a small business as a big business.

Later in his press conference, Mr Husic continued: “In start-up land, a start-up that gets to a billion dollars is actually described as a ‘unicorn’. Scott Morrison has become the unicorn farmer of this budget by basically redefining what a small business is – creating a big business into a small one to make it a unicorn that earns a billion dollars. Like I said, it is all tricks and games, but the reality is that you need to do the hard yards to actually make businesses competitive.”

11.14:New definition for superannuation

A raft of changes affecting retirement incomes in the budget have been hailed as the first sign a new definition for superannuation is starting to drive policy.

Annuities provider Challenger’s chief executive Brian Benari said changes including a $1.6 million cap on tax-free sums to provide income had highlighted a shift in purpose away from accumulation.

The Federal government has accepted a recommendation from David Murray’s Financial System Inquiry to define purpose for super as providing income for retirement. The definition is a shift in emphasis away from using tax-advantaged superannuation as a wealth accumulation vehicle and is designed to relieve pressure on the budget from rising taxpayer-funded pension payments.

Mr Benari said the changes in the budget would help the development of deferred lifetime annuities and paved the way for comprehensive income products for retirement (CIPR).

“The system has just been focused on accumulation of wealth and now we get in and design products that provide an income in retirement,” Mr Benari said.

In The Budget the Government gave the green light for removing tax impediments to products which provide pooled longevity risk, including deferred lifetime annuities.

Challenger said the new rules will permit a range of options to suit retirees and superannuation funds with DLAs able to be bought pre-retirement, on retirement or post-retirement, with either a single or multiple premiums. The rules will allow new products to be developed while existing products that meet existing rules can continue to be provided.

The government is consulting on the development of CIPRs and could have rules in place by the year.

11.00am:Refugee resettlement spends down

Australia is spending less money on refugee resettlement than forecast one year ago, despite moving to accept an additional 12,000 asylum-seekers from the war-ravaged Middle East, Labor says.

Michelle Rowland, the opposition multiculturalism spokeswoman, said budget figures revealed the government spent $141 million on settlement support, down from $221 projected in December.

“The Turnbull Government is unable to settle these new humanitarian arrivals in a timely manner,” she said.

At last count, a mere 187 people have arrived and only 1600 visas have been issued. In Canada, the Trudeau Government was elected in October 2015 and within six months had accepted 20,000 new migrants.”

Immigration Minister Peter Dutton has defended delays in approving refugees for travel to Australia, citing security concerns.

10.38am:What MPs think of budget

A recap of what some of the key MPs are saying:

MALCOLM TURNBULL

“This is not a short-term political budget.” “This is a plan that will ensure our children and our grandchildren enjoy the great opportunities these times offer them.” “You see people on higher incomes, that includes me of course, are seeing a very big scale-back on their benefits under superannuation.”

I gave Kochy the elevator pitch on why Australians will benefit from #Budget2016https://t.co/x0NOJa6PuX

— Malcolm Turnbull (@TurnbullMalcolm) May 3, 2016

BILL SHORTEN

“This is a budget which favours the millionaires over the battlers. The high-income earners over the families.” “I think this budget was meant to be Malcolm Turnbull’s big justification for rolling Tony Abbott, but at the end of listening to Scott Morrison last night I thought is that what all the fuss is about?”

While there's a lot in this budget for big business and high income earners, there's nothing in it for everyday Australians.

— Bill Shorten (@billshortenmp) May 4, 2016

SCOTT MORRISON

“It wasn’t just another budget. We need a national economic plan to see the economy through the transition, which we are succeeding in ensuring is positive, but there is a lot more work to do. We have to stay on that course.”

THE GREENS

“We are very worried that this budget is going to turn the election into a tax cuts arms race.” - MP Adam Bandt

“In an act of reasonably predictable political cowardice, the treasurer and the prime minister have squibbed it on these overly generous negative gearing and capital gains tax concessions.” - Senator Scott Ludlam

“University fee deregulation is not dead yet, it is just resting and I know that the Liberal Party want to dig it up after the election” - Senator Robert Simms

A DISGRUNTLED GOVERNMENT MP

“This budget is a fudged opportunity, unfortunately. Nothing in particular done to rein in rampant spending, which is at very high levels as a percentage of GDP.” - Outgoing Liberal Dennis Jensen.

LABOR MPS

“We didn’t see Budget 2016, we saw Fudge-it 2016.” - Frontbencher Anthony Albanese

“It’s not an economic plan, it is more a preview for an RSL hypnosis trick where in Malcolm Turnbull’s mind Donald Trump is a corner store owner, the Hilton is a bed and breakfast and BHP’s a landscaping company.” - Frontbencher Ed Husic

INDEPENDENTS

“It’s been a budget with very, very little substance. It’s like having a burger with the lot without having the lot in the middle of it and I’m disappointed.” - Senator Jacqui Lambie.

“An unprincipled attack on low-income earners, the disabled, students and families.” - Senator John Madigan.

10.17am: ‘Intern program will help youth’

Malcolm Turnbull has side-stepped questions on whether a new interns program could displace permanent job positions by creating a “revolving door”.

Mr Turnbull said it was easy to be very cynical about the planned JobPaTH program the government has outlined in its budget. “What we’re seeking to do is tackle this challenge of youth unemployment, and give these young people a chance to work, to get the experience of a workplace,” he told ABC radio in Melbourne.

10.11am:PM reprimands Jon Faine

Malcolm Turnbull has reprimanded the ABC’s Jon Faine after the Melbourne radio host suggested the Prime Minister may have structured his own finances to avoid paying his fair share of tax.

“John, I have always paid tax in Australia,” the PM said. Read the full story here.

10.05am:‘Shorten knows more millionaires than me’

An interview between Scott Morrison and 2GB’s Ray Hadley took a peculiar turn when an occasional listener to the program – who the radio host describes as a “raging left winger” – asks why his “boyfriend” (ScoMo) has given the top 10 per cent a tax break and the bottom 60 per cent nothing.

We’ll let the Treasurer take the stand: “I think people are so over these Left, Right arguments … honestly, I think people are so over it,” Morrison said. “I mean Bill Shorten’s out there saying ‘oh, you know, millionaires’ and all the rest of it. I tell you what, Bill Shorten hangs out with a lot more millionaires than I ever have. He went to Xavier I think in Victoria, I went to a public school. So if he wants to have that argument, I suppose we can. But frankly if people get to go to private schools, good for you, and if your family’s invested and given you the opportunity to go there. I mean honestly these people have just got to move on.”

Hadley agrees: “The class war is crass.”

ScoMo: “It’s just not us”.

10.01am:Multinationals crackdown ‘anticipated’

KPMG chairman Peter Nash says he doubts anyone could disagree with the government’s crackdown on multinationals who shift profits offshore.

The budget outlined a 40 per cent tax on global companies that shift profits offshore, which is set to raise $3.9 billion over the next four years.

“Multi-nationals who are avoiding their tax obligations are going to get tougher enforcement,” Mr Nash said.

“We all anticipated it but the penalty tax rate of 40 per cent is something that was perhaps not anticipated.”

Tax commissioner Chris Jordan will get an extra $679m to go after multinationals, large public and private companies and wealthy individuals who try to hide income or shift it to low-tax jurisdictions.

“The crackdown on multinational tax is a good thing and it is something that companies who pay their fair and equitable share of tax would agree with,” Mr Nash said.

9.38am:‘Super tax won’t surprise wealthy’

Billionaire retailer Gerry Harvey says the superannuation hit to high income earners will not surprise those that will be impacted.

With immediate effect the government intends to place a 15 per cent tax on any money above $1.6 million which may be held in super. Until now funds for pension income were free of tax and there was no limits upon it.

“The reality is that a lot of people have had a wonderful run on that superannuation deal, it’s been around for a long time and people have been very generously treated,” Mr Harvey said.

“I think most of them on it would think “I had a pretty good run on this, I guess I knew it would always end”.

“They might complain and not be happy but at the end of the day they can probably understand it. I think it was always going to change, it’s been in a long time.”

9.35am:Chris Kenny’s verdict

The Australian’s Chris Kenny gives his take on the 2016 budget:

9.34am:‘Budget confirms costly plebiscite’

The government has set aside $160 million in the contingency reserve for the referendum on constitutional recognition of indigenous Australians and the same amount for the same-sex marriage plebiscite.

But gay marriage advocates say “fairness and equality” shouldn’t cost a cent.

“We call on the government to drop its plan for an expensive and unnecessary plebiscite and spend this money on essential services instead,” Australian Marriage Equality national director Rodney Croome said.

“The budget has confirmed just how costly a plebiscite will be, and how wasteful given parliament could pass marriage equality tomorrow.”

AME will be campaigning in more than 30 seats across the country to “win over candidates and communities”.

9.15am:‘Great budget for millionaires’

Bill Shorten has attacked Scott Morrison for delivering a “great budget for millionaires” that had distilled the policy difference between the parties.

“If you earn a million dollars, if you are an income earner who earns a million dollars, you are going to get nearly $17,000 in tax cuts. But if you earn less than $80,000 you will not get a cent,” the Opposition Leader told reporters in Canberra.

“For the half a million people who earn between $80,000 and $87,000, they’re getting the equivalent tax cut per week of a cup of coffee and a biscuit.

“This election will be about who’s got the positive vision for Australia, and I’m really confident that Labor’s plan to put people first is the key policy for this election.”

Mr Shorten says there is “much to annoy many people” about the budget.

But he confirms Labor will support the government’s tax cut for workers on more than $80,000, which Scott Morrison has admitted would give them $315 a year at most.

“If you earn a million dollars, if you are an income earner who earns a million dollars, you are going to get nearly $17,000 in tax cuts. But if you earn less than $80,000 you will not get a cent. What it means is that for the half a million people who earn between 80 and $87,000, they’re getting the equivalent tax cut per week of a cup of coffee and a biscuit,” Mr Shorten told reporters this morning.

“Now Labor will support that, because they’re the people we want to see do well and we’ll take any progress for them.”

Prime Minister Malcolm Turnbull said Labor was “setting themselves up for some kind of class war”.

“They are arguing that people who earn $80,000 a year are rich,” he told ABC radio.

“That’s the type of war of envy, the politics of envy, which absolutely stands in the way of aspiration and enterprise and growth.”

9.07am:‘Right to abolish Work for the Dole’

The Australian Council of Social Service’s Cassandra Goldie hailed the ideological shift on superannuation but said the government’s tax cuts and spending reductions ignored the need to address Australia’s “revenue problem”.

“This is really unfair. The government has withdrawn compensation for social security recipients but left in the tax cuts,” she told Sky News.

However she supported moves to abolish the “failed” Work for the Dole program.

“Certainly what the government has done in recognising that Work for the Dole was a failed program, didn’t achieve any results that anybody could celebrate, and to instead put money in real paid work experience for young people. It’s something we have been urging for some time,” she told ABC radio.

8.57am:‘Aboriginal people left out’

Greens spokeswoman for Aboriginal and Torres Strait Islanders Rachel Siewert has lashed the Treasurer for using the word ‘indigenous’ in his budget speech just once.

“That’s a pretty accurate reflection of the attention Aboriginal people got in the budget papers,” she says.

“Apart from a $10.5 million increase to provide more services for Fetal Alcohol Spectrum Disorder, funding for the Indigenous Advancement Strategy (IAS) has not increased.”

The government will also cut $23.1m from Indigenous Business Australia and redirect the funds to the IAS, which is run by the Department of Prime Minister and Cabinet.

Read more: Indigenous Land Corporation bailed out of Ayers Rock Resort debt

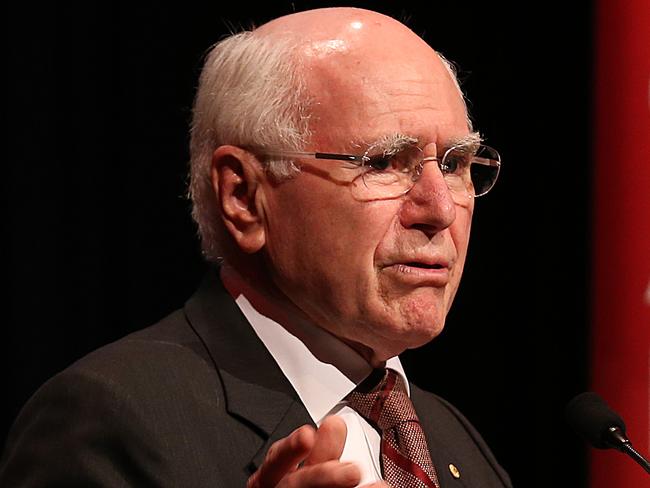

8.52am:Howard praises Morrison’s budget

In conversation with journalist Ellen Fanning and former Labor leader Kim Beazley at a post-budget breakfast in Brisbane, former prime minister John Howard said Treasurer Scott Morrison had done a “good job in the circumstances” of sluggish global growth.

“I think Scott Morrison did a very good job of juggling the politics and the economics last night,” Mr Howard said.

Mr Beazley said Mr Morrison had little room to move, and was “dancing on a pin head”.

“The budget was a budget of a man surrounded. I don’t think it’s a negative at all for the government,” he said.

Mr Howard also criticised the idea of a royal commission into the banks as “stupid” and said it would send an “unfortunate” message to the world about the institutions that helped Australia through the global financial crisis.

Mr Beazley said Mr Turnbull should have gone to the polls immediately after he seized the leadership, but had since lost momentum.

Mr Howard said “no one expected” another change in Prime Minister, after the turmoil of the Rudd-Gillard-Rudd years.

“(It was) certainly a shock,” he said.

Mr Howard said he was sure former PM Tony Abbott was committed to helping Mr Turnbull, rather than causing instability.

“I think what happened to Tony Abbott was bruising,” Mr Howard said.

“It was personally humiliating.”

“(Mr Abbott has) stayed in and he wants to make a contribution.”

Mr Howard said Mr Morrison wouldn’t have been consciously seeking to distance his first budget from the unpopular 2014 budget from Joe Hockey and Tony Abbott.

“(That’s) a construction of the commentariat,” Mr Howard said.

“I don’t think Scott Morrison was setting out to demonise Joe Hockey or anything,” Mr Howard said.

He praised the restoration of some measures that were cut in the 2014 budget, but said last night’s budget was “thematically” connected to the 2014 document, especially in relation to small business.

8.48am: What the papers say

Scott Morrison’s maiden budget has drawn diverse, animated responses from the nation’s newspapers. See more of today’s front pages here.

8.30am: PM’s own super affected

Malcolm Turnbull’s own superannuation account has featured in the news cycle this morning, with the PM pointing out he will also have to pay may more tax as a result of the government’s changes to super for high-income earners.

“Yes the reduction in the caps, the increase in the tax for superannuation contributions for people earning over $250,000, they obviously apply to me,” he told the Nine Network’s Karl Stefanovic.

“The reality is that overall people on high incomes like myself and indeed yourself Karl will be paying more tax one way or another as a result of this. Yes, there is a benefit for everybody who earns over $80,000, but for people on high incomes they will be paying more tax because of the very big changes, the very foundational changes to superannuation to make it fit for purpose.”

Mr Turnbull asked if he will be PM in two months replies: “I am quietly confident that the Australian people will give us another term in government. But you can’t take anything for granted and it is a two-horse race and it’s a choice. It’s a choice between me and Bill Shorten.”

8.28am:Morrison defends 10-year tax plan

Treasurer Scott Morrison has rejected claims his 10-year plan for tax cuts is unfunded, saying the budget hit would be “covered” through changes to multinational tax and superannuation.

“It’s covered over the forward estimates and it’s covered beyond … because the multinational tax arrangements, the superannuation tax incentives that have been closed off for those on high incomes, they continue – they continue beyond the budget and forward estimates,” he told ABC radio.

Mr Morrison questioned the opposition’s reluctance to support a tax break for businesses with annual turnover of up to $1 billion.

“I’m surprised by that because last year Bill Shorten said we need to get to 25 per cent... They seem to have a problem with small business,” he said.

“Company tax cuts across the board, ultimately ten years from now, will make Australia more competitive.”

Mr Morrison downplayed concerns about slowing growth in China, saying it remained a “thumping big economy” that was growing at more than 6 per cent annually.

“We are in there with the best trade deal with China that anyone has. I would say that positions us well,” he said.

Mr Morrison defended his refusal to extend the Abbott government’s temporary deficit reduction levy on top earners, despite the tripling of the deficit since that time.

“I don’t know how I could look the Australian people in the eye and say when we introduce a law and vote for it and say it’s temporary, that we turn around and say we have changed our mind on that law,” he said.

8.12am:PM keeping quiet on election call

The Prime Minister is not giving away when he will visit the Governor-General and call the July 2 election, simply saying it will happen between now and May 11. He dismisses a dive in his personal poll ratings, telling ABC radio he sleeps well at night.

The interview concludes on asylum-seekers. The plight of asylum-seekers on Nauru and Manus Island has been at the fore over the past week, with PNG’s Supreme Court ruling detention on Manus was unconstitutional and two people on Nauru self-immolating. The PM says we “grieve for them” but maintains asylum-seekers who come by boat to Australia will not be settled here.

8.08am:Disgruntled Lib slams budget

Disgruntled Liberal MP Dennis Jensen has castigated his own government’s budget as a “fudged opportunity” that relied on “heroic growth assumptions” while failing to address “rampant spending”.

Dr Jensen, who has lost preselection for his West Australian seat, took to social media this morning to criticise the lack of any action to rein in “rampant spending”.

“We simply cannot go on like this. This is just like Wayne Swan and `the four years of surpluses I announce tonight’. Where is someone like a Peter Costello when you need him?” the MP posted.

Dr Jensen is mulling an independent run in his Perth seat of Tangney after being disendorsed by the “faceless men and women” of the Liberal Party one month ago.

He said the Treasurer should feel “shame” at adding to the growing deficit.

8.07am:Budget ‘ignores’ Queensland

Queensland Treasurer Curtis Pitt has slammed the federal budget for “ignoring” Queensland, accusing the Turnbull government of trying to blackmail the states into asset sales.

Speaking at the PwC post-budget breakfast in Brisbane this morning, Mr Pitt said the budget left Queensland as the “forgotten state”.

There was no money in last night’s budget for the proposed second Townsville Stadium, for which Queensland has promised $100m, Mr Pitt said. Nor was there funding for state Labor’s Cross River Rail plan in Brisbane.

“This budget didn’t deliver a spark for Townsville which has been through the (Clive) Palmer Tube Mill with the collapse of the Queensland Nickel refinery.”

He said the federal government’s mental health funding national partnership agreement with Queensland would end on June 30; early childhood education funding will end next year on June 30.

“The Sunshine State is now the Forgotten State,” Mr Pitt said.

“If this is an election budget, then the Prime Minister may not be planning on winning many seats north of the Tweed.”

He said last night’s budget had perpetuated the asset recycling scheme from when Tony Abbott was prime minister.

“Tying infrastructure funding to ‘asset recycling’ is nothing short of political blackmail,” Mr Pitt said.

“…if the Prime Minister is planning to base his re-election efforts in Queensland on a campaign for asset sales, then I’ll politely stand aside and let him do it.”

8.05am:‘$2.1 billion ripped from health’

Opposition health spokeswoman Catherine King has accused the government of “ripping $2.1 billion from health”.

“The scrapping of the Child Dental Benefits Scheme will deny millions of Australian children, many of whom have never before been able to afford dental treatment, access to ongoing affordable dental care,” Ms King said.

“The cuts to pathology and diagnostic imaging will mean patients being treated for cancer, and other serious health conditions could be forced to fork out thousands of dollars upfront to pay for vital scans and tests.”

8.00am:ABC cuts ‘savage’

Jason Clare, the opposition communications spokesman, has accused the government of “savage” new cuts at the ABC.

The ABC’s public funding will fall $48 million this year, while commercial broadcasters have won a $163m saving from the cost of licence fees over four years.

Mr Clare said: “These cuts will result in job cuts at the ABC and programs will be affected across the country including in regional Australia.

“The difference between Labor and Liberal could not be more stark tonight - we’ll put people first, whilst the Liberals will cut our public broadcasters and put big business ahead of Australian families.”

7.57am:Super cuts ‘appropriate’

Malcolm Turnbull concedes Australians on high or very high incomes will see a “very significant reduction” in the tax advantages they get out of superannuation.

“Those people are the ones that are the higher income earners and they will be paying a lot more tax on their super balances as a result of this. That is appropriate,” he tells ABC radio.

But the PM points out the temporary deficit levy on people earning $180,000 will be lifted as planned.

OPINION: Building wealth just got harder

7.49am:‘Cuts will hit trade’

Opposition trade spokeswoman Penny Wong says the budget has cut $24 million from Austrade, the agency charged with opening new markets for exporters, while diverting another $5.3m to build a trade post in the Iranian capital, Tehran.

“These cuts to trade will reduce support for business, affect trade policy development and diminish Australia’s ability to negotiate good trade outcomes,” Senator Wong said.

“(Trade Minister Steve) Ciobo had the opportunity to step out from under the shadow of (his predecessor) Mr (Andrew) Robb. Instead, his defining contribution to the trade portfolio is a big fat funding cut.”

7.46am:Super tax ‘fit for purpose’

Finance Minister Mathias Cormann has defended the government’s hit on superannuation savings of high-income earners and wealthy retirees, saying it is designed to ensure tax concessions in super are “better targeted” and “fit for purpose”.

“The important point is this: this actually impacts on just about 1 per cent of Australians with superannuation,” Senator Cormann said on Sky News. “About 96 per cent of people with superannuation are not impacted at all or are better off. So it is a very small part of the population here.

“This is part of our efforts to ensure tax concessions in superannuation are better targeted, are fit for purpose, and of course the purpose of superannuation being to provide an income in retirement to replace a supplement, the pension, not to be a tax effective wealth transfer vehicle between generations.”

7.36am:‘What about Australia’s future?’

Bill Shorten welcomed the Coalition’s adoption of Labor’s policies of hiking tobacco taxes and attacking wealthy superannuation accounts, but accused the government of doing only “half the job” of providing for Australia’s future.

“The pensioners are losing money, the schools, the hospitals. This budget doesn’t do anything about setting Australia up for the future,” the Opposition Leader told the Nine Network.

“This government has missed an opportunity. It is not nation-building, it is nation-shrinking”.

Mr Shorten said the government had tripled the deficit, but was not providing answers to reduce it.

He also took a shot at the government ahead of the election being called.

“I think that this budget was meant to be Malcolm Turnbull’s big justification for rolling Tony Abbott, but at the end of listening to Scott Morrison last night I thought `is that what all the fuss is about’?”

7.30am:‘Right direction for business’

Business Council of Australia chief executive Jennifer Westacott has told ABC radio the Turnbull government’s first budget will be good for growing the economy but - no surprises here - would like to see a tax cut for big business brought forward. Big business has been told it’ll need to wait a decade for tax relief.

“All-in-all this is a budget that will give business confidence, give the community confidence that we’re sort of headed in the right direction,” she said.

“What the government’s put forward here is probably the most comprehensive plan to reduce our business taxes with everyone but clearly it’d be good if we brought it (a tax cut for big business) forward and there are risks the longer we take to make our total business tax system more competitive, the more uncompetitive the economy is overall.”

7.20am:‘Confident about China growth’

Malcolm Turnbull has defended the government’s optimistic growth projections, dismissing concerns about an economic slowdown in China.

“I am confident about the China growth story. The demand for commodities has obviously changed, they’re not building as much infrastructure, they’re not using as much steel, but … more money is moving into the pockets of households,” the Prime Minister told the Seven Network.

He said Chinese demand for Australian services, including tourism and education, was booming.

“Above all they want to buy Australian food. We have a clean, green image … and the farmers of Australia haven’t had as good a time as this for a long time for exports,” he said.

Mr Turnbull also defended the lack of handouts in the federal budget, saying average Australian families will benefit from stronger economic growth.

“This is a plan that will ensure our children and our grandchildren enjoy the great opportunities these times offer them,” he said.

Mr Turnbull recommitted to hold a double-dissolution election on July 2.

“This weekend is looking pretty good (to visit the Governor-General),” he said.

7.10am:Small business tax cut ‘unsustainable’

Labor wants the government’s small business tax cut limited to firms with annual turnover up to $2 million, rejecting moves to lift the threshold to $1 billion as a gift to major companies “dressed up as a small business tax cut”.

Chris Bowen, the opposition treasury spokesman, cast the small business tax cut as “an unfunded, unsustainable and uncosted” policy that would endanger the nation’s AAA credit rating.

Speaking on ABC radio, he strongly suggested Labor would retain the Abbott government’s “temporary deficit reduction levy” on the highest earners, saying the spiralling budget deficit meant the case for slugging the rich was “even stronger” than in 2014.

Mr Bowen is casting the divide between the parties as one of long-term vision, pledging to impose “good quality, long-term, structural saves in the budget”.

“You’ve got to have the long term policies dealing with the structural budget deficit we have in Australia and policies that will stand the test of time and will work in different fiscal and cyclical circumstances,” he told Sky News. “These are decisions that will last us more than 30 years.”

Mr Bowen reserved judgment on Scott Morrison’s surprise $1.6 million cap on the amount of accumulated super that could be transferred by an individual into retirement accounts where earnings are tax-free.

Although he was not overtly hostile to the idea, Mr Bowen told Sky News the opposition needed to ensure its details passed the “common sense” test.

7.00am:Hard sell begins for Treasurer

Treasurer Scott Morrison will hit the airwaves today to sell his first budget just days out from his prime minister calling a July 2 election.

The budget contains tax cuts for small and medium-sized businesses, a reduction in excessive superannuation tax concessions and a modest adjustment to the middle-income tax bracket to tackle bracket creep.

SUMMARY: David Crowe’s wrap of the 2016 budget

AS IT HAPPENED: How budget night played out

AT A GLANCE: All The Australian’s budget coverage and opinion

- With AAP