US President Donald Trump’s ‘recession’ comment sparks ASX 200 sell-off

US President Donald Trump has refused to rule out a recession in the world’s largest economy and now Aussie shares are plummeting.

More than $49bn in value was wiped from the Australian sharemarket on Tuesday morning following a shock recession comment from US President Donald Trump.

In an interview with Fox News on Sunday, Mr Trump refused to rule out the possibility his tariff policies could tip the US economy into recession and spark inflation.

“I hate to predict things like that,” he said.

“There is a period of transition because what we’re doing is very big.

“We’re bringing wealth back to America. That’s a big thing and there are always periods of, it takes a little time. It takes a little time.”

The remark sparked a bloodbath on Wall St overnight on Monday, with the benchmark Dow Jones index shedding 890 points, or 2.08 per cent, to settle at 41,911.

The S and P 500, a basket of the 500 largest companies in America, lost 2.7 per cent, while the tech-heavy Nasdaq index fell a whopping 4 per cent.

Elon Musk’s Tesla lost 15.4 per cent in value, while chip giant Nvidia fell 5.07 per cent.

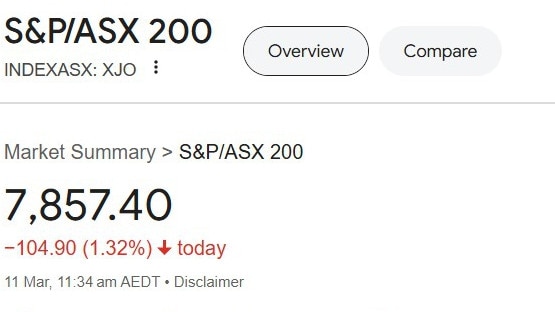

The Australian markets followed suit on Tuesday morning, with the benchmark ASX 200 slumping 1.78 per cent in morning trade for a $49bn wipe-out.

“These comments have intensified investor growing fears about a recession,” IG markets analyst Tony Sycamore said on Tuesday morning.

“Throwing fuel on the tariff bonfire already burning with serious intensity, Trump warned that reciprocal tariffs on Canadian dairy and lumber could be imminent.

“Market sentiment has rapidly shifted from post-election optimism to serious concerns about recession, fuelled by ongoing policy uncertainty and a rolling stream of soft economic data.”

Market heavyweight Commonwealth Bank lost 1.27 per cent to $146.26 a share as of 11.30am and Aussie tech stocks are crumbling.

Xero retreated 5.3 per cent to $158.12, WiseTech Global fell 3.83 per cent to $84.41 and TechnologyOne slumped 6.09 per cent to $27.12.

Consumer stocks are also getting pummelled, with JB Hi-Fi down 2.5 per cent to $89.06 and Myer sliding 3.14 per cent to 77c.

The All Ordinaries index, which includes the 500 largest companies on the Australian Securities Exchange, is faring even worse, down nearly 2 per cent to 8032.8 points.

The All Technology index has tumbled 4.29 per cent.

Year-to-date, the ASX200 has lost 4.64 per cent in value.