One in three Australians have fallen victim to scams

An astounding number of Aussies are falling victim to scams, with an eye-watering amount of money handed over to crooks in 2022.

Australians are increasingly falling victim to scammers, with an eye-watering sum paid to cyber criminals this year.

Almost one in three Australians have been hit by a financial scam, RateCity.com.au research shows.

Twenty-nine per cent of 1000 people surveyed admitted they had been scammed through credit card hacks, identity theft and being tricked into handing over money.

In the last 12 months, Australians have handed over $526.3 million to scammers, an astounding 88 per cent increase from the same period in 2021, when $266.7 million was swindled, according to the ACCC’s Scamwatch.

People should be extra cautious with their money around the holiday season, RateCity.com.au research director Sally Tindall says.

“Scammers don’t take holidays, so while it might be a great time to put our feet up and relax, people should stay on their toes when it comes to scams.

“Whether it’s a text message, email or a social media post – think before you click,” she says.

Aussies keen to hit up Boxing Day sales should also be aware of who they’re giving their financial information to.

“The post-Christmas sales can be a great time to nab a bargain, but it’s also an opportune time for scammers to catch people out,” Ms Tindall says.

“When shopping online, question everything. Is it a website I recognise and trust? Is the payment option secure? Is the site asking for unnecessarily personal or financial details? If something looks suspicious, close the browser and walk away.

“Check your bank statements regularly and if you see a suspicious transaction, query it. Often it’s just a shop with a funny trading name, but it’s better to feel momentarily silly for questioning it than potentially being robbed of thousands of dollars.”

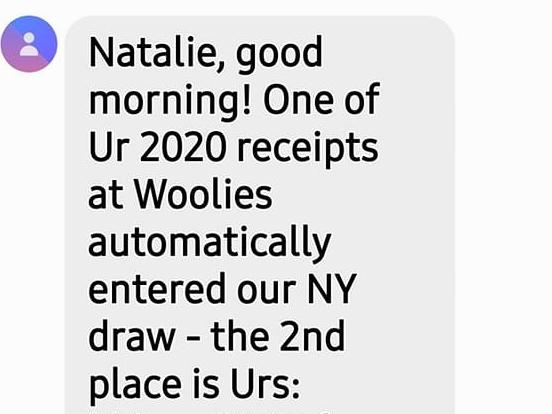

Phishing, a practice where a scammer will send a fake message to trick someone into revealing sensitive information, has proven highly effective for scammers, with 66,649 reports of the tactic in 2022.

The method can include emails or texts designed to look like they’re from an official company or from a loved one in trouble.

Investment scams cost australians the most, with $351.6 million in financial losses reported.

If you suspect you’ve fallen victim to a scam, contact your bank immediately, as it can stop any pending transactions and put a freeze on your account.