New low for renters as vacancy rate hits new lows

The end of the pandemic has brought about a surge in demand for rentals in the nation’s biggest cities and it doesn’t appear to be improving any time soon.

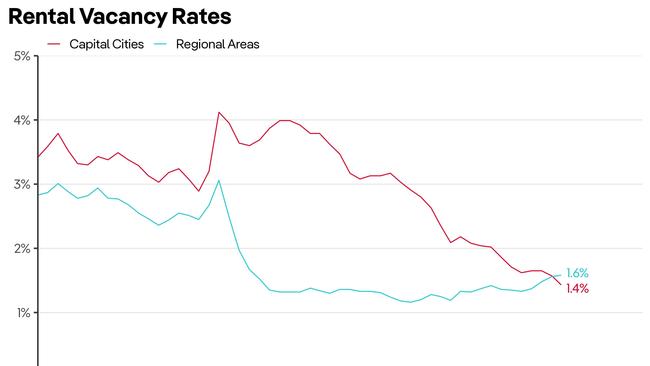

The national rental vacancy rate is at its lowest level since 2018, reflecting a further tightening of an already scarce rental market.

The capital cities experienced a 0.1 percentage point drop in the vacancy rate in February to now sit at 1.43 per cent, according to the latest PropTrack Market Insight report.

Vacancy rates measure what percentage of rental properties are available for lease, meaning that only 1.43 per cent of all rental properties are on the market for renters.

That figure is half the level seen before the pandemic, with the capital cities experiencing a -55 per cent change in the vacancy rates since March 2020.

The end of the pandemic has brought about a surge in demand for rentals in the nation‘s biggest cities, with Sydney a full percentage point lower in the past year and Melbourne 1.8 per cent lower.

Adelaide and Perth had the fewest available rentals with 0.92 per cent and 0.85 per cent vacancy rates respectively.

Brisbane recorded a slight 0.07 per cent drop, while Hobart and the ACT were the only two cities to see a tiny boost of 0.06 per cent and 0.02 per cent respectively.

The news is not good for renters with a lack of available supply to drive “continued rapid rent price increases over 2023”, according to report author and senior Proptrack economist Paul Ryan.

“Almost all regions across the country have rental

vacancy rates below 2 per cent – meaning less than 2 per cent of all rental properties are available for lease,“ Mr Ryan said.

“A vacancy rate below 2 per cent points to extremely tight conditions.

“With demand for rentals expected to remain strong, we see no reprieve for tenants in the coming months.“

February was also the first time that it became harder to find a rental property in the capital cities over regional areas for the first time since the pandemic began.