Labor pledges $10b for 100,000 homes for first homebuyers

Anthony Albanese has made a massive announcement about the future of housing in Australia, outlining a $10b scheme.

Anthony Albanese has pledged $10b to build 100,000 homes exclusively for first homebuyers in a major move, as Labor officially kicks off their re-election campaign in Perth.

First homebuyers will also have access to a five per cent deposit under the scheme, with property price caps to be increased and caps on places or income to be removed.

The pledge brings Labor’s total investment in housing since the 2022 election to $43bn, including through the establishment of the Housing Australia Future Fund (HAFF).

“I want to help young people and first home buyers achieve the dream of home ownership,” Mr Albanese said.

“When a young person saves a five per cent deposit, my government will guarantee the rest with their bank.

“This will help people buy their first home faster, without paying the burden of Lenders Mortgage Insurance.

“We will also invest $10 billion to build 100,000 homes to be set aside and kept affordable for first home buyers.

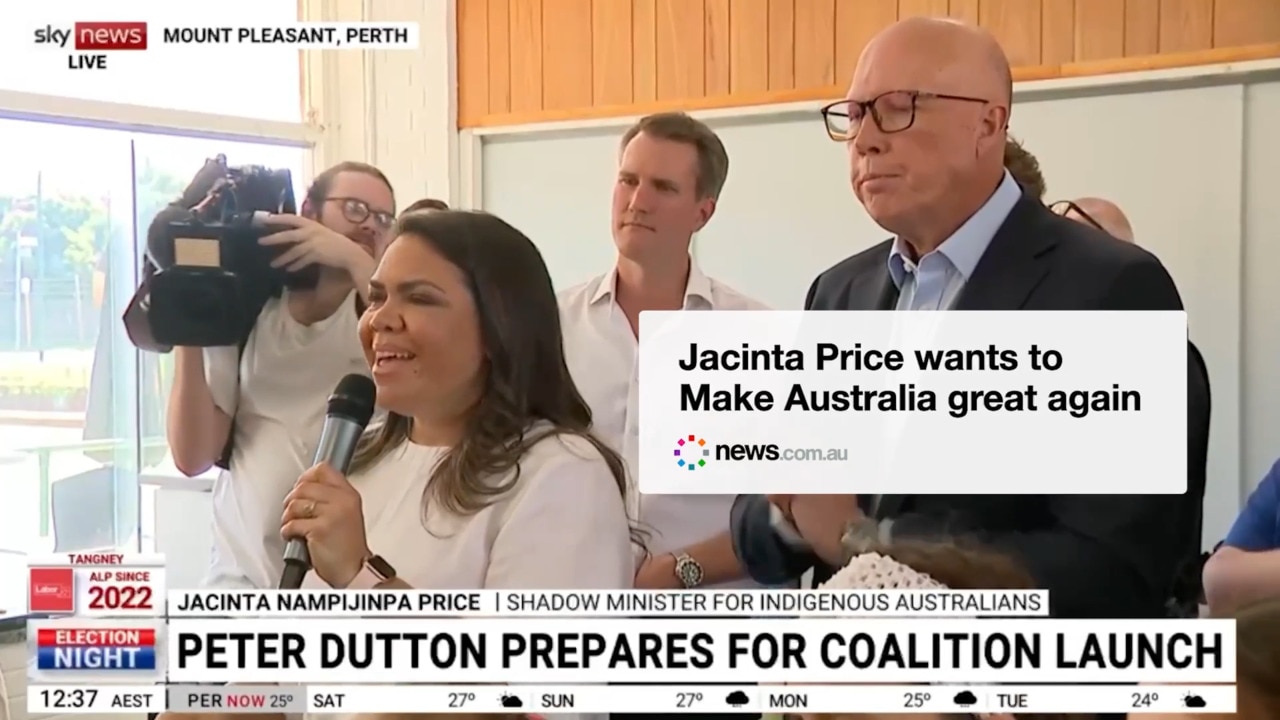

“We have a plan to get more Australians into their own homes – this is in stark contrast to Peter Dutton who wants to cut billions from housing.”

Labor will aim to work with the states and territories to identify suitable projects, such as vacant government land, and will encourage them to fast track land releases and rezoning.

The new funds will include $2bn in grants and $8bn in zero-interest loans or equity payments to the state and territory governments, who will have to match the $2bn contributions.

Construction is slated to get underway between 2026-27.

The first residents will hopefully move in by 2027-28.

It comes amid what Labor has described as a “generational scale” change in house prices.

House price caps for government loans will be greatly increased under the revised scheme.

For Sydney homebuyers, the maximum property price limit to be eligible for a government-backed loan will increase from $900,000 to $1.5m.

In Melbourne, the cap will increase from $850,000 to $950,000, in Brisbane from $700,000 to $1m, and $600,000 to $800,000 in Perth, with the cap also increased for regional areas.

Under the plan, a person looking to purchase an apartment in Sydney for $1m, just under the current median price, will be able to make the payment with a $50,000 deposit.

A further $150,000 - or 15 per cent of the loan value - is guaranteed by the federal government, meaning homebuyers can avoid Lenders Mortgage Insurance.

The changes are expected to be made on January 1, 2026, following industry consultation.

Housing Minister Clare O’Neil said young Australians were bearing the brunt of the housing crisis.

“Our government is going to step up to give them a fair go at owning their own home,” she said.

“We want to help young Australians pay off their own mortgage, not someone else’s.”