Our Team

Latest

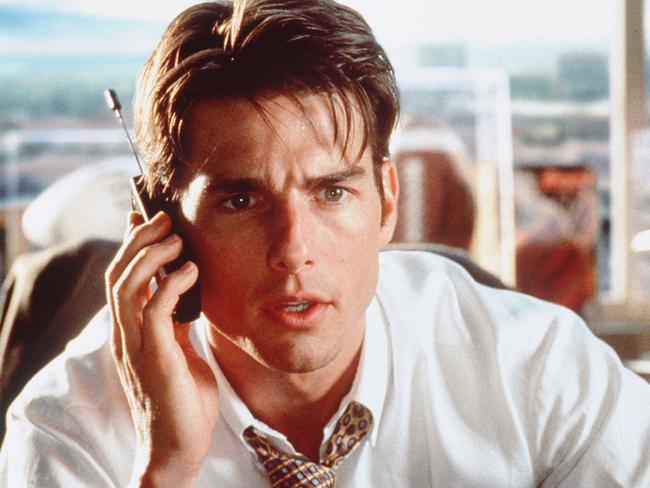

It’s ‘show me the money’ time for Australia’s investment bankers

Vanishing rural bank branches require bold solution

ASX to defend landmark ASIC legal action, denies breaking law

140 complaints per week: Super funds claims grievances triple

CBA boss takes swing at ‘free-riding’ tech giants

Australian super funds boost global investment focus

Business leaders raise alarm over Trump trade wars

Business chiefs revive push to cut tax impost

NAB warns of spike in bad loans

Original URL: https://www.theaustralian.com.au/author/joyce-moullakis/page/5