Why RBA deputy role could go to an outsider

As Jim Chalmers moves to appoint Michele Bullock’s deputy in coming weeks, two names are the focus of market chatter – one an orthodox outsider.

As Jim Chalmers moves to appoint Michele Bullock’s deputy in coming weeks, two names are the focus of market chatter – one an orthodox outsider.

The RBA’s decision this Tuesday as to whether to raise interest rates in response to third-quarter inflation is too close to call.

There’s no evidence of a developing wage-price spiral and long-term inflation expectations remain well-anchored, said Ian Harper, a member of the RBA’s interest-rate setting board.

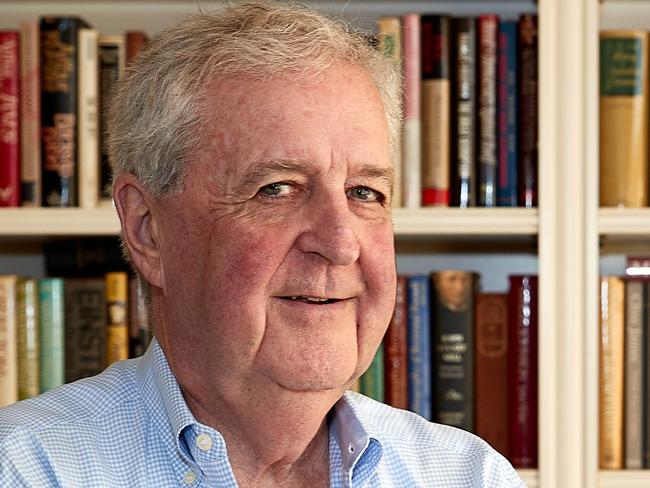

Former Reserve Bank governor Ian Macfarlane says, far from being best practice, the federal government’s reforms of the RBA board are radical and untested anywhere in the world.

Philip Lowe’s experience over the past two years shows the reputational damage that can occur if the central bank appears to be out of step with opinions on the street.

RBA is sure to maintain its hawkish guidance for a while yet. But it could become one of the first central banks globally to start cutting.

The RBA has indicated its growing confidence that the supply and demand imbalances that drove inflation to its highest level in over three decades are now correcting.

Bullock is calm in a storm and able to explain complex economic ideas to the public, a skill RBA governors need given an unusually high level of public scrutiny.

The departure of Luci Ellis is part of a recent exodus from the central bank that has stripped it of decades of experience and talent.

With Jim Chalmers set to announce a new central bank head within days, Philip Lowe will be reading the room and preparing for his exit.

Original URL: https://www.theaustralian.com.au/author/james-glynn/page/5